Can a global climate risk pool help the most vulnerable countries?

Extreme climate events related to global warming will happen somewhat randomly and could have a huge cost for the most vulnerable countries. A global

The issue

Global warming leads to more and more-intense disasters, such as storms, flooding and droughts. The low and middle-income countries around the equator are especially vulnerable to these extreme weather events which could damage a large part of their production capacity. The temporary loss of tax revenues and increase in expenditures to reconstruct factories and infra-structure might put vulnerable countries into a downward fiscal and macro- economic spiral. While protecting each country against the most-extreme possible events is neither possible nor cost-efficient, a global climate risk pool could help the most-affected countries recover from the initial macroeconomic shock.

Policy challenge

The optimal response to climate change is a mix of deep greenhouse-gas emissions cuts, investment to reduce the adverse impacts of climate change and endurance of some climate-related events against which protection would be too expensive. Extreme climate events related to global warming will happen somewhat randomly and could have a huge cost for the most vulnerable countries. A global climate risk pool, with contributions from all countries, could help these vulnerable countries to recover from such events and might thus smooth the way towards a broader climate deal. As extreme events, such as storm surges, will increase because of climate change, the pool can only insure events that significantly exceed the trend line.

The idea of a climate risk pool

Global warming increases the chance of extreme weather risks, which should be insured against as an element in global solidarity and to ensure that vulnerable countries’ fiscal capacities and incoming investment can be maintained as far as possible. Pooling risk can thus avoid vicious cycles initiated by rare local events. Climate-related risks include the occurrence of very different natural disasters, such as floods, droughts, hurricanes or heat-waves. All of these need to be insured against – primarily by private sector insurance. Some of the support from developed countries for adaptation in developing countries would be well spent on improving the access of the poorest to private insurance, for example through capacity building in the underdeveloped financial sectors of developing countries.

But local and regional climate events will not only affect companies and individuals that might buy some form of insurance in order to protect their assets. Such events might in extremis wipe out significant parts of the infrastructure and productive capacity and hence fiscal capacity of a developing country, because they will result in lower tax revenues and high rebuilding costs. Developing countries cannot insure against such events on a market basis, nor would it be sensible to divert scarce fiscal resources away from infrastructure investment (including adaptation) into accumulating a financial buffer for such situations. International risk pooling is the only sensible strategy. Otherwise investors might shy away from all potentially affected countries, because of unpredictability in how they will respond to climate-related crises – for example, fiscal squeezes caused by extreme-weather disasters could lead to tax hikes or one-off levies, or even to government defaults.

