Abenomics, five years in

Five years have passed since Japan’s Prime Minister Shinzō Abe was elected in 2012 and started “Abenomics”, a macroeconomic package based upon the “th

The Economist points out that five years later, Japan’s currency is about 30% cheaper in dollar terms than it was in November 2012 and the Nikkei 225 stock-market index is up by more than 150%. That has provided some of the intended stimulus to the economy, and Japan’s GDP has risen for seven quarters in a row, its longest spell of uninterrupted growth for 16 years. Exports contributed a lot to the increase, but private investment has also grown by more than 18% in nominal terms over the past five years. Employment has also increased by more than 2.7m, despite an unfavourable demographic trend. Yet, inflation has not picked up: the consumer prices (excluding fresh food) rose by only 0.7% in the year to September 2017. One reason for the weak inflation performance is that wages have not risen as fast as expected, partly due to the fact that the bulk of Japan’s workers are permanent and their wage settlement mostly just follows the cost of living. A second reason is the increase in the labour force, as more women, elderly men and to some extent also foreign workers entered the market. Moreover, where the cost of labour has risen, some firms have found ways to raise productivity rather than prices, investing in labour-saving technologies.

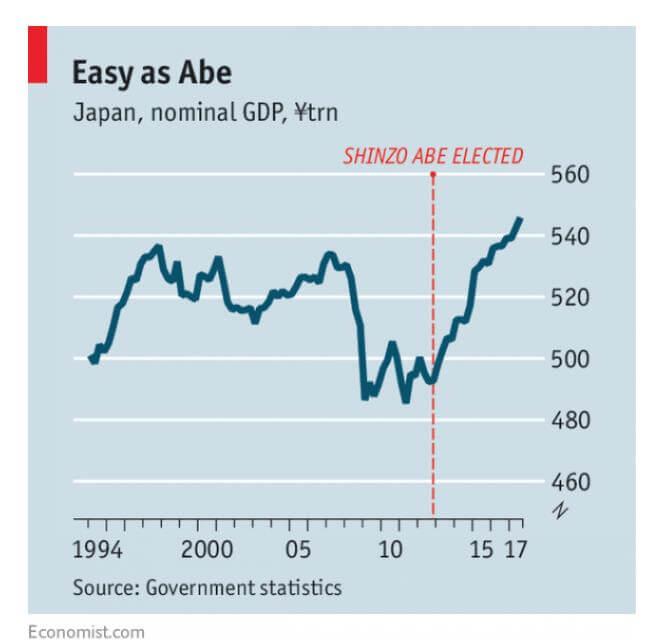

Figure 1

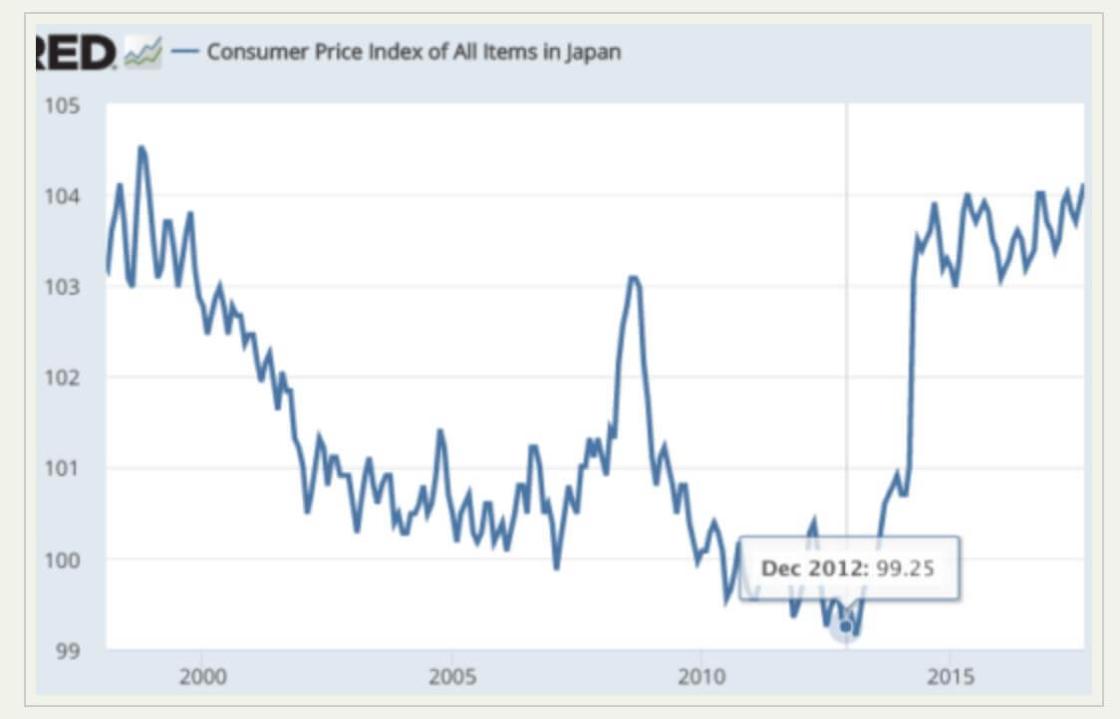

Scott Sumner at The Money Illusion agrees that the most important impact of Abenomics was on Nominal GDP, which had been trending downwards prior to Abe’s election. According to market monetarist theory, strong NGDP can be useful in solving two problems: excessive debt burdens and high cyclical unemployment. Abenomics has been very successful on both fronts. Unemployment had fallen to 2.7%, the lowest level in 23 years; and the ratio of public debt to GDP has leveled off, after soaring higher at a dangerous rate in recent decades. Prices are up over the past five years, and certainly better than the deflation that preceded Abenomics, but well short of the 2% target (Figure 2).

