The capital tax cut debate

How much do workers gain from a capital gains tax cut? CEA chairman Hasset claims the tax cut will cause average household labour income to increase b

Former chair of the Council of Economic Advisers (CEA) Jason Furman writes on Twitter that “the economic debate about the %age of the corporate tax paid by labour ranges from 0% to 100%. The new CEA study puts it at 250%.” Larry Summers writes in the Washington Post that White House Chief Economist Hasset’s claim that cutting the corporate tax rate from 35 percent to 20 percent would raise wages by $4000 per worker is absurd, as it implies that workers would benefit by $600 billion — or 300 percent of the tax cut. Summers argues that in the presence of full expensing, a corporate rate reduction has no effect on the cost of capital for equity-financed investments and raises the cost of capital for debt-financed investments. Changes in transfer pricing practices induced by tax policy changes do not represent changes in economic welfare or real incomes of Americans. Theory suggests that there are relationships between changes in corporate taxes and changes in wages rather than between the level of corporate taxes and wage growth.

Greg Mankiw answers with an exercise to understand by how much a tax cut will affect wages. In an open economy with a production function y = f(k), capital stock adjusts so that the after-tax marginal product of capital equals the exogenously given world interest rate r = (1-t)f '(k) and wages are set by the marginal product of labour, which equals w = f(k) -f '(k)*k. If we cut the tax rate t, the static cost of the tax cut (per worker) is dx = -f '(k)*k*dt. The effect of a tax cut on wages (dw/dx) will be dw/dx = 1/(1 - t). So if the tax rate is one third, then every dollar of tax cut to capital (on a static basis) raises wages by $1.50. John Cochrane agrees with Mankiw and supplements the post with a dynamic result.

Steve Landsburg weighs in, pointing out that Mankiw’s result is only incidentally about wages. It’s fundamentally about the ratio of the long-run to the short-run government revenue shortfall (not counting the correction to the long-run shortfall that is due to new investment). That’s relevant to wages only because the long-run shortfall happens to end up entirely in the hands of workers.

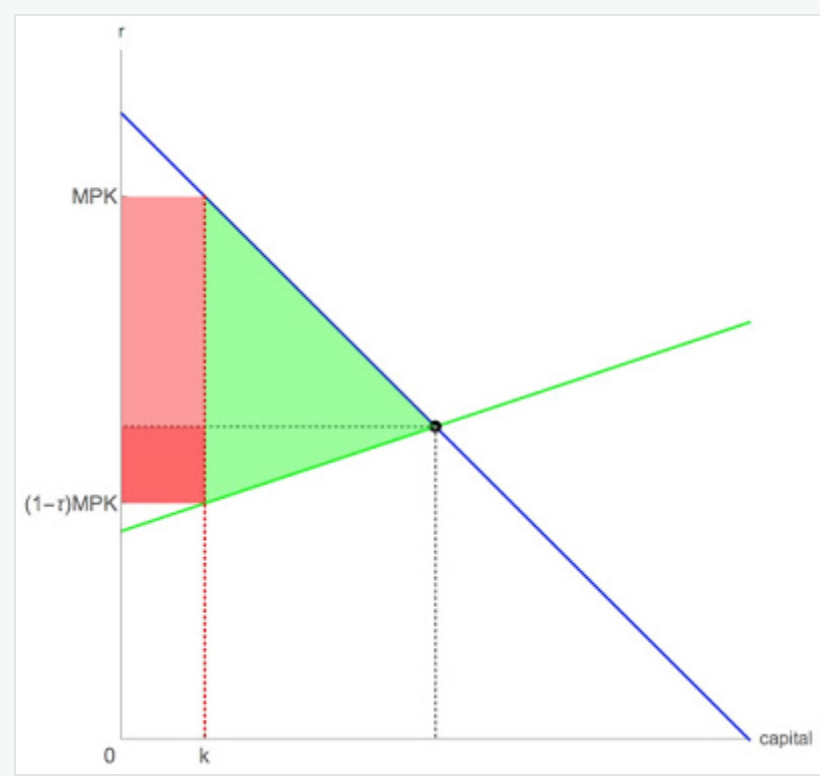

Casey Mulligan writes along the same lines that Furman and Summers have it backwards. The red area (R) in Figure 1 is the revenue from a capital income tax. The red and green areas (R + G) are the losses from that tax suffered by owners of the factors of production, combined for capital and all other factors. The revenue is a lower bound on the factor owners' loss. In the long run, all of the factor owners' loss from a capital income tax is a loss to labour (the area below the horizontal dashed line is negligible; see A below). Therefore, in the long run, capital-income tax revenue is a lower bound on labour’s loss. Furman and Summers don't seem to understand that the wage gains from a cut come not only from the Treasury but also the economic waste created by the corporate tax, so the long-run Furman ration must be greater than 100%.