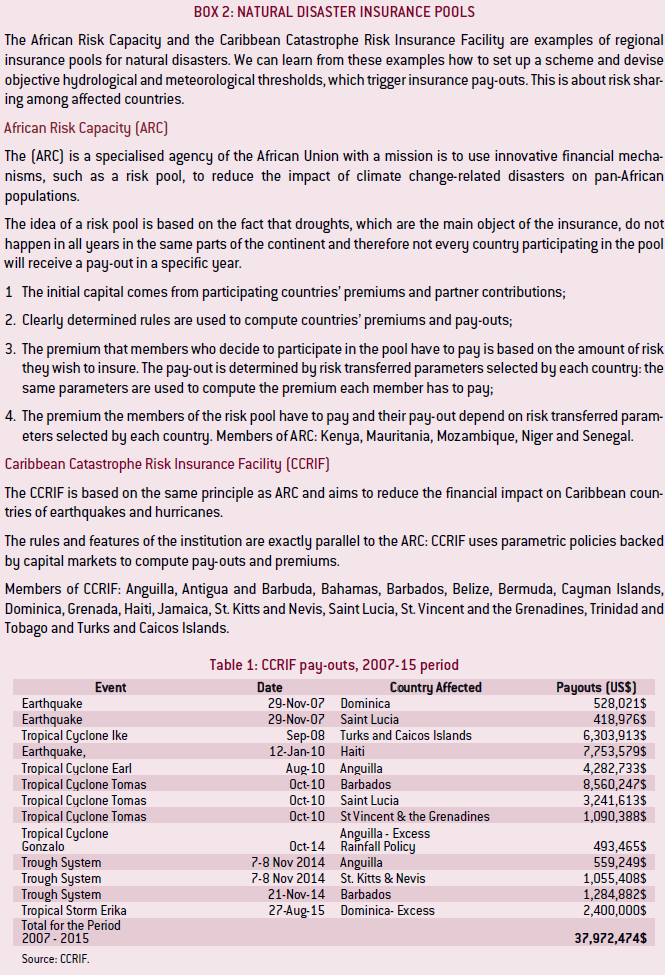

The scope of our proposed global climate risk pool is to protect vulnerable countries against such ‘fiscal shocks’ following extreme weather events. This global pool can build on experiences with regional insurance pools for natural disasters such as the African Risk Capacity and the Caribbean Catastrophe Risk Insurance Facility.

Identifying extreme events in times of climate change

Climate related disaster-insurance is an instrument for risk reduction that can protect developing and least developed economies: it operates through the provision of security against losses and damage caused by climate change.

The principle of insurance is generally based on diversification of loss risk among people and across time. However, in the case of climate-related disasters, insurance cannot be reliably based on historic data because the frequency and magnitude of some types of events are expected to increase in some regions. Climate change is a structural shift and its main effects (sea level rise, changing regional climate) will not happen gradually, but through repeated shocks. So any insurance approach will have to reliably tell apart, which effects are ‘extreme events’ that can be insured against and which effects are ‘below the trend’– eg what is a flood and what is a sea-level rise.

