The great fiscal lever: An Italian economic obsession

In the Italian macroeconomic context, many are convinced that if only we had a large enough fiscal lever, we could set in motion an economy that has s

“Give me a fulcrum and a lever long enough, and I shall move the world” – so the great Greek mathematician Archimedes used to say. In the Italian macroeconomic context, many are similarly convinced that if only we pushed more on the fiscal lever, we could set in motion an economy that has stagnated for almost 20 years, and put it back on a positive growth trajectory.

This school of thought is well illustrated by a recent quote from Finance Minister Giovanni Tria, who explained how “public investment will be the [government’s] silver-bullet to foster growth”. This, in his view, will generate enough GDP expansion and fiscal space to finance the spending promises included in the coalition agreement, such as a pension counter-reform, a flat tax, and a universal basic income. The same fiscal convictions are behind the demand in the coalition agreement that public investment be excluded from deficit computations in EU fiscal rules.

These views are not consigned to anti-establishment parties, rather they are pervasive across the political spectrum. For a long time, similar positions have been advocated by former prime minister Matteo Renzi, for example. Even Confindustria, the General Confederation of Italian Industry, would be in favour of an increase in VAT if used to finance more public investment, as this “would foster growth and reduce the debt-to-GDP ratio”.

Figure 1 shows the public capital stock, expressed as a percentage of GDP, in three European countries of broadly comparable size. Prima facie, by historical standards, there does not seem to be a comparatively small (or shrinking) public capital stock in Italy. Germany, on the other hand, is what a country with a chronic lack of investment looks like, as discussed in detail by my colleagues Roth and Wolff (2018). Even France, a country known for its large public sector, has a capital stock 10 percentage points smaller than Italy.

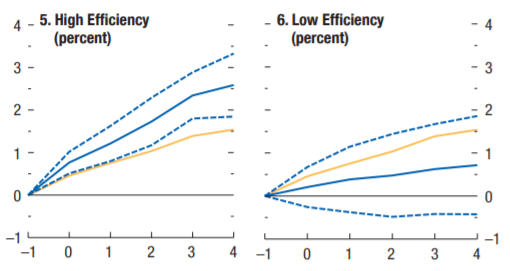

Moving beyond capital stocks, proponents of an Italian public investment boost usually refer to the recent economic literature on secular stagnation in a low interest rate environment. Building on the IMF World Economic Outlook (WEO [2014]), for example, some have reported how “[it] finds that increased public infrastructure investment raises output in both the short and long term”. As such, Mr Tria’s views would seem vindicated. The key, however, is in the continuation of the sentence – specifically “[…] particularly during periods of economic slack and when investment efficiency is high”. Building on OECD data, Figure 2 shows Italy’s output gap. As of next year, actual GDP will be above potential, making it hard to argue along the lines of an economic slack.

Moreover, the IMF WEO (2014) explains how “debt-financed projects could have large output effects without increasing the debt-to-GDP ratio, if [emphasis added] clearly identified infrastructure needs are met through efficient investment”. When this is not the case, even after four years, the multiplier effect of public investment in advanced economies is not significantly different from zero (see Figure 3).

Figure 3. IMF estimates of the impact of a 1 p.p. of GDP increase in public investment at t=0 in advanced economies for high (LHS) and low (RHS) investment efficiency

Source: IMF

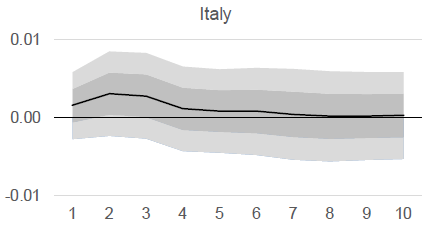

The key empirical question is then how efficient public investment in Italy is. Building on data since the 1960s, De Jong et al (2017) calibrate a country-specific VAR model for Italy and show how a shock in public capital stock does not have a statistically significant impact on growth, neither in the short- nor long-term (Figure 4).

