Dial N for NAIRU, or not?

What’s at stake: The concept of the NAIRU (Non-Accelerating Inflation Rate of Unemployment) has recently divided the minds in the economic blogosphere

NAIRU, a useless concept?

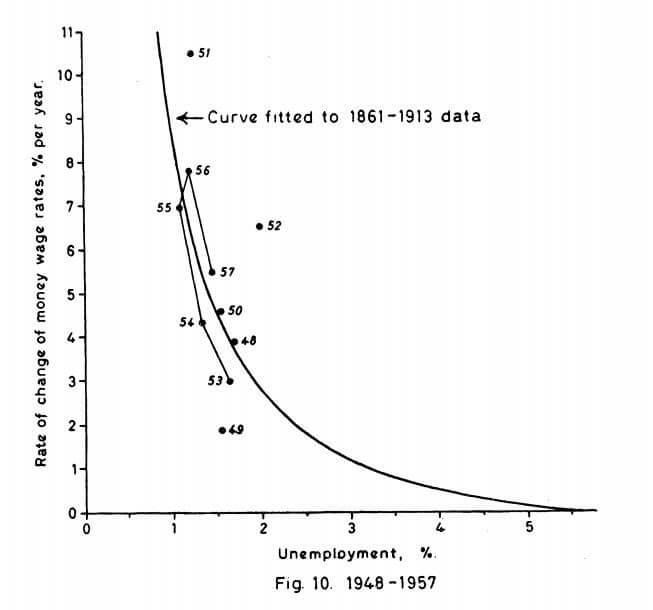

Matthew C Klein asks why a purely real variable (unemployment) should have any bearing on a purely nominal one (inflation). In 1926, Irving Fisher found a relationship between the level of unemployment and the rate of consumer price inflation in the US. In 1958, AW Phillips studied UK data from 1861-1957 and found a relationship between the jobless rate and the growth of nominal wages, although the relationship seems to have been an artifact of the gold standard given the vertical line he found in the postwar period:

Source: FT Alphaville

Some people (wrongly) interpreted Phillips’ data to mean that there was a straightforward trade-off between the inflation rate and the unemployment rate. Policymakers could just pick any spot they wanted on “the Phillips Curve”. This worked out poorly, but the reaction took the form of an equally dubious idea: the Non-Accelerating Inflation Rate of Unemployment, or NAIRU. In this view, the change in the inflation rate should be related to the distance between the actual jobless rate and some theoretical level.

If the unemployment rate were above this “neutral” level, the inflation rate would slow down and potentially turn into outright deflation. If the jobless rate were “too low”, however, consumer prices would rise at an accelerating rate. According to the wacky world of NAIRU, however, hyperinflation can coexist just fine with hyper-employment. Klein concludes that NAIRU isn’t just a useless concept, it’s a counterproductive one that encourages policymakers to focus on the jobless rate as a means to an end (price stability) even though there is zero connection between the two variables. The sooner NAIRU is buried and forgotten, the better.

Simon Wren Lewis disagrees, and notes that the NAIRU is one of those economic concepts that is essential in understanding the economy but is extremely difficult to measure. He cites reasons for this difficulty: first, unemployment is not perfectly measured (with people giving up looking for work who start looking again when the economy grows strongly), and may not capture the idea it is meant to represent, which is excess supply or demand in the labour market. Second, it looks only at the labour market, whereas inflation may also have something to do with excess demand in the goods market. Third, even if neither of these problems existed, the way unemployment interacts with inflation is still not clear.

So then why do we still care about the NAIRU?

Simon Wren Lewis continues, asking that if we really think there is no relationship between unemployment and inflation, why on earth are we not trying to get unemployment below 4%? He points out that while we should not be obsessed by the 1970s, we should not wipe them from our minds either. Policymakers then did in effect ditch the NAIRU, and we got uncomfortably high inflation. In the 1980s policy changed in the US and UK – unemployment increased, and inflation fell.

