Do wide-reaching reform programmes foster growth?

With growth gathering momentum in the eurozone, some have claimed this is the proof that structural reforms implemented during the crisis are working,

This January at Davos, European heads of state or government had a joint political message to the world: “Europe is back”[1].

Following almost a decade of economic malaise and recession, growth figures seem to support this view, as the euro-zone economy expanded by a solid 2.5% last year – the strongest figure since 2007.

Observing particularly robust economic performances in the euro-zone periphery, some have been quick to conclude this is the proof that painful structural reforms implemented during the euro-zone crisis are finally paying out[2]. Contrarians will instead claim that the current upswing is due to expansionary conditions in monetary policy and global demand, or to a generic bounce-back after years of recession, all of which has little to do with reforms.

do wide-reaching structural reforms contribute to fostering long-term growth?

Clearly, the ultimate problem is the lack of a counterfactual. The broader question therefore remains: do wide-reaching structural reforms contribute to fostering long-term growth?

Academics are perhaps more divided than is often believed. Aside from the view of multilateral institutions that the depth and breadth of reform packages will shape long-term economic performance, other schools of thought remain more dubious. Some, for example, claim that there are important interaction effects between reforms and, therefore, that few tailored interventions are more likely to foster growth than broad reform packages of the kind seen in Portugal and Greece (Rodrik 2009).

In line with the contrarians mentioned above, others make the point that good luck seems to be of greater importance than good policy (Easterly et al. 1993). Some underline how success rests on the quality of institutions implementing the policies and therefore, inherently, that structural reforms will work better in advanced economies rather than in emerging markets (Prati, Onorato, and Papageorgiou 2013).

In Marrazzo and Terzi (2017), we provide a fresh approach to test these claims empirically. In particular, we identify outstanding episodes of structural reform implementation in terms of breadth and depth, building on a database put together by Giuliano et al (2013) that provides detailed information on both real and financial-sector reforms in 156 countries over a 40-year period.

Indicators considered specifically cover trade-, product market-, agriculture-, and capital-account liberalisation, together with financial and banking sector reform[3]. In particular, we scout for instances where a country implemented a very large (top-five percentile) structural reform in at least two of these policy indicators in quick succession (so-called “reform waves”). This allowed us to identify 23 reform waves between 1961 and 2000, spanning six continents (see Figure 1).

We then tracked top-reforming countries over the 10 years following adoption and estimated the dynamic impact of reform waves by employing the Synthetic Control Method (SCM) – a recently developed econometric technique that is now increasingly being used to build sensible counterfactual policy analysis[4]. The SCM allowed us to quantify the individual impact of a country’s reform package, therefore catering for the fact that each country and reform package was different. However, at the same time, it made it possible to aggregate results and draw some general conclusions on the relationship between reforms and economic performance.

The overall impact of reforms

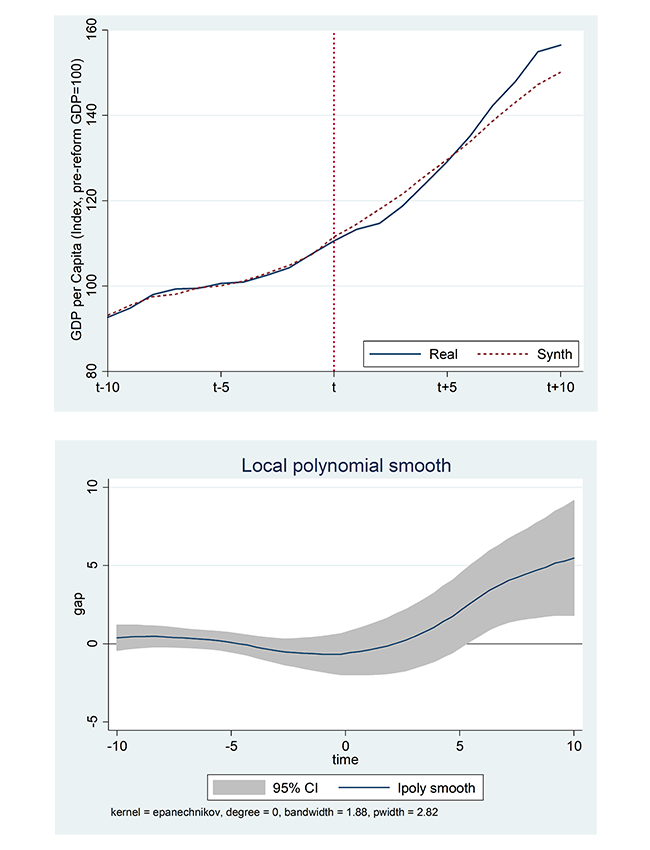

Our general findings are broadly summarised in Figure 2 (LHS), which displays the trend in GDP per capita of the average reforming country and a synthetic counterfactual scenario, before and after implementation. This information, combined with other statistical analyses, suggests that reforms had a negative but statistically insignificant impact in the short term (Figure 2, RHS). We show how the initial slowdown was connected to the economic cycle, and the tendency to implement reforms during a downturn, rather than it being an effect of reforms per se.

