Greece budget update

As Eurogroup discussions with Greece continue, the latest budget execution bulletin from the Greek finance ministry has been published yesterday, comp

As Eurogroup discussions with Greece continue, the latest budget execution bulletin from the Greek finance ministry has been published yesterday, comparing the actual budget execution with the estimates presented in the 2015 budget.

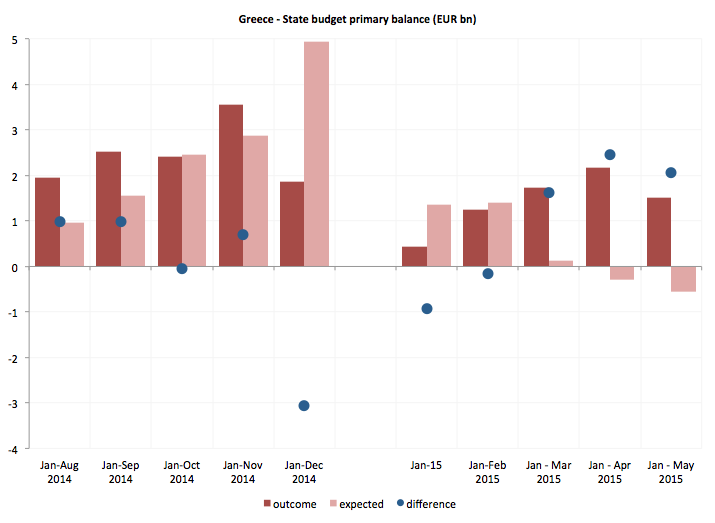

The state budget balance records a deficit of 1.4 billion euros for January-May 2015, against the target deficit of 3.5 billion, 590 million lower than for the same period of 2014. Growth in the state budget primary balance has slowed down compared to previous months, but remains above target. Greece recorded a primary surplus of 1.5 billion euros over the first five months of the year, against an expected primary deficit of 556 million euros. In cumulative terms, the state primary balance has therefore exceeded its target by 2 billion euros (figure 1).

Source: Ministry of Economy and Finance, Greece

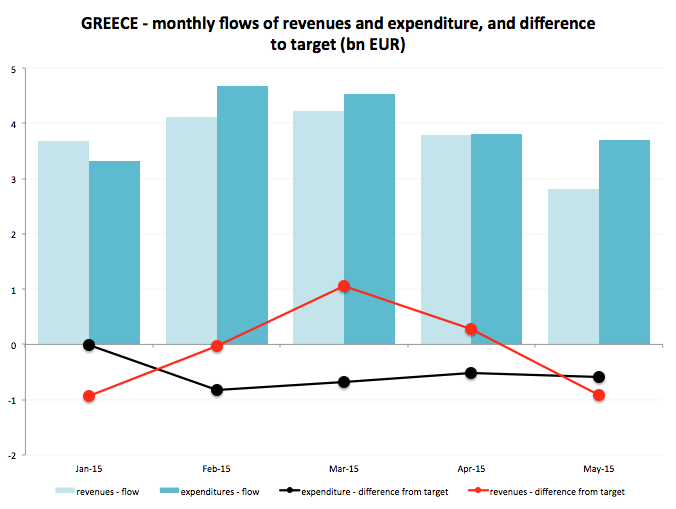

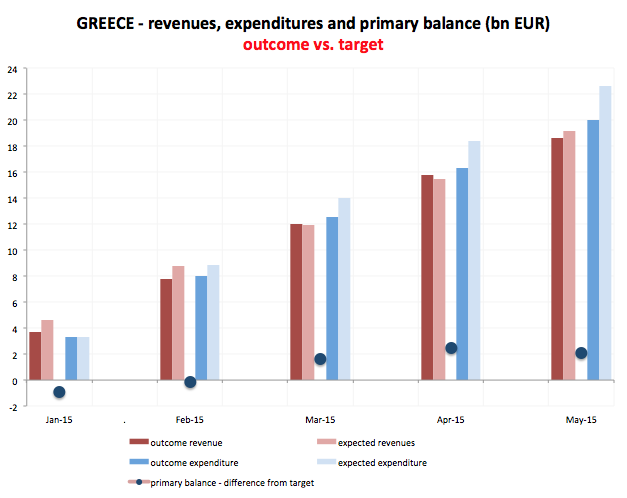

Revenues had slightly overperformed compared to their cumulative target last month, giving rise to some hope, but this bulletin reveals that revenue collection has now fallen back below target. State budget net revenues amounted to a cumulative 18.6 billion euros for the period January-May 2015, missing the target by 546 million euros. For the month of May alone, net revenues amounted to 2.8 billion euros, 918 million euros short of the monthly target. In fact, this shortfall is very close to the one recorded in January, in the immediate aftermath of the elections. Figure 2 shows that revenue flows for the month of May are the worst since beginning of the year, and this month’s shortfall has effectively wiped out the improvements of three previous months.

According to the Ministry of Finance, the shortfall is partly attributed to the fact that the first installment of corporate income tax was not received (worth an estimated 555 million euros). It is also partly due to the fact that Greece has not received disbursements related to national central banks’ ANFA holdings, i.e. holdings by National Central Banks’ in their investment portfolio. The missed disbursement is estimated by the Ministry of Finance to be worth 132 million euros. However, these two components explain only 687 million out of the total shortfall of 918 million, and point once again to problems in the revenue side of the Greek budget.

Source: author’s calculations based on MEF bulletin

As has become regular over the last months, the revenues gap was covered by reductions in expenditures against the target. For the month of May, state budget expenditures amounted to 3.7 billion euros, 591 million lower than the target, with ordinary budget expenditures underperforming by 311 million. Over the period January-May 2015, cumulative state budget expenditures amounted to 20 billion euros, 2.6 billion lower than the target. Ordinary Budget expenditures amounted to 19 billion euros and decreased by 1.9 billion against the target, again due to the reduction of primary expenditure by 1.7 billion euros and the reduction of military procurement, down by 219 million compared to the target.

Source: Ministry of Economy and Finance, Greece

Overall, the data confirms what has by now become a clear pattern. Greece’s primary surplus remains positive, but this is mainly due to cuts in primary expenditure, as revenues continue to underperform (particularly this month). As previously mentioned, a significant share of the expenditure cuts come from delayed payments. The budget execution bulletin shows that since January, payments for settlements of general government arrears have been zero, against 181 million for the same period last year.

This recent deterioration in collection of revenues is worrying, not only because it undermines the improvements achieved over the last few months, but because it could signal a new drop in confidence, which the Greek government should not underestimate.