There is a relationship between inflation and unemployment, but it is just very difficult to pin down. For most macroeconomists, the concept of the NAIRU really just stands for that basic macroeconomic truth. He goes on by noting that a more subtle critique of the NAIRU would be to acknowledge that truth, but acknowledge that we should stop using unemployment as a guide to setting monetary policy, because the relationship is difficult to measure. Let’s just focus on the objective – inflation – and move rates according to what actually happens to inflation.

NAIRU in the heterodox world

Jo Michell enters the debate by noting that there is a deeper question of what the NAIRU actually means – what is a NAIRU? The simple definition is straightforward: it is the rate of unemployment at which inflation is stable. At first glance this appears all but identical to the ‘natural rate of unemployment’, a concept originating from Friedman’s monetarism and inherited by some New Keynesian models – in particular the ‘standard’ sticky-price DSGE model of Woodford and others. In this view, the economy has ‘natural rates’ of output and employment, beyond which any attempt by policymakers to increase demand becomes futile, leading only to ever-higher inflation.

Since there is a direct correspondence between stabilizing inflation and fixing output and employment at their ‘natural’ rates, policymakers should simply adjust interest rates to hit an inflation target. Economists refer to this as the ‘Divine Coincidence‘ – despite the fact it is essentially imposed on the models by assumption. More sophisticated New Keynesian formulations of the NAIRU are a good distance removed from the ‘natural rate’ theory – these models incorporate (at least short-run) involuntary unemployment and see inflation as driven by competing claims on output rather than the ‘too much nominal demand chasing too few goods’ story of the monetarists and simple DSGE models.

It is also the case that such a relationship is found in many heterodox models. Recent Post-Keynesian models also include NAIRU-like relationships. For example, Godley and Lavoie’s textbook includes a model in which workers and firms compete by attempting to impose money-wage and price increases respectively. The size of wage increases demanded by workers is a function of the employment rate relative to some ‘full employment’ level. That sounds a lot like a NAIRU – but that isn’t how Godley and Lavoie see it:

This highlights a key difference between Post-Keynesian and neoclassical approaches to the NAIRU: where Post-Keynesian models do include NAIRU-like relationships, the relevant employment level is endogenous, due to hysteresis effects for example. In other words, the NAIRU moves around and is influenced by demand-management policy. As such, the NAIRU is not an attractor for the unemployment rate as in many neoclassical models.

Simon Wren Lewis agrees with the point on hysteresis, which however just adds a complication to the NAIRU analysis, rather than overturn that analysis altogether. What hysteresis does is to make periods where unemployment is above the NAIRU extremely costly. It also means that periods of being slightly below the current NAIRU might be justified if they reduce the NAIRU itself.

So NAIRU, forever contested?

One of the sharpest reactions to the NAIRU piece by Simon Wren Lewis came from Brian Romanchuk, who stated that the NAIRU has to be bashed, smashed, and trashed. Simon Wren Lewis countered by stating that accepting the concept of the NAIRU does not mean you have to agree with their judgements. But if you want to argue that they could be doing something better, you need to use the language of macroeconomics. You can say, as many besides himself have done, that the NAIRU is either a lot lower than central bank estimates, or is currently so uncertain that these estimates should not influence policy. But just bashing it will get us nowhere.

Jo Michell wonders why the NAIRU is such a contested concept and cites Engelbert Stockhammer, who distinguishes between the New Keynesian NAIRU theory and the New Keynesian NAIRU story. Stockhammer argues (writing in 2007, just before the crisis) that the NAIRU has been used as the basis for an account of unemployment which blames inflexible labour markets, over-generous welfare states, job protection measures and strong unions. The policy prescriptions are then straightforward: labour markets should be deregulated and welfare states scaled back. Demand management should not be used to reduce unemployment. Jo Michell suspects that the NAIRU story is one reason why defence of the NAIRU theory generates such strong reactions.