Reforming countries, however, experienced significant growth acceleration in the medium-term. As a result, 10 years after the reform wave started, GDP per capita was roughly six percentage points higher than the synthetic counterfactual scenario. To put this into perspective, over the past decade, at a time of so-called “great convergence” (Baldwin 2016), the GDP-per-capita gap between high- and upper-middle-income countries[5] has shrunk by a comparable amount.

Figure 2. Average trend in GDP per capita: reform countries versus synthetic control (LHS) and statistical analysis on the difference between the two (RHS)

Source: Marrazzo and Terzi (2017)

Heterogeneity of reform impact

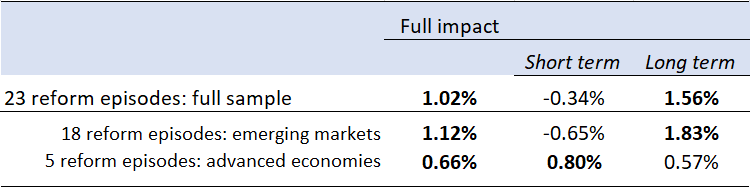

We highlight how average-point estimates mask the fact that the impact of reforms is highly heterogeneous, in particular between advanced[6] and emerging markets. Table 1 illustrates the average impact of reforms on yearly per-capita GDP growth rates vis-à-vis the counterfactual for the full sample of reformers, dividing between short term (up to Year t+4) and long term (year t+[5-10]), and offering a breakdown by advanced economies and emerging markets.

The overall positive effect of reforms is confirmed in both instances (Table 1). However, advanced economies seem to have reaped fewer benefits from their extensive reform programmes than emerging markets. Moreover, the time-profiling of the pay-offs seems somewhat different; while countries closer to the technological frontier, and probably with better institutions, see benefits from reforms in the first five years, these materialise only in the longer run for emerging markets.

Table 1. Average impact of reforms on yearly per capita GDP growth rate vis-à-vis counterfactual

Note: Bold indicates significance at the 5% level

Source: Marrazzo and Terzi (2017)

Concluding remarks

‘Structural reforms’ is very much the buzz phrase of the moment, often presented as the silver bullet to recommence growth both in advanced and emerging markets. But have they worked in the past? Our novel empirical approach suggests that, over a period of four decades and across continents, on average, they did. As such, the view that the current growth acceleration in Europe is at least partially propelled by reforms implemented during the crisis would seem vindicated.

However, average point estimates mask a large degree of heterogeneity in reform impact. Even just among advanced economies, in one out of the five reform instances considered (New Zealand), GDP per capita was significantly below its synthetic comparator at Year t+10. As such, a deep understanding of country-specific factors seems all the more important to increase the chances of designing a successful reform strategy, in line with the diagnostic approach of Rodrik (2009).

The views expressed in this column are those of the authors and do not necessarily reflect those of the European Central Bank.

Bibliography

Adhikari, Bibek, Romain Duval, Bingjie Hu, and Prakash Loungani. 2016. IMF Working Paper Can Reform Waves Turn the Tide ? Some Case Studies Using the Synthetic Control Method.

Baldwin, Richard. 2016. The Great Convergence. First. Cambridge, Massachusetts: Harvard University Press.

Easterly, William, Michael Kremer, Lant Pritchett, and Lawrence H. Summers. 1993. “Good Policy or Good Luck - Country Growth-Performance and Temporary Shocks.” Journal of Monetary Economics 32(3): 459–83.

Giuliano, Paola, Prachi Mishra, and Antonio Spilimbergo. 2013. “Democracy and Reforms: Evidence from a New Dataset.” American Economic Journal: Macroeconomics 5(4): 179–204.

Marrazzo, Pasquale Marco, and Alessio Terzi. 2017. “Structural Reform Waves and Economic Growth.” ECB Working Paper Series (2111).

Prati, Alessandro, Massimiliano Gaetano Onorato, and Chris Papageorgiou. 2013. “Which Reforms Work and Under What Institutional Environment ? Evidence From a New Data Set on Structural Reforms.” The Review of Economics and Statistics 95(July): 946–68.

Rodrik, Dani. 2009. One Economics, Many Recipes: Globalization, Institutions, and Economic Growth. Princeton, NJ: Princeton Univerity Press.

[1] “Europe Is Back. And Rejecting Trumpism.”, New York Times, 24 January 2018.

[2] “This is a remarkable turnaround, testament to […] the efforts of national governments — in Spain, Portugal, Ireland and elsewhere — to effect painful fiscal and structural reforms.” Financial Times, 9 November 2017.

[3] Note that our indicators do not cover labour markets. However, Adhikari et al (2016) reach similar conclusions when using the OECD’s labour and product market reform indicators, and a similar methodology.

[4] See for example “£300 million a week: The output cost of the Brexit vote”, Vox EU, 28 November 2017

[5] World Bank definitions.

[6] These include: Belgium 1988, Great Britain 1976, Norway 1988, New Zealand 1981, and Portugal 1990.