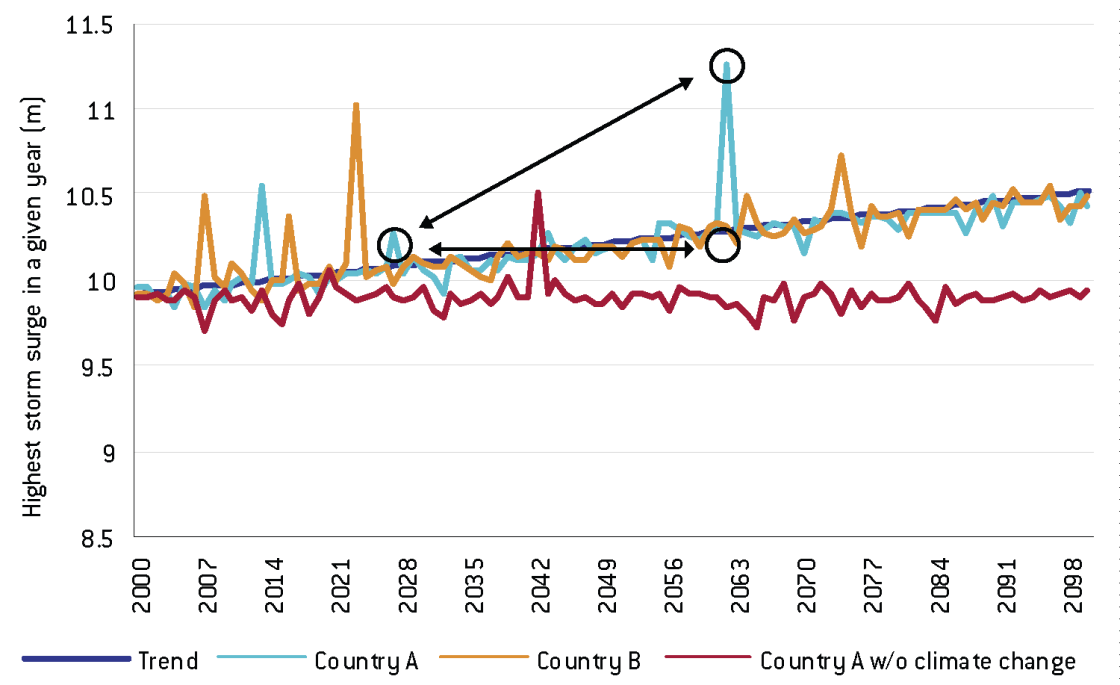

An upward trend in storm surges, as illustrated in Figure 1, might lead to a greater frequency of events that would be considered ‘extreme’ today. But in fifty years, these occurrences might be considered ‘normal’ if they are not above the trend line. However, establishing the new trend is still fraught with uncertainty. For sea-level rise, for example, bottom-up modelling preferred by the Intergovernmental Panel on Climate Change projects up to a 1 metre global sea level rise, while extrapolation of historic trends projects up to 2 metres (Jones, 2013). In addition, this new trend is not expected to develop uniformly across the globe, but to develop very differently for different regions (Dasgupta et al, 2014). Hence, there still appears to be a significant knowledge gap about the regional impacts of climate change.

Figure 1 shows a stylised example of a maximum annual storm surge. A storm surge is a coastal flood of rising water caused by a tropical cyclone in combination with the timing of tides. The upward sloping line (blue) reflects the expected increase in the maximum height of annual storm surges as a consequence of climate change. Other lines show the maximum annual storm surge experienced by countries A and B. The trend in maximum annual storm surge in both countries is upward, because the maximum storm surge level is expected to increase over time. By contrast, the ‘flat’ red line indicates the maximum annual storm surge, without climate change.

Figure 1: Maximum annual storm-surge, stylised example

Source: Bruegel

Distinguishing climate related events from not climate related events

It is not possible to clearly distinguish whether or not an individual event is a consequence of climate change. A once-in-a-thousand-years flood happens about once in a thousand years. Consequently, all extreme events for which we expect an increase in frequency or amplitude because of climate change would have to fall under the insurance scheme.

Consequently, the conditions that trigger a pay-out would need to change over time and need to be different in different regions. A generalisable trigger could be a ‘once in a hundred years’ event of a certain type in a certain country at a certain point in time, given the best available model. Mathematical solutions that distinguish trends and shocks, always based on the latest available information, are conceivable1. But there remains a significant amount of discretion in selecting the model, which is a political problem, because the selection of the model will have distributional consequences. In addition, extreme weather insurance is often not linked to a single measure, but to a weather index compiling different meteorological measures (which might for example include, rainfall, temperature, humidity, fog or wind velocity). So again, there is some room for discretion.

The second issue is the pay-out, in case the trigger-point is reached. Making the pay-out dependent on the actual cost of the event might provide an incentive to under-invest in adaptation. So a direct pay-out function based on how much the trigger-point has been exceeded would make most sense. This is in line with our proposal to cover the fiscal/macroeconomic consequences of the extreme event instead of the actual cost. But again, a sensible calibration might be technically feasible – but politically difficult.

Resources: climate fund versus risk pool

Coping with climate change requires finding the optimal balance between adaptation to the impacts of climate change, enduring some of the effects and insuring against certain extreme risk.

In the case of extreme weather events, Hochrainer-Stigler et al (2014) assess countries’ vulnerability to ‘fiscal disasters’, defined as the public sector’s ability to pay for relief to the affected population and support the reconstruction of lost assets and infrastructure. Using methods to estimate extremes of country disaster risk, they find that many countries appear fiscally vulnerable and would require assistance from donors in order to bolster their fiscal resilience. An initial estimate is in the order of $3.3 billion annually to cover those gaps in fiscal resources in case of extreme weather events, which can happen once in every 10 to 50 years.

