The international effects of ECB’s monetary policy

What’s at stake: the literature on monetary policy spillovers is abundant of studies investigating the impact of the US Federal Reserve’s monetary pol

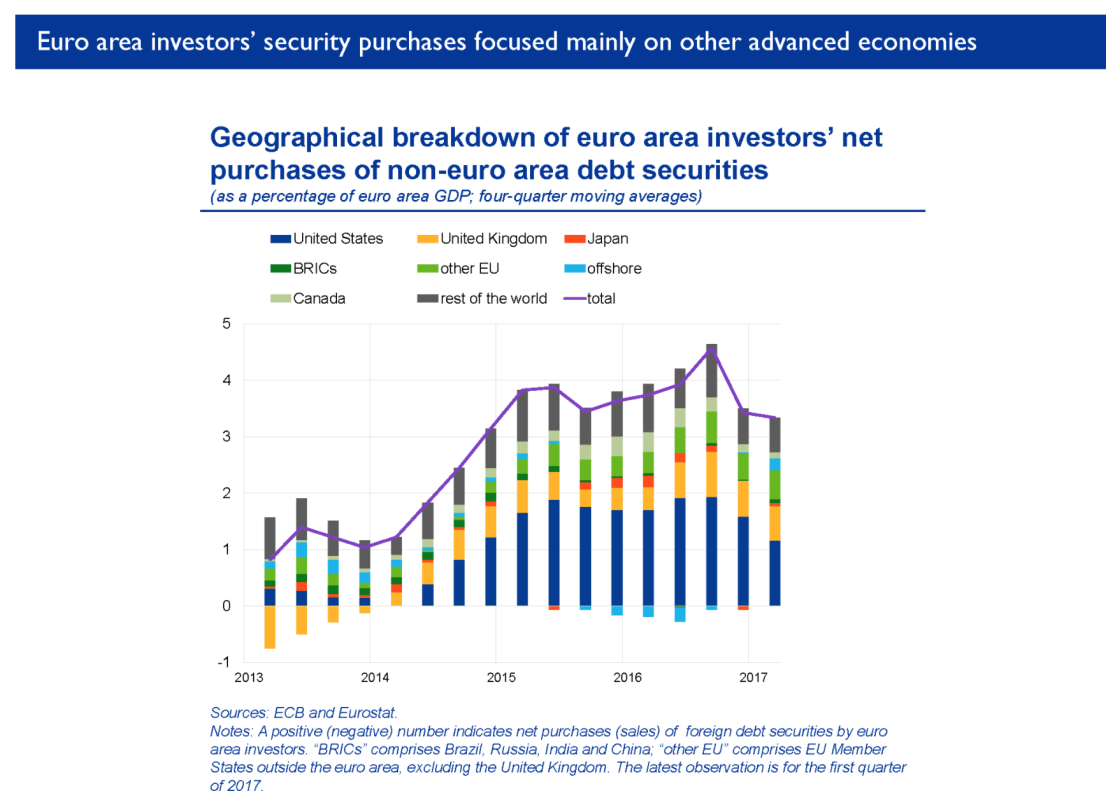

In a recent speech, ECB’s Executive Board Member Benoit Coeuré discussed the international effects of the ECB’s asset purchase programme. The data show a turnaround in capital flows in the Euro Area from net inflows to net outflows starting in mid-2014, after the ECB announced its credit easing package. Asset purchase programmes are shown to have had spillover effects on other countries via capital flows and relative asset price movements. The evidence does not suggest that these capital flows have led to major exchange rate movements. Rather, exchange rates seem to have responded to forward-looking interest rate differentials. Asset purchase programmes, together with negative interest rates, may have exacerbated those differentials through signalling and non-linear effects, but their effect on exchange rates is, by and large, not fundamentally different from conventional policy.

