Who would bet on currency unions after EMU crisis?

The European Monetary Union (EMU) was founded with the idea that nominal convergence would bring real convergence, but structural differences between

The recent years of crisis have made clear that real convergence in the euro area has been insufficient to prevent stress through asymmetric shocks. Following this experience, and building on earlier work, we assess the opportunities for current union in the two most promising integration processes in the emerging world: ASEAN and the Pacific Alliance. We conclude that both blocs are also far from an Optimal Currency Area (OCA) and should pursue other forms of coordination to be successful.

Economic and financial integration still in its early stages

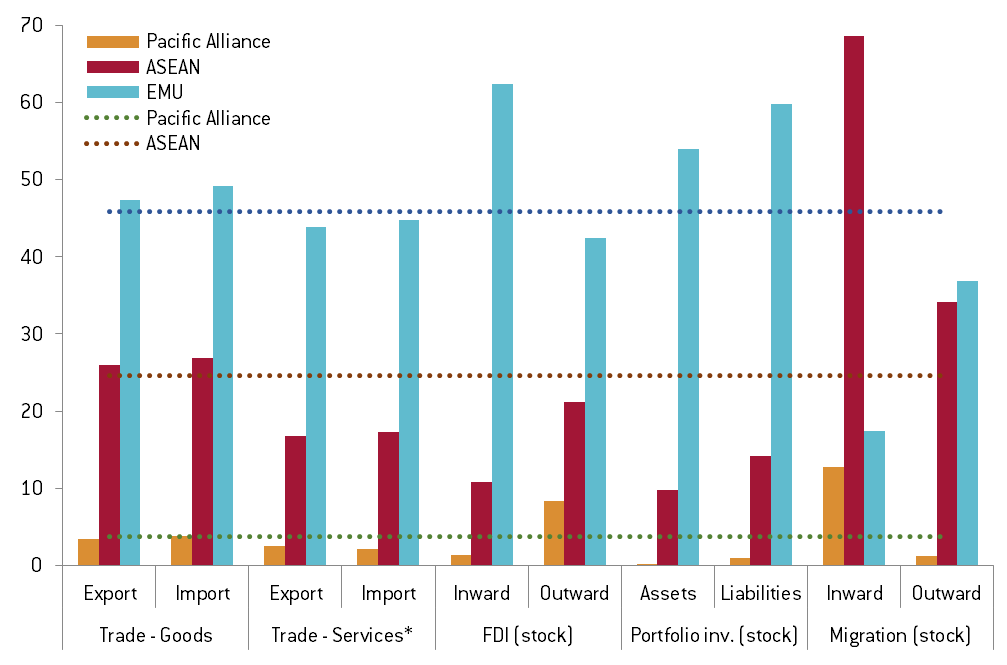

The degree of integration in the ASEAN, and particularly in the Pacific Alliance, is limited compared to EMU standards when measured as financial, trade and migration relations (Chart 1). Given a negative correlation between the size and openness of countries, this result is widely consistent with the dimensions of the different economic areas. However, other factors might be playing a significant role. These include geographical conditions, which ease trade through land connections in the EMU and through maritime routes in the ASEAN, in clear contrast with the harder natural barriers present in the Pacific Alliance. Lower levels of financial development in the ASEAN and Pacific Alliance regions must also be having an impact through limited cross-border flows.

Chart 1. Intraregional economic relations by area

Percentage of total relations, latest available data

*Including construction and utilities

Note: dotted lines correspond to the simple average of all indicators in each area

