Has the Phillips curve disappeared?

The Phillips curve prescribes a negative trade-off between inflation and unemployment. Economists have been recently debating on whether the curve has

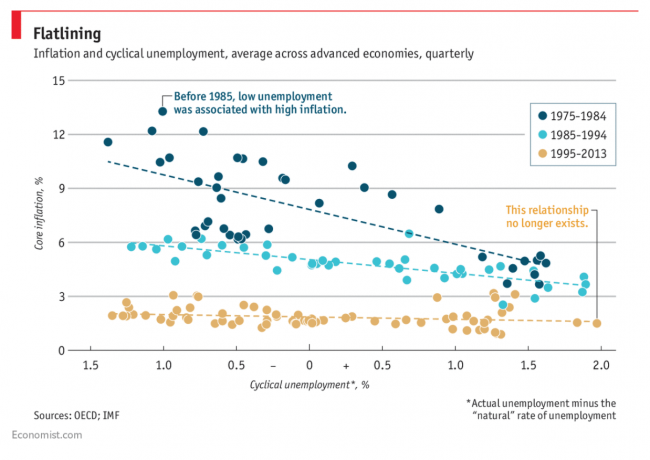

The Economist argues that the Phillips curve may be broken for good, showing a chart of average inflation and cyclical unemployment for advanced economies, which has flattened over time (Figure 1). The Economist also refers to a recent paper by three economists at the Philadelphia Fed, arguing that the Phillips curve is not very useful at forecasting inflation: their Phillips curve models’ forecasts tend to be unconditionally inferior to those from a univariate forecasting model. Phillips curve forecasts appear to be more accurate when the economy is weak and less accurate when the economy is strong, but any improvement in the forecasts vanished over the post-1984 period.

Figure 1

Source: The Economist

Jeremie Banos and Spyros Michas argue on PIMCO’s blog that the broken US Phillips curve is a symptom of lower inflation expectations. The Phillips curve framework is doing a poor job at forecasting inflation, even after tweaking the two main inputs: inflation expectations and (to a lesser extent) the NAIRU. Inflation expectations seem to be well anchored, but no one knows where. And the NAIRU could, at least theoretically, drop all the way down to 0% before inflation accelerates meaningfully.

Lawrence Summers is also of the opinion that the Phillips curve has broken down and believes that the most important factor explaining it is that the bargaining power of employers has increased and that of workers has decreased. Technology has given employers more leverage to hold down wages; on the other hand various factors have decreased the leverage of workers. For a variety of reasons, including reduced availability of mortgage credit and the loss of equity in existing homes, it is harder than it used to be to move to opportunity. Diminished saving in the wake of the crisis means that many families cannot afford even a very brief interruption in work. Summers argues that unions have long played a crucial role in the American economy in evening out the bargaining power between employers and employees, and thus America needs its unions more than ever.

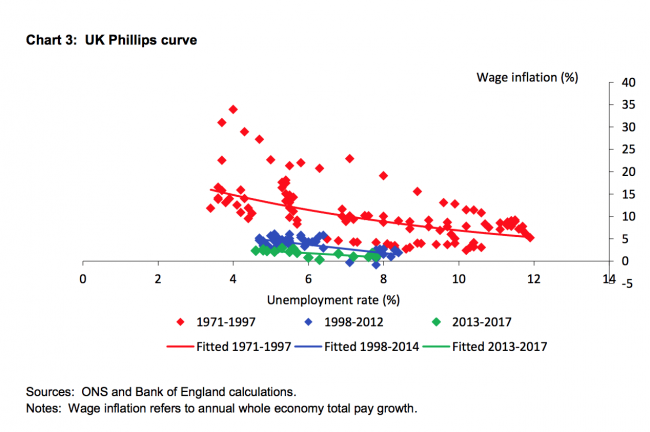

Andrew Haldane makes a similar point for the UK (Figure 2), by pointing at the decrease in unionisation as a symptom for the change in workers-employers relations. In 1990, around 38% of employees in Great Britain belonged to a trade union. That membership rate has steadily declined over time, extending a broad trend apparent since at least the mid-1970s. In 2016, membership of trade unions stood at 23%. Today, around 6 million employees are members of trade unions, less than half the peak of around 13 million in the late-1970s.

Figure 2

Source: Haldane

John Hawksworth and Jamie Durham write on PWC blog that – besides unionisation – increased migration to the UK from other EU countries since 2004 may also have played some role in dampening wage growth in response to increased labour demand, as it has made labour supply more elastic. Depending on how UK migration policy evolves, this factor may become somewhat less important after Brexit. This could potentially worsen skills shortages in the UK, but might also offer some support for wage growth at the lower end of the labour market (in addition to the effect of planned future increases in the national minimum wage).

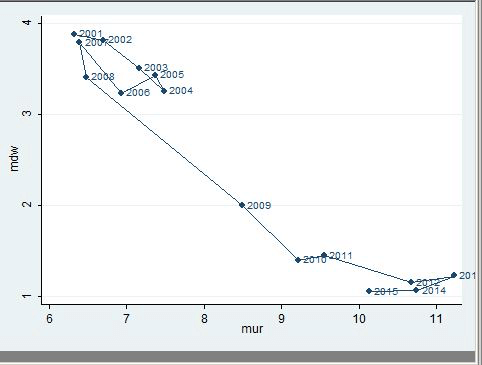

Robert Waldmann at Angry Bear argues that the argument that anchored expectations eliminate the relationship between monetary policy and real outcomes is based on the hypothesis that, once economic agents understood the policy rule, the changes in interest rates, monetary aggregates and inflation rates caused by the the policy would be uncorrelated with real variables. Somehow this changed from a hypothesis to a revealed truth. The simple fact, however, is that inflation and unemployment are still correlated even now that inflation is stable and can be predicted. The Phillips curve is actually alive and well in Europe, at least if we look at the average wage inflation over the 15 countries which were in the European Union in 1997 compared to the average unemployment rate (Figure 3).

Figure 3

Source: Robert Waldmann

Finally, Gavyn Davies argues that while the Phillips curve might be in hiding, it still exists beneath the surface. Focusing on the US, he highlights five questions. First, are we using the right measures of inflation and unemployment? Wage inflation seems to be at the heart of the PC “puzzle”, but the use of the average hourly earnings series, and similar official data, may have exaggerated the stickiness of low wage inflation. Second, global forces may be holding US inflation down – e.g. the slack in the global economy, notably in the euro area, may be exerting downward pressure on US inflation. Third, the Phillips Curve is still visible in state-by-state data in the US: if the national curve has been disguised by structural shocks, including globalisation, these shocks should have applied fairly evenly across all of the 50 states in the Union. Fourth, the standard version of the Phillips curve always includes a term for inflation expectations. As expectations fall, price and wage inflation are expected to change in the same direction, even if unemployment is stable or declining. The recent drop in inflation expectations could partially explain why recorded inflation has remained low, even though unemployment has dropped below the natural rate. Fifth, inflation shocks are larger than changes in coefficients of the Phillips curve. On balance, empirical work seems therefore to support the existence of a negative relationship between unemployment and inflation in the US and the Euro Area in recent years. This relationship has been disguised by other shocks, unconnected to unemployment, that have had important effects on inflation, but it has not disappeared.