Figure 2

Source: The Money Illusion

Over at Econlog, Sumner also argues that 1% is too low and the the Bank of Japan (BOJ) should adopt easier money, for two reasons. First, Japan has set an official inflation target of 2% and once an official inflation target is set, it needs to be hit for monetary policy to be credible (which in turn is key in view of potential future crisis). Second, Sumner thinks the BOJ has been foolish to use interest rates as a policy instrument, because even 2% inflation in Japan is probably not high enough to avoid the zero bound during a recession. So Japan is in a weird situation where it doesn't need monetary stimulus, but the BOJ should nonetheless adopt monetary stimulus because if it does not do so, Japan might fall into recession at a time when the BOJ has lost credibility.

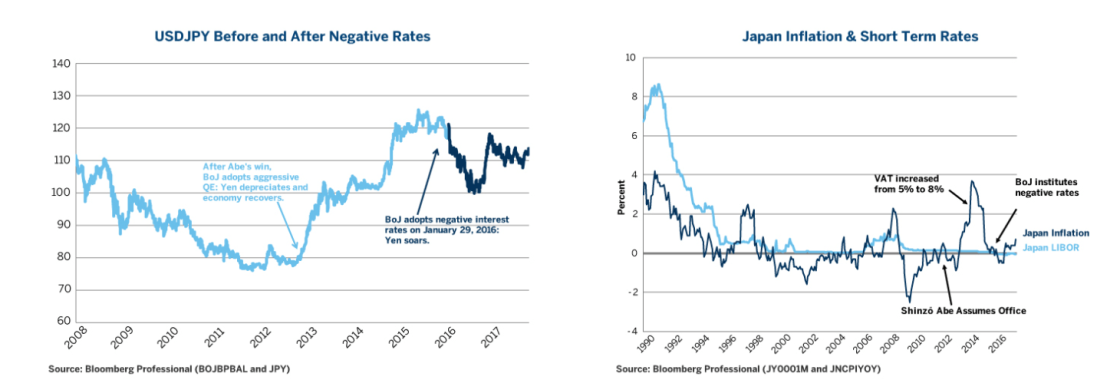

Erik Norland of CME Group thinks that Abenomics is a work in progress. Japan’s economy has improved since 2012, but has slowed since early 2015 and the BOJ’s experiment with negative short-term interest rates does not appear to have been a success (Norland argues that negative rates halted Japan’s return to positive rates of inflation). Approximately half of the temporary 2013-2014 spike in inflation can be attributed to the increase in value added tax (VAT) from 5% to 8% and although it was not a major theme of the campaign, one key thing to watch for will be another attempt to hike the VAT from 8% to 10%, which would increase pre-purchase activity but temporarily slow the economy after the increase. Another issue that was sidestepped in the campaign is that of nuclear energy. Abe’s government has allowed for a progressive and partial return to nuclear, which should limit Japan’s budget deficit and soften demand growth for crude oil and natural gas. Overall, Japan currently benefits from a favorable international context with the first synchronised global growth since 2007 – but China poses a major risk, as 25% of Japan’s exports head to China or Hong Kong and both have accumulated massive debts. Norland thinks that Japan’s own high debt levels will probably relegate it to low short-term rates for many years to come, despite improved economic performance.

Figure 3

Source: Erik Norland

Lechevalier and Monfort argue that, over the past five years, the proactive policies pursued under Abenomics played a decisive role in reversing one cause of the Japanese slowdown – inconsistent economic policies – and that they are now yielding preliminary results. However, they stress that, five years in, the results have fallen short of targets, especially with regard to price dynamics and GDP growth. They are more critical with regard to long-term issues, and think that Abenomics might ultimately fail because of the inability to clearly define the nation's growth model for the next two decades. In Lechevalier and Monfort’s view, the problem is not so much the lack of structural reforms as their limited ability to enhance the nation's growth potential.

A similar point is highlighted by Shaori Shibata, who argues that those Keynesian-style remedies that form part of Abenomics have not been able to address Japan's longer-term problem of weak demand, especially in terms of private consumption. This is in large part due to the liberalising measures that also form part of Abenomics, and which are incompatible with the Keynesian remedies pursued. Whilst Abenomics has the potential (at least in the short-to-medium term) to improve the profitability of Japanese businesses, in the absence of a corresponding move to redistribute corporate wealth to labour, Abenomics also represents a hazard to future economic growth in Japan.

Heizo Takenaka writes that while the economy has clearly improved, a number of serious challenges remain. Efforts for fiscal consolidation and revitalisation of regional economies remain slow; the expanding income disparity has been left unaddressed; despite improvement of the economy, Japan’s competitiveness position in the world has deteriorated further; and the international rankings of Japanese universities keep going down. Overall, the bottom line is that while Abenomics has substantially lifted up the economy, it has yet to sufficiently cope with the rapid changes taking place in the rest of the world. Takenaka thinks that behind these developments are several characteristics of policy formulation in the Abe administration. There are numerous policies that can be potential legacies of this administration – a fundamental overhaul of the social security system to thwart the social divide; the major reform of the individual identification system as the key infrastructure in the Fourth Industrial Revolution; and the beefing up of the concession scheme to meet new infrastructure demand. Takenaka anticipates that the administration will embark on even bolder economic reforms for future generations.