The Fed’s Unwinding

The Federal Open Market Committee (FOMC) held short-term interest rates steady on September 20th and announced that starting from October 2017 the Fed

Joseph Gagnon at PIIE thinks that the unexpected development was a further reduction in the median view of FOMC participants about where the short-term interest rate will settle in the long run. The Fed apparently endorses the view that the slowdowns in the growth rates of productivity and the working-age population have persistently lowered both the economy's potential growth rate and the rate of return on investment. Shrinking the balance sheet will tighten financial conditions because it will increase the amount of long-term bonds in the market and thus push up their yields. Much of any increase is probably already priced into bond yields, given that this decision was telegraphed so clearly in advance. The 10-year Treasury yield rose only 2 basis points on September 20, but it has risen 58 basis points over the past 12 months, in part reflecting expectations of today's decision. The FOMC continues to project another federal funds rate hike in December. However, Chair Janet Yellen made it clear in her press conference that many participants in the committee are troubled by the decline of measures of core inflation earlier this year. If data over the next three months do not show some evidence of inflation returning toward its target of 2 percent, as the FOMC currently expects, rate hikes are likely to be postponed.

Richard Clarida on Pimco Blog thinks there are intriguing clues from the dot plot, which shows the median FOMC participant is inclined to hike the fed funds rate by year-end 2017 and also has marked down her or his longer run dot to 2.75% (from 3% in the previous dot plot in June).

Clarida argues that the FOMC dot plot now clearly indicates that many on this committee expect that the Fed may have to overshoot the longer run neutral rate. This reflects the fact that the Fed’s statement of economic projections (SEP) shows U.S. unemployment falling to 4.1% over the next two years, well below the unchanged estimate of NAIRU of 4.6% (the non-accelerating inflation rate of unemployment). To keep projected U.S. inflation at 2% – and according to the SEP, the Fed expects to see 2% inflation by 2019 – the Fed’s models, and several of the dots, indicate this would call for a tighter-than-neutral policy rate. Each dot in the plot tells a story – but the eventual outcome is not yet written.

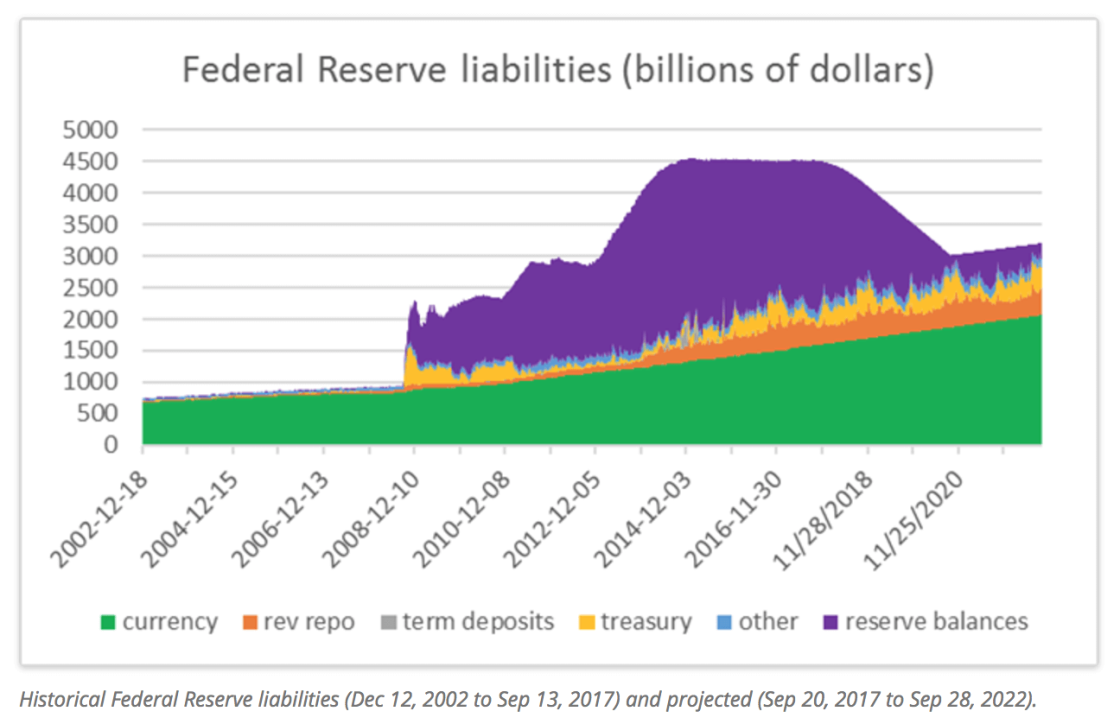

James Hamilton at Econbrowser thinks we may not have seen the end of balance sheet expansion. He created a mock-up of what the balance sheet would look like if the Fed reduced its holdings by the maximal amount at a smooth weekly rate and supposing that the Fed maintains the rate achieved by the end of 2018 through 2019 and the first three quarters of 2020. These projections assume the Fed will resume growing its balance sheet in 2020:Q4, and never let total assets fall below $3 trillion. The reason the Fed may go back to growing its balance sheet within three years comes from thinking about the liability side of its balance sheet. The big bulge in assets has mainly been financed by extra Federal Reserve deposits held by financial institutions, but several other liabilities are also significant– deposits held by the U.S. Treasury’s account with the Fed, deposits that get returned temporarily to the Fed through reverse repos, and currency held by the public.