Source: own estimations from IMF, OECD and United Nations data

Maastricht-like nominal criteria fairly simple to meet

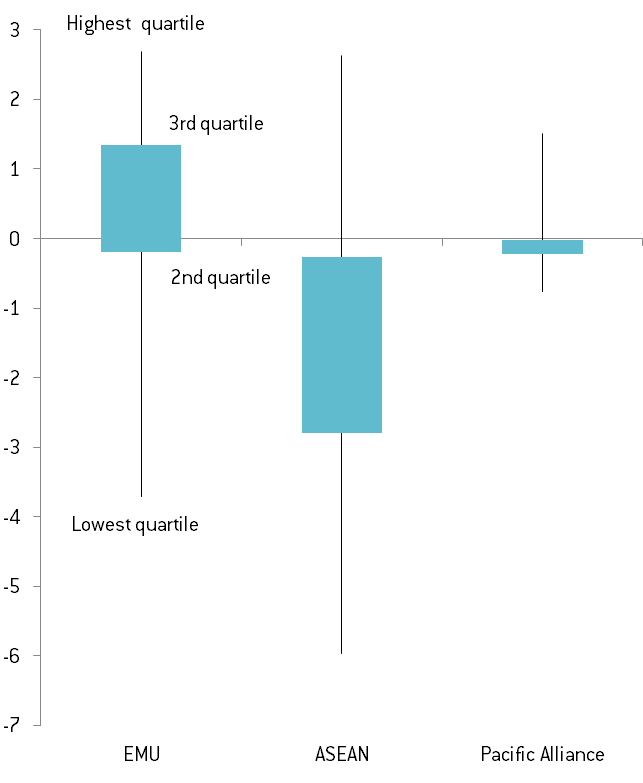

The so-called convergence criteria for EMU membership, which were all established in nominal terms, aimed to homogenise the conditions in which a single monetary policy would be implemented. If we were now to apply similar standards to the ASEAN and the Pacific Alliance members, we find that both integration blocs display dispersion levels not higher than in EMU at the time of its foundation– despite a certain degree of heterogeneity among their members (Chart 2A).

In addition, further promising conclusions are drawn when using a tentative Taylor rule, estimating interest rates adjusted for cyclical and inflationary conditions. This shows that in the Pacific Alliance deviations between countries are limited, while the ASEAN would not be worse off than the EMU (Chart 2B).

Having said that, and according to the experience of the EMU during the last 15 years, we have seen that nominal convergence criteria do not eliminate by themselves distortions that affect the implementation of a single monetary policy, requiring real divergences to be minimised.

Chart 2. Nominal convergence and estimated Taylor rule

Chart 2B: Deviation from area average (2014)*

*The reference interest rate is fixed according to the Taylor rule following Nechio (2011): 1 + 1.5*Headline Inflation – Unemployment Rate Gap (gap as the difference between the observed unemployment rate and the 11-year moving average); area average weighted by PPP-adjusted GDP