Selling of euro area bonds by non-residents is to some extent a mechanical feature of the ECB’s asset purchase programme, because foreign investors are holding a relatively large share of outstanding euro area government bonds. This feature makes the ECB’s asset purchase programme structurally different from its counterpart in Japan and the US.

Coeuré proposes three main factors that can explain the difference in post-QE debt flows in the United States and the euro area. First, the yield differential: ten-year US Treasuries and equivalent German Bunds were generating, on average, broadly the same return, in local currency, during the Fed’s QE programmes from late 2008 to early 2013. But yield differentials were quite different in recent times. As a result, portfolio rebalancing during the ECB’s asset purchase programme has been more attractive for investors than it was during the Fed’s QE programmes. The second factor is negative rates. In addition to yield differentials, the absolute yield level may also matter for investors, particularly if rates are negative. And third, political uncertainty and the role of the US dollar in the international financial system.

Falagiarda, McQuade and Tirpák (2015) use event-study techniques to investigate the presence and the magnitude of spillovers from the ECB’s non-standard monetary policies on financial assets in selected non-euro area EU countries from Central and Eastern Europe (the Czech Republic, Hungary, Poland and Romania). They find strong evidence of spillover effects from the ECB’s announcements on bond yields, and that the SMP announcements resulted in significant spillovers, while those from the OMT and the PSPP announcements were rather limited. Turning to the transmission channels, they argue that spillovers from the SMP announcements operated through the portfolio rebalancing and the signalling channels; the transmission of the OMT operated via the confidence channel and for the PSPP both the confidence and the signalling channels were at play.

Falagiarda, McQuade and Tirpák also review the impact of the Fed’s QE and tapering announcements, finding that CEE countries were subject to monetary policy spillovers not only from the euro area, but also from the US. When comparing the magnitude of spillovers from monetary policy announcements, however, spillovers to CEE countries from ECB policies were stronger and affected more asset classes than spillovers from Fed’s policies.