Source: Econbrowser

A key feature of those last three is that under current Fed operating procedures these quantities are basically chosen outside the Fed. The reason that total liabilities have remained almost constant week-to-week for three years in the face of this volatility is that Fed deposits of financial institutions have acted as a big buffer, elastically growing or contracting in response to whatever happens at the Treasury or with reverse repos. In Hamilton’s simulation, if the Fed were to continue reducing its balance sheet through the end of 2020, the level of Fed deposits by financial institutions may not be enough to cover the plausible variation in other Fed liabilities. There are other changes the Fed may consider to its basic operating system, such as changing the way it conducts reverse repos, using temporary open-market operations to add or withdraw reserves as needed to offset changes in the Treasury balance, or moving to a true corridor system for controlling interest rates. The gradual pace of contracting the balance sheet gives the Fed a couple of years to sort out how it’s going to do that.

The Economist’s Free Exchange makes the case against shrinking the Fed’s balance sheet. A way of viewing QE is as an operation that changes the maturity profile of government debt. The best size for the Fed’s balance-sheet therefore depends on the best maturity profile for government debt, once the liabilities of the Fed and the Treasury have been combined. If money is more useful than Treasury bills, then the Fed performs a useful service by swapping one for the other. And there is literature showing that money is useful, in the sense that abundant bank reserves increase financial stability, because otherwise increased money demand i satisfied by the private sector with very short-term debt like asset-backed commercial paper. But the political power of worries about the Fed’s balance sheet will help determine the endpoint for the Fed’s balance-sheet. The Fed will need more assets than it did before the financial crisis, because of increased demand for currency, another central bank liability.Which system is used, and hence the ultimate size of the balance-sheet, is a decision that will probably be taken after President Donald Trump decides whether or not to reappoint Mrs Yellen as chair.

Philippe Waechter argues that the Fed normalises but does not become optimist. Janet Yellen has indicated that the hierarchy of monetary policy instruments is clear. The Fed is confident that the US economy has definitively overcome the crisis, but it is not optimist. The projection of the Fed funds rate in the long term is 2.75%, which suggests the absence of a rebound in productivity gains as well as the demographic shock that will affect the American economy in the long term. The normalisation is anyway a relative one, because nobody could imagine today to go back to the pre-crisis equilibrium. The crisis may be over, but that does not mean a renaissance: it’s rather the management of a long-lasting degraded situation.

Matthew Klein on the FT writes that the Fed’s forecasts imply the bank will deliberately tighten monetary policy to slow the US economy, possibly to the point of outright recession, by the early 2020s. The economy’s growth rate is expected to slow down by more than half a percentage point. Ideally, this would mean that the gap between actual and potential output will have gently closed by the end of 2020, but several FOMC members seem to think the US economy will already be growing by less than its potential as early as 2019 and that the jobless rate will continue to be well below its longer run level even by the end of 2020. Either the longer run forecast will be revised lower, or central bankers are expecting to push the unemployment rate up by perhaps as much as a full percentage point. The median forecast for the “longer run” Fed Funds rate is currently 2.75%, a new all-time low, but the really interesting issue is how this theoretical estimate of “neutral” fits with the forecasts for actual policy 2019 and 2020. Seven current members of the FOMC want the policy rate to be above 2.75% by the end of 2019, and five want it to be above 3%. Only one person thinks the “longer run” rate is above 3%. That means at least five out of the maximum of 19 policymakers want the Fed to be actively slowing the US economy by the end of 2019.

Tho Bishop at the Mises Institute thinks that while tapering has been priced in, there are still major questions left unanswered. One of the biggest questions going forward is who will step up to replace the Fed’s purchasing power in the US Securities market. In the past, the US has been able to count on China to purchase US debt. Even before the Trump administration threatened the country with sanctions, China was selling off Treasuries in order to help prop up its economy. With other nations also backing off from US debt, the hope is that investors will fill the gap. While the continued actions of the ECB, BOJ, and other central banks may make US debt more attractive in comparison, increased investments in bonds is likely to come at the expense of other assets. Bishop thinks that the noise of the Fed’s actions only serves to distract from the real issue, which is the continuing economic stagnation of the US economy. While Yellen continues to boast about modest employment gains, full-time employment remains lower than it was prior to the recession and the Fed itself — which is regularly overly-optimistic — doesn’t seem to have much faith in the future. It is now projecting long-term below 2%.

David Beckworth at Macro Musing argues that while most people know the arguments for and against shrinking the Fed's balance sheet on purely economic terms, there are other political economy forces at work too. Writing in The Hill, Beckworth argues that the large-scale asset purchasing program, combined with the introduction of the Fed’s program to pay interest on excess reserves (IOER) to banks, effectively transformed the Fed from a standard central bank into one of the most profitable financial firms on the planet. The Fed has been earning relatively high interest on its expanded holdings and paying very low interest on short-term deposits from the banks as part of the IOER program.

Given the profitability, prestige and jobs created by maintaining the Fed’s large balance sheet, it will not be painless for the Fed to shrink it. The Fed’s main reason for doing so is that it believes a large balance sheet is no longer needed for stimulus reasons. Another reason is that some Fed officials worry about the footprint its large balance sheet has on the financial system. But the Fed may also be eager to unwind its balance sheet because of bad optics politically. Most of the increased liabilities have been in the form of banks’ excess reserves, which banks deposit at the Fed and earn interest on. That means foreigners and the U.S. banks bailed out during the crisis are getting most of the interest payments from the Fed. Only time will tell whether these reasons will provide enough incentive for the Fed to completely follow through.