Source: own estimations from OECD and IMF data

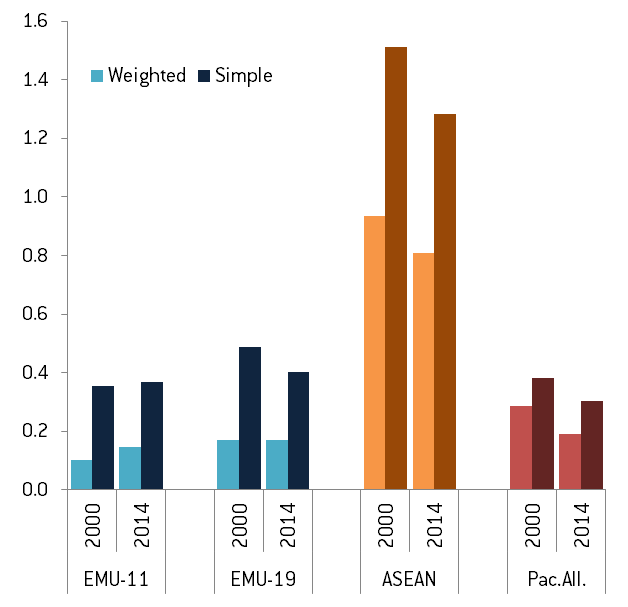

On-going convergence of income per capita

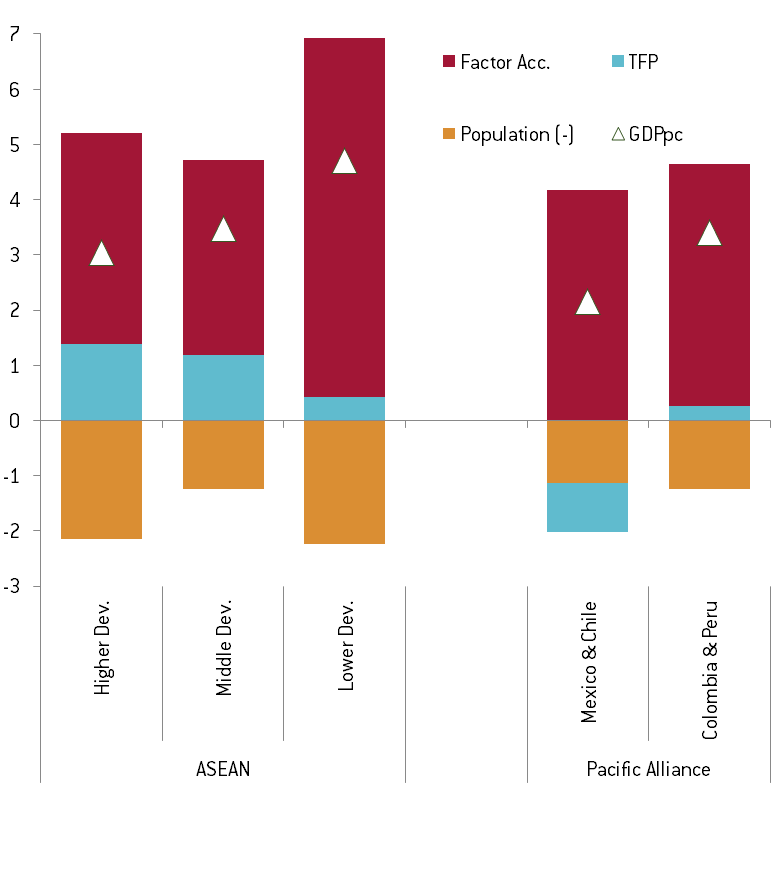

The Pacific Alliance shows today a degree of convergence (or divergence) similar to the existing one in the EMU in terms of GDP per capita (Chart 3A). Average growth since 2000 has been higher among countries with the lowest development levels (Colombia and Peru) relative to the most developed economies in the area (Chile and Mexico). The narrowing of the income gap has been founded on a higher growth of total factor productivity (TFP) in the less developed countries, while factor accumulation per capita has been pretty similar in both member groups (Chart 3B).

In the case of the ASEAN region, despite positive developments in terms of GDP per capita convergence, dispersion is still very high and much greater than in the other two integration areas. The development levels of some ASEAN members is at opposite ends of the global range: Singapore and Brunei average more than 70000 PPP-adjusted dollars per capita, while Cambodia, Laos, Myanmar and Vietnam do not even reach 6000 dollars. Contrary to what happens in the Pacific Alliance, factor accumulation is the converging driver in the case of the ASEAN. Meanwhile TFP, which increases across the board, shows a faster growth in more developed economies. This latter fact warns us about future divergence risks once the accumulation of labour and capital start to fade away in less developed economies as they reach later stages of income transition.

Chart 3. Real convergence: GDP per capita

Chart 3A: Coefficient of variation for GDP per capita*

*Ratio of the standard deviation to the average of PPP-adjusted GDP per capita; we use population shares for the weighted average

Source: own estimations from IMF data

Chart 3B: Contributions to GDP per capita annual change*

*“ASEAN with higher development” includes Singapore and Malaysia; “ASEAN with middle development” Thailand, Indonesia and the Philippines; and “ASEAN with lower development” Vietnam and Cambodia

Source: own elaboration from The Conference Board and United Nations data

Asymmetric shocks still very significant

Despite progress in GDP per capita convergence, there is still wide dispersion in competitiveness capacities and in productive structure among countries of the ASEAN and the Pacific Alliance. This affecting the nature of domestic shocks and the response to external shocks, and would therefore distort the management of a single monetary policy.

The degree of divergence is large particularly due to the fact that some members are producers and exporters of raw materials, while others present a very different characterisation of their manufacturing industries in terms of technological content. For instance, in the ASEAN, Cambodia is specialised in textiles and Singapore in chemical and electronic products. In the Pacific Alliance, the share of industries linked to raw materials is high in Colombia and Chile, while Mexico is specialised in automobile industries, electronics and electric manufacturing.

