Trade war: Is the U.S. panicking due to China's big hedge?

U.S.-China trade war has suddenly taken centre stage following Donald Trump’s unexpected announcement to ramp up tariffs if no deal is reached. U.S. i

After several months of relative calm, the U.S.-China trade war has suddenly taken centre stage following Donald Trump’s unexpected announcement to ramp up tariffs from 10% to 25% on Friday if no deal is reached before then. Fear of uncertainty spread quickly among investors, sending global markets tumbling over the past few days.

So far, the market’s reading of Trump's latest action has been ambiguous. Some argue the ultimatum his administration has issued is only a negotiating tactic to push for a deal, but others view it as a clear turn to a worse scenario in terms of reaching a resolution of the trade war. My take is neither prognosis is correct, rather we should see this as an important sign that, since early 2017, the U.S. has realized that it has entered a phase of strategic competition which is here to stay. Whether a deal can be finally struck or not should not be taken as huge piece of news by financial markets because it only constitutes a truce.

To the question of why the U.S. suddenly raised the stakes again at this point in time, my take is that the U.S. is in desperate need for a comprehensive victory, which it is not even close to obtaining. China is ready to make concessions, but not to the extent of transforming its state-led economic model into a market-based economy. Trump’s abrupt change of direction in his negotiation strategy reveals despair more than strength.

The reason is that China has clearly learned its way, painfully but surely, out of its current impasse with the U.S. From a tit-for-tat approach to negotiation and hedging, China is more in control of the situation now than before. In fact, China has been negotiating with the U.S. since November, aware that the U.S. also needs a deal for its consumers and investors and only a comprehensive deal revamping China’s economic model will be acceptable. Along with the negotiation, China has also worked harder to hedge its economy against the negative effects. More specifically, rather than drafting a detailed foreign investment law, handing in a complete list of subsidies to SOEs, or applying a workable measure of "competitive neutrality" to Chinese corporates as Trump's negotiators have demanded, China’s policymakers have focused on stimulating the economy with considerable effect. In addition, with a longer-term perspective in mind, Beijing has been making efforts to extend friendly ties with as many countries as possible.

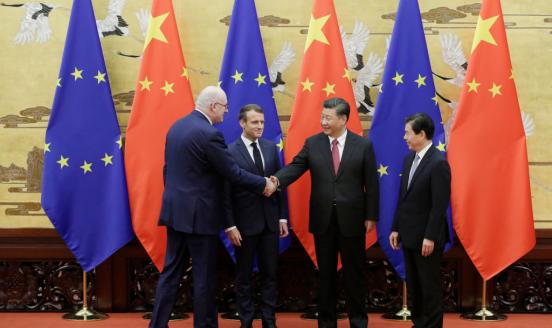

For the former, a credit-led stimulus, aimed at the under-served private sector, is well underway, which lifted China’s business sentiment as well as stock markets for the past few months. For the latter, the number of countries officially joining Xi Jinping's Belt and Road Initiative has surged from the original 63 to over 130 countries recently. In addition, Xi Jinping and Li Keqiang have more frequently engaged in high-level summits with the key countries (three with Europe since November and one with Japan in April).

From an economic perspective, the global environment has also become more supportive for hardline policies. The U.S. and China have been performing moderately well in the past quarter, albeit with some intrinsic problems. The macroeconomic recovery gives both parties an opportunity to flex their muscles at this particular moment.

China's growth hedging strategies seem to be working for China, at least temporarily. The U.S.’s super-cycle led by monetary stimulus after the financial crisis could also slowly come to a turning point. All of these are actually bad news for U.S. negotiators, which might be behind Trump’s sudden resort to threats. Moreover, if the threats aren't followed by actions on Friday, this will only lift China’s confidence further in the negotiation process.

Bear in mind, though, that one of China’s main hedges, namely, growth for today, may turn into a burden for the future, as more debt would pile up as a consequence. As for the frantic search for external alliances, the U.S. is already reacting to pressure from its allies (the EU in particular) to join the trade war and escalate the economic confrontation to security threats (such as 5G and Huawei).