The return of market volatility

What’s at stake: The size of the market gyrations this week took everybody by surprise. Several stories have been put forward to rationalize thes

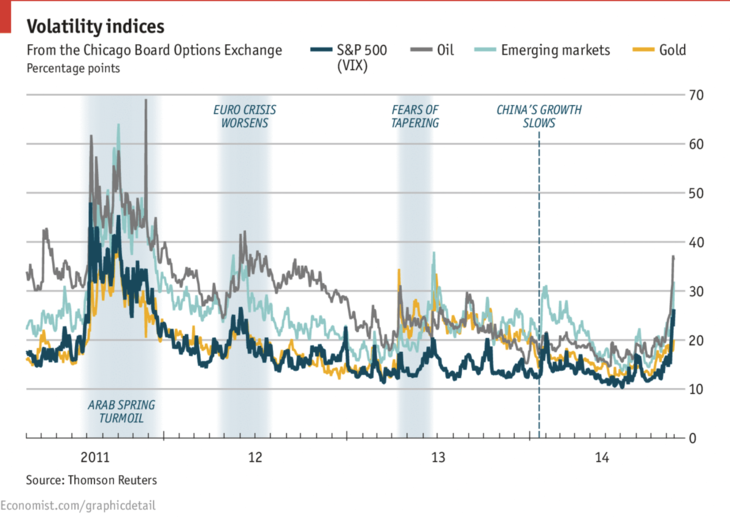

What’s at stake: The size of the market gyrations this week took everybody by surprise. Several stories have been put forward to rationalize these movements, but the abruptness of the adjustment is puzzling and underlines that the degree of liquidity in these markets may have been overestimated.

Last week wrap-up

We are definitely back in the “risk-on-risk-off” regime again

Sober Look writes that we are definitely back in the “risk-on-risk-off” regime again. In its Global Market overview, the FT notes this morning that high volatility will likely remain the story for now especially as expectation on monetary policies shift back and forth. Luigi Speranza write that market fluctuations have reached fever pitch over the past few days, with the continued decline in equity markets accompanied by new cyclical lows in bond yields and, more recently, a sharp widening of eurozone bond spreads.

Gavyn Davies writes that on Wednesday, the US ten year treasury, perhaps the most liquid financial instrument in the world, traded at yields of 2.21 per cent and 1.86 per cent within a matter of hours. This type of volatility in the ultimate “risk free” asset has previously been seen only in 2008 and other extreme meltdowns, so it clearly cannot be swept under the carpet.

What is the market telling?

The most prominent story since the September peak seems to be a “global slowdown” with associated “deflation

Gavyn Davies writes that overall three separate factors have probably been at work:

- a reversal of speculative positions, which has had temporary effects on asset prices;

- a contractionary and deflationary demand shock in the euro area;

- an oil shock that will also be deflationary, but will be expansionary for many economies.

Robert Shiller writes that the most prominent story since the September peak seems to be one of a “global slowdown” with associated “deflation.” Underlying this tale are deeper, longer-term fears. There is a name for these concerns too. It is “secular stagnation” — the idea that there is disturbing evidence that the world economy may languish for a very long time, even for generations, as the word “secular” suggests. Gavyn Davies expresses doubts about this story since this fails to show up in any recent change in consensus GDP forecasts.

Paul Krugman writes that the financial turmoil of the past few days has widened the gap between what we’re told must be done to appease the market and what markets actually seem to be asking for. We have been told repeatedly that governments must cease and desist from their efforts to mitigate economic pain, lest their excessive compassion be punished by the financial gods, but the markets themselves have never seemed to agree that these human sacrifices are actually necessary. The real message from the market seems to be that we should be running bigger deficits and printing more money. And that message has gotten a lot stronger in the past few days.

Market volatility and growth

Roger Farmer writes that that a persistent 10% drop in the real value of the stock market is followed by a persistent 3% increase in the unemployment rate. The important word here is persistent. If the market drops 10% on Tuesday and recovers again a week later, (not an unusual movement in a volatile market), there will be no impact on the real economy. For a market panic to have real effects on Main Street it must be sustained for at least three months. And there is no sign that that is happening: Yet.

A persistent 10% drop in the real value of the stock market is followed by a persistent 3% increase in the unemployment rate

Mohamed El-Erian writes that after a period of excessive risk taking and prolonged complacency, it will probably take some time for markets to fully recalibrate – a choppy process that will be driven both by fundamentals and by technically-oriented repositionings of crowded trades.

Liquidity, regulation and price swings

Philip Gisdakis writes in Unicredit Sunday Wrap that with some clouds on the horizon, it took only a tiny trigger to send everyone bolting for the exit. With tightened market regulation also affecting banks’ trading books, market liquidity was gone within seconds, which resulted in huge price jumps. Mohamed El-Erian writes that traders are discovering – yet again – that market liquidity is not as deep as they had hoped for, causing wild price gyrations even in the most traditional of all asset classes (for eg, witness the speed and size of Wednesday’s price movements in US equities and Treasuries).

Gillian Tett writes that the question of “liquidity” – the degree to which assets can be traded – matters hugely. What is worrying is that liquidity appears to have decreased because unorthodox monetary policy experiments have collided with financial reforms and technological upheaval in an unexpectedly pernicious way. Having lots of money in the system does not guarantee that funding will flow freely, or that traders can cut deals. Systems flooded with cash can sometimes freeze. Sometimes this occurs because investors lose faith in each other and stop doing trades, as they did in 2008. But markets can also become illiquid because it is difficult to match buyers and sellers. In the past big investment banks often matched buyers and sellers by holding large inventories of securities. But since 2008 banks have slashed their inventories by between 30 and 80 per cent (depending on the asset class) to meet tighter rules. This reduced their ability to act as market makers, and removed shock absorbers from the system.