In order to test the importance of these real divergences, we estimate a structural vector autoregression for each available country in the ASEAN and the Pacific Alliance, as well the 11 largest countries in the EMU. We run estimations with quarterly data from Q1/2000 to Q2/2015, extracting external and domestic supply and demand shocks under structural restrictions, following the methodology used in García-Herrero (2014).

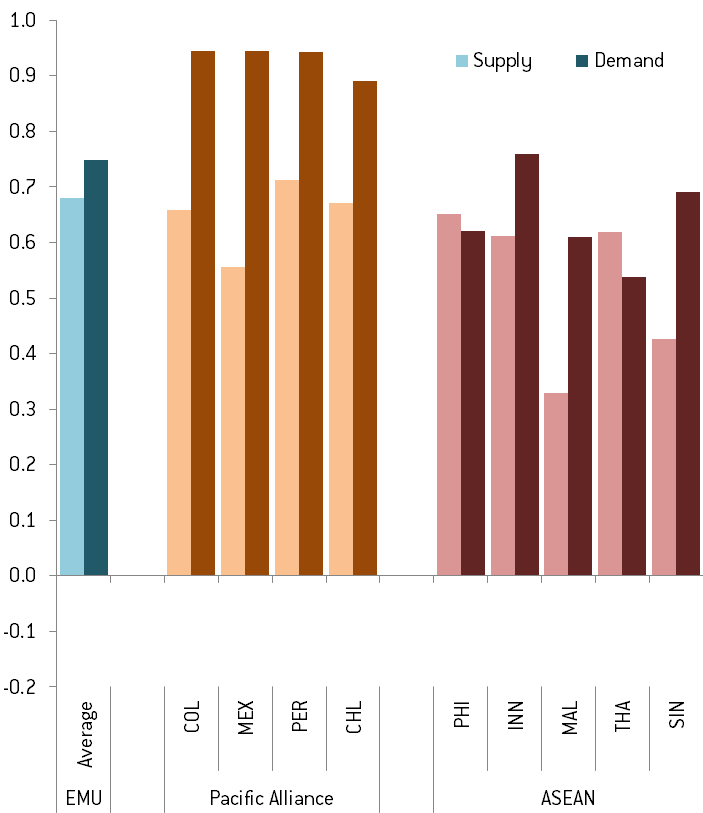

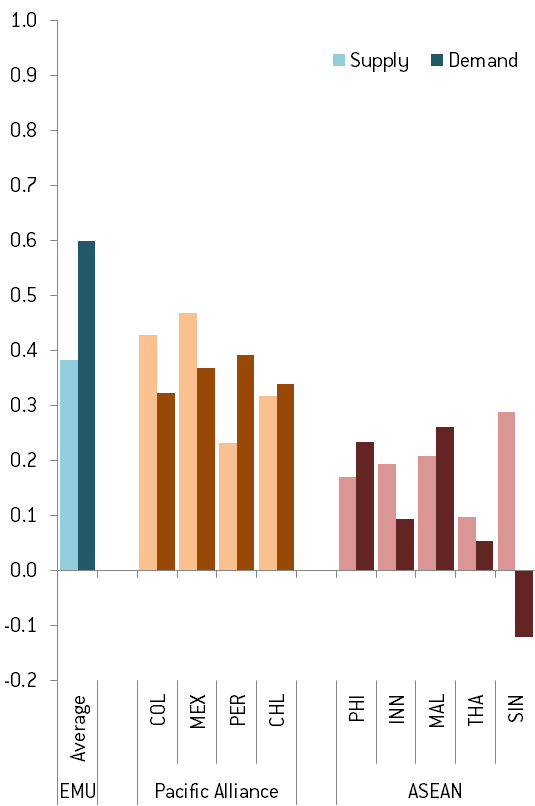

The results are shown in Charts 4 and 5. In the best case scenario the Pacific Alliance would be close to the correlation of domestic shocks present in the EMU. But divergences are quite substantial within the ASEAN, and would be even greater if we take into account that data for countries with lower development – such as Cambodia, Laos, Myanmar and Vietnam – is not available.