Figure 4. Impact of a public investment shock on GDP in Italy

Source: De Jong et al (2017)

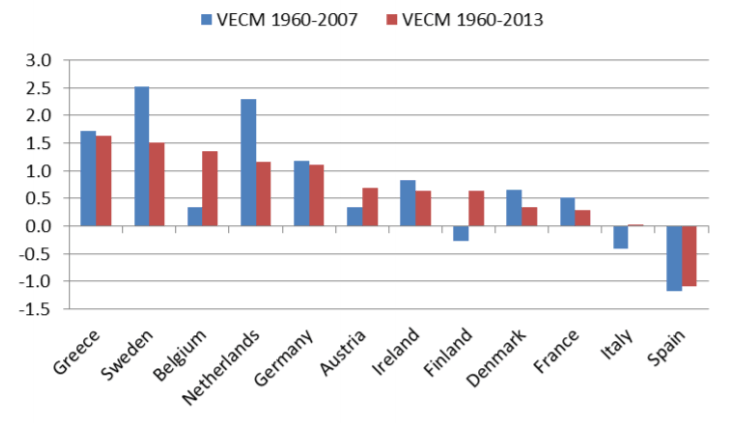

The international comparison in this respect is particularly striking, as Italy has some of the lowest long-run multiplier effects of public investment in the euro area (Figure 5).

Figure 5. Long-term impact of a public investment shock in selected euro area countries

Note: numbers denote long-run (10-year) responses of GDP to a one-standard deviation in public capital in a Vector Error Correction Model calibrated over the period 1960-2007 and 1960-2013.

Source: De Jong et al (2017)

What this means is that the efficiency of, and hence the return on, (public) investment is low. Therefore, the mantra that public investment will pay for itself does not seem to hold in the Italian case. As discussed in depth in Bank of Italy (2012), as long as the origins of such small returns are not identified and corrected, the public investment lever will remain short and ineffective. These origins can include poor selection of projects – due to bad political practices in the best case, and corruption in the worst case – poor project implementation, and bureaucratic hurdles that prevent project completion, just to mention a few. These factors are found to be particularly relevant when exploiting cross-regional heterogeneity in Italy (Fiorino et al, 2012).

The findings of OECD (2017) seem to resonate with these results. In particular, they show how Italy positively stands out among advanced economies in the short-term impact of investment, when this is combined with structural reforms.

Supporting structural reforms as a more likely way to foster a growth acceleration than an investment boost is also a recent analysis by Peruzzi and Terzi (2018). In particular, we show how a sudden investment ramp-up (public and private) is the least likely way to spark a growth acceleration, meant as a positive structural break in long-term growth. As a matter of fact, all the growth accelerations observed in Europe over the past few decades were preceded by significant structural reforms and none by a sharp ramp-up in investment.

From a political economy perspective, the likely reason for this Italian obsession with deficit-financed public investment is that it postpones hard choices. Everybody can agree with more investment, especially when it is debt-financed, as it does not unsettle vested interests. This is particularly true in a low-interest environment where the risk of a sovereign debt crisis is perceived as muted.

This column does not suggest that public investment should be demonised. However, it aims to propose a more optimal timing of economic policy. Identifying country-specific bottlenecks that curtail investment selection and efficiency should take priority, and actions should be taken on this front in the form of structural/public sector reforms[1]. This will increase the return on public investment. Ideally, at the same time, one could restructure the overall composition of public expenditure to open up fiscal space for investment spending[2]. Once that is done, the public investment lever should be used, exploiting the (now-enlarged) multiplier effects.

In the words of former IMF official Carlo Cottarelli, it is more useful to understand how to spend better, before spending more.

Bibliography

Bank of Italy (2011), “L’efficienza della spesa per infrastrutture”, Workshops and Conferences Proceedings, vol. 10.

De Jong, J., Ferdinandusse, M., Funda, J., Vetlov, I. (2017), “The effect of public investment in Europe: a model-based assessment”, ECB Working Paper Series 2021.

Fiorino, N., Galli, E., Petrarca, I. (2012), “Corruption and growth: evidence from the Italian regions”, European Journal of Government and Economics, Vol. 1, issue 2.

IMF (2014), “Is it time for an infrastructure push? The macroeconomic effect of public investment”, IMF World Economic Outlook.

IMF (2015), “Making public investment more efficient”, IMF Staff Report.

OECD (2017), “Using the fiscal levers to escape the low-growth trap”, OECD Economic Outlook, Vol. 2016, Issue 2.

Peruzzi, M., Terzi, A. (2018), “Growth acceleration strategies”, Harvard CID Working Paper Series 91.

[1] Even from a strict Keynesian demand-side standpoint, increasing the efficiency of project selection in good times implies that the latter can then be quickly activated during downturns.

[2] For more on this, see Roberto Perotti’s insightful book ‘Status Quo’.