Wage and price inflation

What’s at stake: For the past few months, the Fed has been in a "wait-and-see" mode to assess the strength of the US recovery.

What’s at stake: For the past few months, the Fed has been in a "wait-and-see" mode to assess the strength of the US recovery. In particular, it has been waiting for signs that employment gains translate into wage pressures before beginning its tightening cycle. Although wage gains remain useful to assess the amount of slack in the labor market, the connection between wage and price inflation appears less mechanical than in the past.

Wage-based explanations of inflation dynamics

Yash Mehra writes that for gauging inflationary pressures, many policymakers and financial market analysts pay close attention to the behavior of wages. It is widely believed that if wage costs rise faster than productivity, the price level may rise as firms pass forward increased wage costs in the form of higher product prices. Hence changes in productivity-adjusted wages are believed to be a leading indicator of future inflation. Tim Duy writes that attention for Thursday’s employment report will not be on the headline employment number, but on the wage numbers.

Ekaterina Peneva and Jeremy Rudd write that wage-based explanations of inflation dynamics have seen increased prominence of late, as a number of observers have sought to use developments in the labor market (e.g. nominal downward rigidity, duration composition of unemployment) to explain why price inflation did not decline by as much as conventional models would have predicted following the 2007–2009 recession (the so-called “missing disinflation” puzzle).

Tracking wage growth

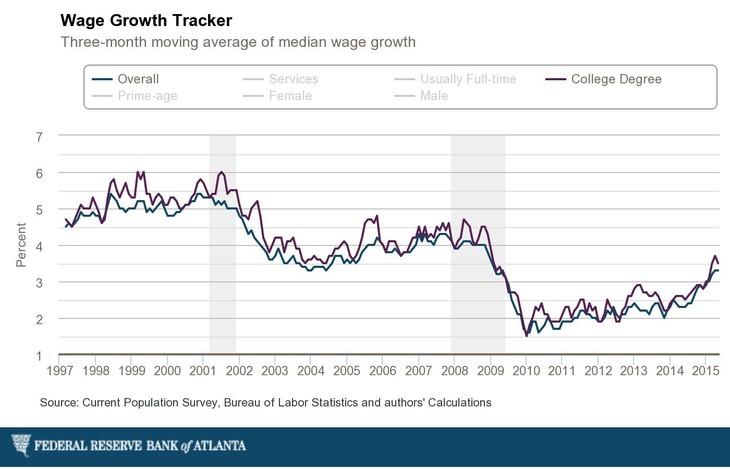

Kevin Drum writes that there are various way of tracking wage growth (with or without benefits, employer survey vs. worker survey, nonsupervisory vs. everyone, etc.).

Martin Feldstein writes that average hourly earnings in May were 2.3% higher than in May 2014. Since the beginning of this year, hourly earnings are up 3.3%, and in May alone rose at a 3.8% rate. Average compensation per hour rose just 1.1% from 2012 to 2013, but then increased at a 2.6% rate from 2013 to 2014, and at 3.3% in the first quarter of 2015. Real Time Economics notes that employer costs for employee compensation jumped 4.9% from a year earlier in March, the second consecutive increase at that relatively robust level. The Labor Department’s employment cost index. RTE points out that some measures have diverged potentially underlying permanent shifts in the structure of the workforce, with faster-growing occupations seeing stronger wage gains.

Economists at the Atlanta Fed write that the current pace of nominal hourly wage growth is similar to that seen during the labor market recovery of 2003–04 and about a percentage point below the pace experienced during 2006–07, which was the peak of the last business cycle.

Nick Bunker writes that the level of compensation growth is below the level we’d expect. Assuming a 1.5 percent labor productivity growth rate and 2 percent annual inflation – the target inflation rate of the Federal Reserve—then adequate nominal wage growth is at least 3.5 percent. Wage growth for production and non-supervisory workers has only hit that target over the past 25 years when the prime-age employment ratio was at least 79 percent six months prior. How long will it take to hit that 79 percent target? If we assume the employment ratio continues to grow at the rate it has been over the past year, then it will hit that target in 27 months, or around September 2017. And then six months later, in March 2018 we would expect to see healthy wage growth.

The pass-through of labor costs to price inflation

Martin Feldstein writes that these wage increases will soon show up in higher price inflation. The link between wages and prices is currently being offset by the sharp decline in the price of oil and gasoline relative to a year ago, and by the strengthening of the dollar relative to other currencies. But, as these factors’ impact on the overall price level diminishes, the inflation rate will rise more rapidly.

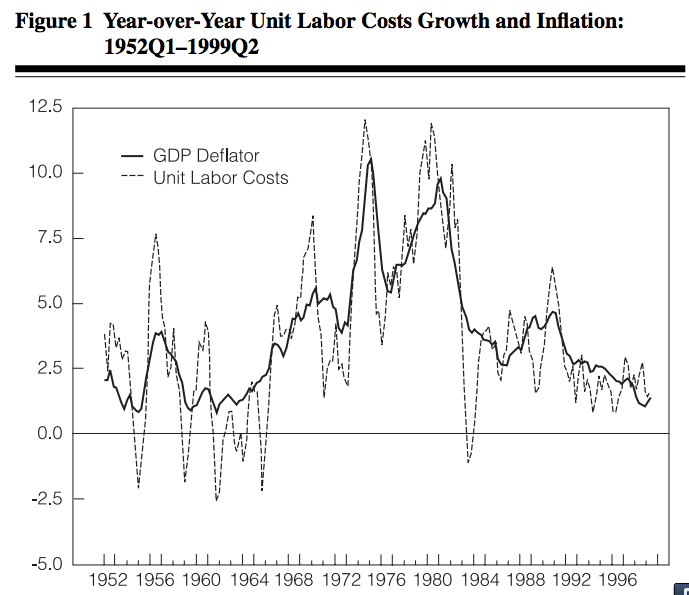

Ekaterina Peneva and Jeremy Rudd write that many formal and informal descriptions of inflation dynamics assign an important explicit or implicit role to labor costs. Intuitively, labor compensation should be a key determinant of firms’ pricing behavior as, in the aggregate, it represents about two-thirds of firms’ total costs of production. More formally, economic theory suggests that increases in labor costs in excess of productivity gains should put upward pressure on prices; hence, many models assumed that prices are determined as a markup over unit labor costs.

Source: Yash Mehra

Yash Mehra writes that in the short run, productivity-adjusted wage growth and inflation appear to comove closely only over a subperiod that begins in the mid 1960s and ends in the early 1980s. This subperiod is the one during which inflation steadily accelerated. In the remaining subperiods, there does not appear to be much strong comovement between wage growth and inflation, at least in the short run.

Carola Binder writes that recent research from Fed economists fails to find an important role for labor costs in driving inflation movements, casting doubts on wage-based explanations of inflation dynamics in recent years. In 1975 and 1985, a rise in labor cost growth was followed by a rise in core inflation, but in recent decades, both before and after the Great Recession, there is no such response.

Wage, productivity and GDP growth

John Cochrane writes that the long-delayed "middle class" (real) wage rise is here. In addition to worries of cost-push inflation, we often hear that real wages have not kept up with productivity. So, maybe we should cheer – rising real wages means wages finally catch up with productivity, and do not signal inflation. YiLi Chien and Maria A. Arias write that, over the past 42 years, the real hourly wage rate has increased by half the increase in per capita GDP. Moreover, real wages grew very little or even experienced negative growth for a long period until the mid-1990s.