Chart 5. Real convergence: shocks*

Average correlation of shocks with other area members (2000-2015)

External shocks

*Countries ranked by the average of all shocks correlation

Source: own estimations

Domestic shocks

Don’t give up, avoid short-cuts and follow other paths for further integration

As shown, progress in the degree of real convergence, which plays a critical role on the transition towards an efficient single monetary policy, is very limited so far in both the Pacific Alliance and, particularly, in the ASEAN. Divergences among members in these two areas are considerable when competitiveness conditions and the productive structure are assessed, conditioning quite heterogeneous domestic shocks and sensitivities to external shocks. These divergences are even more acute due to the limited development of risk mutualisation mechanisms. EMU experience shows how dangerous this can be for a currency area: Greece represents a meagre 2% of EMU’s GDP in contrast with the substantial financial turmoil its situation triggered.

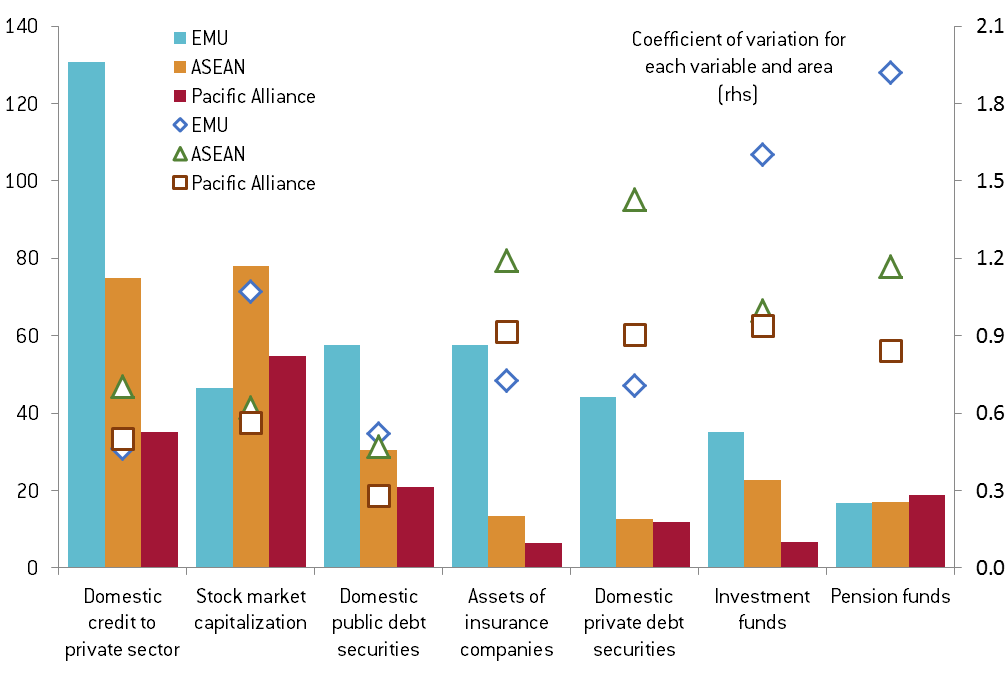

Furthermore, moderate financial deepening (Chart 6) and high reliability on foreign currency in certain markets are significant obstacles for the implementation of a single monetary policy in the two emerging integration processes here considered.

These conclusions perfectly coexist with the fact that both the ASEAN and the Pacific Alliance are indeed making progress in other integration dimensions that could end up in significant welfare gains, either through higher growth and employment rates or through greater financial stability. Cooperation areas are diverse and range from increasing labour mobility to technological diffusion, and their development could pave the way for more ambitious integration steps in the future.

Chart 6. Development of financial markets

Percentage of GDP (2011)

Source: own elaboration from World Bank’s Global Financial Development Database (GFDD)

References

García-Herero, A., 2014: “How close is Asia to an optimal currency in terms of business cycle co-movement?”, IMES Discussion Paper No. 2014-E-12.