Blogs review: Robots, capital-biased technological change and inequality

What’s at stake: What started as a discussion about the rise of automation in manufacturing – and its potential impact on “re-shoring” manufacturing t

What’s at stake: What started as a discussion about the rise of automation in manufacturing – and its potential impact on “re-shoring” manufacturing to the U.S. by some firms – has turned into a broader discussion about the impact of capital-biased technological change on the future of jobs and inequality. The discussion also touches on the role of increasing mark-ups in the shift in income away from labor.

Humans and robots

In his NYT column, Paul Krugman (HT Mark Thoma) writes that skill bias may be yesterday’s story. The wage gap between workers with a college education and those without, which grew a lot in the 1980s and early 1990s, hasn’t changed much since then (see here). Indeed, recent college graduates had stagnant incomes even before the financial crisis struck.

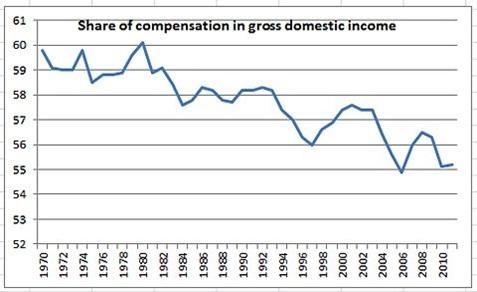

Paul Krugman writes twenty years ago, when he was writing about globalization and inequality, capital bias didn’t look like a big issue. But, in fact, profits have been rising at the expense of workers in general, including workers with the skills that were supposed to lead to success in today’s economy. What has happened is a notable shift in income away from labor.

Source: Paul Krugman

Moshe Vardi – a professor of computational engineering at Rice University – writes in The Atlantic that it is in the context of the Great Recession that people started noticing that while machines have yet to exceed humans in intelligence, they are getting intelligent enough to have a major impact on the job market. Such concerns have gone mainstream in the past year, with articles in newspapers and magazines carrying titles such as “More Jobs Predicted for Machines, Not People,” “Marathon Machine: Unskilled Workers Are Struggling to Keep Up With Technological Change,” “It’s a Man vs. Machine Recovery,” and “The Robots Are Winning.” And the question deserves not to be ignored as it is not clear what humans will do if machines are capable of doing almost any work humans can.

Owen Zidar reports that Larry Summers recently engaged his audience with a thought experiment along similar lines. Suppose that a new technology called “the Doer” will be created tomorrow. Doers can do anything flawlessly. They can build a house, give a massage, or make a guitar. What would the world of Doers look like?

- Cheaper, high quality goods would proliferate.

- The price of raw materials would increase as raw inputs for doers would become more scarce and thus more valuable

- People who can think of new things for Doers to do or of new ways for Doers to do things will make a lot of money

- For everyone else, the value of working for an hour will be nearly zero (since Doers can do everything already, no extra value is created). Therefore, hourly wages will go to zero.

Citing 3D printers and Google’s driverless cars, Summers argued that while we aren’t quite living in the world of Doers, we are perhaps 15 or 20% of the way there.

In a 2011 post, Brad DeLong wrote that the question of what humans will do in the future as machines replace more and more jobs has worried economists since the eighteenth-century French physiocrats tried to figure out how an economy could avoid mass unemployment if the agricultural share of the labor force ever fell below two-thirds. The physiocrats were, of course, wrong. We found lots of useful things that people could do not just to transform but to create value as the agricultural share of the labor force headed down to its current 2% or so share. But what happens next as hardware robots take over manufacturing, mining, and transportation and as software 'bots take over the routine paper shuffling?

Automation, manufacturing and the number of jobs

Econfuture (HT Angry Bear) writes that manufacturing in the U.S. has become dramatically more productive and requires fewer workers. If technology is the primary driver behind the decline in manufacturing employment, then employment in China must inevitably follow the same path. In fact, there are good reasons to believe that manufacturing employment’s downward slope will be significantly steeper for China. The U.S. had to invent the technology to make manufacturing more productive, while in many cases China only needs to import it from more developed nations. It is also true that China is beginning its journey at a time when information technology (which is the primary enabler of automation) is many orders of magnitude more advanced than in the 1950s when U.S. manufacturing employment was at its peak.

Econfuture writes that in the U.S. (as well as in other advanced countries), workers shifted out of manufacturing and into the service sector — which now accounts for the vast majority of jobs. The really big deal in the U.S. will be when automation hits the service sector/white collar jobs.

Brad DeLong does not see a problem with the number of jobs: I don't see any reason that technological unemployment should be any more in our future than it has been in our past. What is of interest is the effect of all of this on the wage distribution. Here, however, I think the key thing to look at is not demand but supply: the supply of workers. White collar, blue collar, skilled, unskilled, whatever – the high salary occupations in the future will be those that manage to construct and maintain barriers to entry to entrench incumbents.

Low interest rates + capital biased technological change = puzzle

Nike Rowe wonders if it’s possible to both have capital-biased technological change and very low real interest rates at the same time (real interest rates were falling even before the recession). Maybe we are forgetting a third factor? We used to think that that third factor was skilled labour, that knew how to work with the new "skill-biased" technology, was very productive at the margin, and so earned high rents. But if, as Paul says, the college premium has stopped rising, and so that third factor is not skilled labour, what is it? Much longer ago, in the days of Malthus and Ricardo, we used to think that that third factor was land. Maybe it is again. Maybe some of those increasing "profits" are really increasing resource rents? Stephen Gordon conjectured in September that the importance of natural resources in Canada might explain why we don’t see such a decline in the labor’s share of income in Canada.

Paul Krugman writes that this could be true; I have doubts about whether it can be a major factor empirically. But there’s another possible resolution: monopoly power. Barry Lynn and Philip Longman have argued that that increasing business concentration could be an important factor in stagnating demand for labor, as corporations use their growing monopoly power to raise prices without passing the gains on to their employees (something we echoed in a recent review on the price markup puzzle). The thing about market power is that it could simultaneously raise the average rents to capital and reduce the return on investment as perceived by corporations, which would now take into account the negative effects of capacity growth on their markups. So a rising-monopoly-power story would be one way to resolve the seeming paradox of rapidly rising profits and low real interest rates.