Mulligan argues that If we begin with a high tax rate, and conservatively assume that the only channel for benefits is a higher capital stock, then 250% is about right for cuts to somewhat lower rates. Using a Cobb-Douglas aggregate production function with labour share 0.7, and a 50% capital-income tax rate, it is possible to get a Furman ratio of 350%. With a 40% tax rate instead, the Furman ratio is 233%.

Lawrence Summers replies on the Washington Post that Mulligan and Mankiw’s analysis is inadequate because they make use of simple academic abstract models that do not capture the complexities of a policy situation to argue that wage increases could be larger than the tax cut. Summers argues that Mankiw’s post is unhelpful for three reasons. First, a cut in the corporate tax rate from 35 to 20 percent in the presence of expensing of substantial or total investment has very little impact on the incentive to invest. Second, neither the Ramsey model nor the small open economy model is a reasonable approximation for the world we live in. Third, a big cut in the corporate rate does not happen in isolation as a break for new investment. Mankiw’s model does not recognise the possibility of monopoly profits or returns to intellectual capital or other ways in which a corporate tax cut benefits shareholders without encouraging investment.

As for Mulligan, Summers argues that he draws wrong conclusions from Summers’ own 1981 paper on Q-theory. One central aspect of the paper was the recognition that the corporate tax rate is, contrary to Mulligan and Mankiw’s assumption, not a sufficient statistic for assessing the impact of the corporate tax system. Summers argues Mulligan entirely ignores the main point of his paper, which was that because of slow adjustment costs the impact of tax changes was felt primarily on asset prices for a long time. He also argues that Mulligan fails to recognise that a corporate rate cut benefits capital and hurts labour outside the corporate sector because it draws capital out of the noncorporate sector, raising its marginal productivity and reducing that of labour.

Brad DeLong argues that Mankiw’s post shows Mankiw is going as far as he believes he can to be helpful to the Republican Party. Mankiw begins his analysis of the effects of a corporate tax cut on the U.S. with "an open economy...", except the U.S. is not a small open economy, so the model does not apply. DeLong also argues that Mankiw’s model is incomplete, as it disregards the government budget constraint somewhere, the timing of the cut, whether other taxes are raised and if so, what taxes and when. Third, DeLong argues that there is a mathematical error in Mankiw’s presentation, which disregards the fact that a tax cut reduces the tax base by reducing the pre-tax rate of profit. This error inflates Mankiw's calculations by a factor of 1/(1-t).

Paul Krugman agrees with DeLong (which is music to DeLong’s ears), arguing that the discussion is confused by putting it in the context of Ramsey models, whereas it’s all about international capital mobility. Krugman geometrically represents the distribution of income in a small open economy with a fixed labour force, under the assumption that the stock of capital changes only through capital inflows or outflow and that factors of production are paid their marginal products. He starts from a situation where the economy faces a given world rate of return r* but the government imposes a profits tax at a rate t, so that to achieve a post-tax return r* domestic capital must earn r*/(1-t). He then does a comparative statics exercise, eliminating the profits tax, showing that in equilibrium, the capital stock rises and so does GDP, profit taxes disappear inducing a revenue loss, but wages rise more than the loss of revenue.

Except that - according to Krugman - several things are wrong with this exercise. First, a lot of what we tax with the corporate profits tax isn’t a return to capital; it’s monopoly profits and other kinds of rents. There is no reason to believe that these rents would be bid down by capital inflows, so the revenue loss on those taxes is just a revenue loss, not something shifted to wages. Second, capital mobility is far from perfect. Third, the US isn’t a small open economy - it can affect world rates of return, meaning that it faces an upward-sloping supply curve of capital, which means that the wage gains from profit tax cuts are smaller. Finally, this is a long-run equilibrium, and long-run analysis is a very poor guide to the incidence of corporate taxes in any politically or policy-relevant time horizon. Over shorter horizons, you’d expect very little of the tax cut to be passed on to workers.

Casey Mulligan argues that Delong and Krugman make a "math error", while falsely accusing Greg Mankiw of making a math error (sic), by equating the wage gain from a small tax cut to the Furman's static revenue loss. They incorporate an equilibrium price change in the calculation of the corporate-income tax base, whereas the static revenue loss from the corporate-income tax must, by Furman's definition of "static," hold corporate income constant.

Robert Waldmann at Angry bear has a very long post on the debate. He agrees with DeLong and Krugman that Mankiw is writing as a partisan Republican, and that with DeLong, Krugman and Summers that Mankiw errs by not considering a complete model and that there is no point in looking at the ratio of one long term effect to a short term effect. But he thinks that the claim that there is a math error is based on an uncharitable guess about which model Mankiw didn’t spell out. Depending on the model which Mankiw didn’t write out, either Mankiw or DeLong could be right. One key issue is that DeLong assumes wages and prices adjust quickly while the capital stock adjusts slowly. The other is that the Ramsey model is not equivalent to a small open economy model.