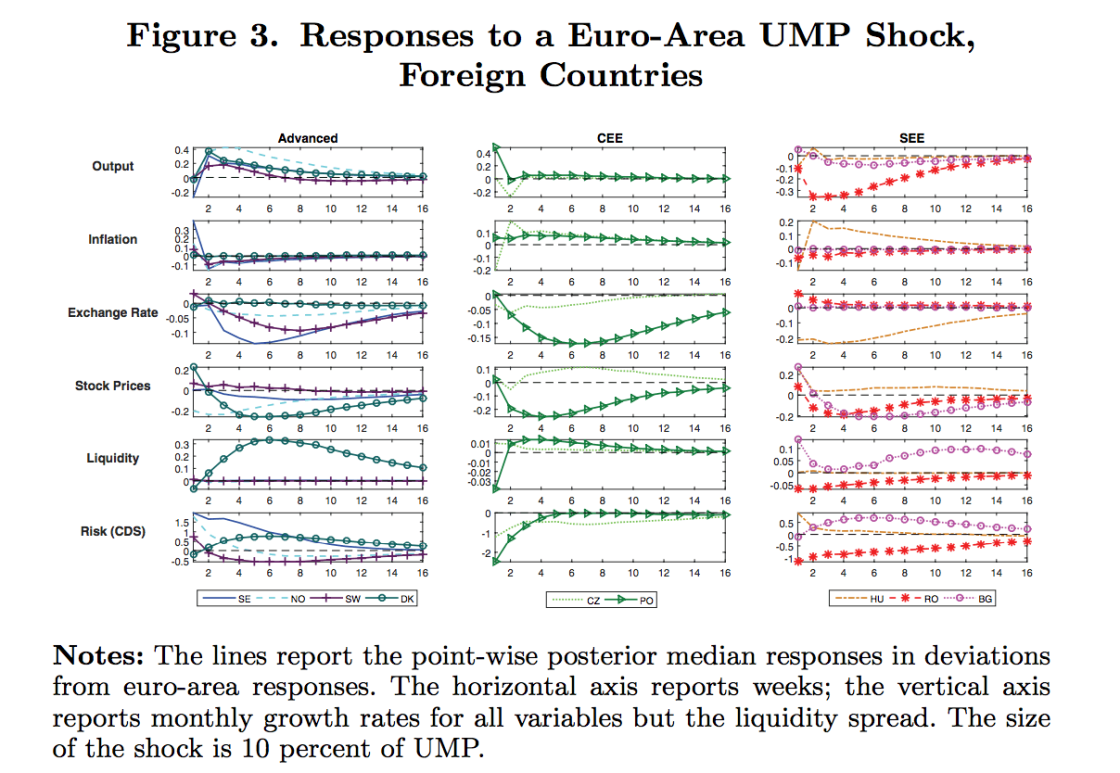

Bluwstein and Canova (2016) examine the effects of unconventional monetary policy measures by the ECB on nine European countries not adopting the euro, using a Bayesian mixed-frequency structural vector autoregressive technique. They find that unconventional monetary policy disturbances generate important domestic fluctuations; the wealth, the risk, and the portfolio rebalancing channels matter for international propagation while the credit channel does not. The responses of foreign output and inflation are independent of the exchange rate regime and international spillovers appear to be larger in countries with more advanced financial systems and a larger share of domestic banks.

Source: Bluwstein and Canova

Fratzscher, Lo Duca and Straub (2016) assess the financial market impact of ECB unconventional monetary policy between 2007 and 2012, looking at a broad range of asset prices and portfolio flows in the euro area and globally. They find that ECB policies boosted equity prices and lowered bond market fragmentation in the euro area. Spillovers to advanced economies and emerging markets included a positive impact on equity markets and confidence, but effects of ECB policies on bond markets outside the euro area were negligible. ECB policies appear to have lowered credit risk among banks and sovereigns in the euro area and other G20 countries, while there is limited evidence of portfolio rebalancing across regions and assets.

Kucharčukováa, Claeys and Vašíček (2016) compare the macroeconomic impact of conventional and unconventional ECB policy actions on the euro area and its spillover to six EU countries outside the euro area (the Czech Republic, Denmark, Hungary, Poland, Sweden and the UK). The comparison is based on a synthetic index of overall euro area monetary conditions (MCI) obtained by factor analysis, and specifically on two subcomponents, one tracking the conventional and the other the unconventional policy of the ECB. A standard monetary VAR shows that the transmission of unconventional monetary policy in the euro area is quite different: prices react more quickly, but the response of output is delayed and weaker. As for the spillover of ECB policy abroad, the importance of euro area monetary policy for macroeconomic developments is confirmed for all six countries. A conventional monetary shock affects inflation and output in largely the same way as within the euro area, but unconventional measures generate a variety of responses. Overall, exchange rates respond rather quickly, the effect on the real economy is slow and limited and inflation often remains unaffected.

Horvath and Voslarova (2016) examine how unconventional monetary policy of the ECB influences macroeconomic stability in three Central European economies. They estimate various panel vector autoregressions (PVARs) using monthly data from 2008 to 2014. Using the shadow policy rate and central bank assets as measures of unconventional policies, they find that output growth and inflation in Central Europe temporarily increase following an expansionary unconventional monetary policy shock by the ECB and the effect of unconventional policies on output growth is much stronger than the effect on inflation.

Ciarlone and Colabella (2016) provide evidence that the effects of the ECB’s asset purchase programmes spills over into CESEE countries, contributing to easing their financial conditions both in the short and in the long term through different transmission channels. In the short term, a number of variables in CESEE financial markets appear to respond to news related to the ECB’s non-standard policies by moving in the expected direction. Over a longer-term horizon, they find that cross-border portfolio and banking capital flows towards CESEE economies have been affected by both the announcement and the actual implementation of the ECB’s asset purchase programmes, pointing to the existence of a portfolio rebalancing and a banking liquidity channel.