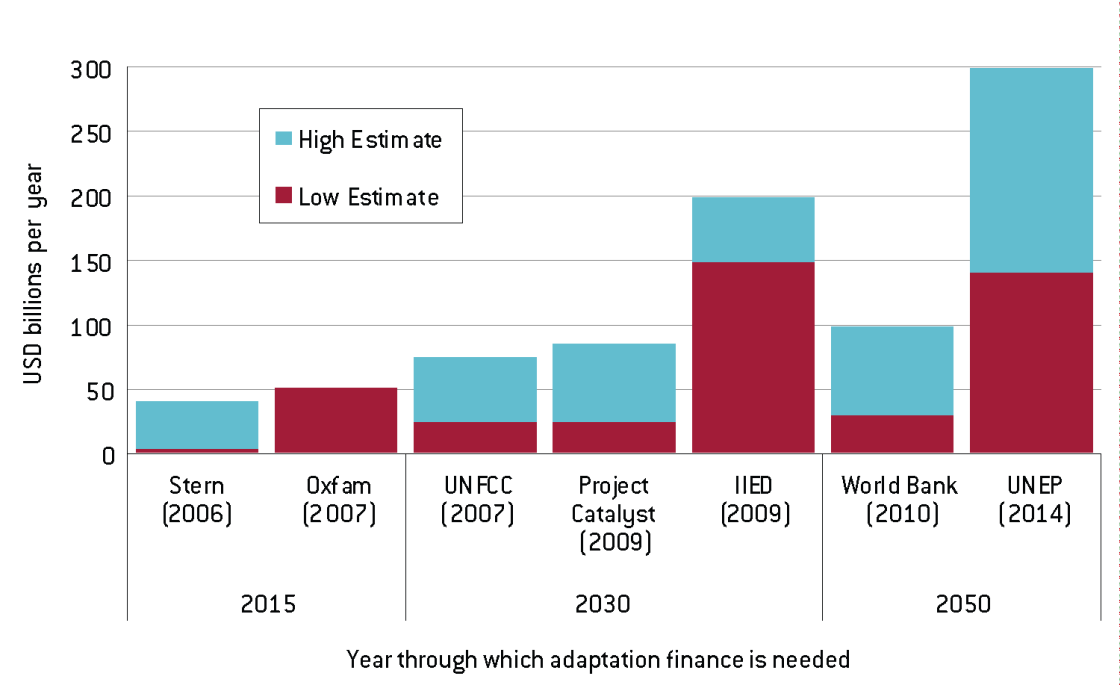

This amount should be seen in the context of the annual adaptation needs of developing countries, which according to estimates shown in Figure 2 is in the range of $70-300 billion.

Figure 2: Estimates of annual adaptation finance needs

Source: Bruegel.

Redistributive elements and loss and damage

Climate is a global public good. So effectively addressing climate change requires the participation of all relevant countries. The international community addressed this in the framework of the United Nations Framework Convention on Climate Change (UNFCCC) – which has held annual Conferences of the Parties (COPs) since 1992. The UNFCCC process requires unanimity. This is a significant challenge, because the costs of mitigation, adaptation and endurance in different countries vary markedly. To ensure the participation of developing and transition countries, so far only industrialised countries have been required to undertake mitigation efforts. This has to change, because the developed-country share of global emissions fell from more than half when the Kyoto Protocol was adopted in 1997 to around a third currently.

But non-industrialised countries argue that most of the man-made emissions currently in the atmosphere (which have already contributed to a warming of about 1°C above pre-industrial levels) served the rich countries to reach their current levels of development. International efforts on climate change are thus based on the principles that industrialised countries should (1) reduce their greenhouse gas emissions to a level that allows developing countries to maintain a modest increase in emissions for two decades; (2) deliver technologies that allow developing countries to adapt and mitigate at lower cost; (3) provide some financing for adaptation and mitigation (preferably in the form of grants); and (4) provide compensation for losses arising from climate change.

Whether this is fair or not is irrelevant. Each of the four items is a major issue in the UNFCCC process2. So concessions by the developed countries on those items might be crucial to secure participation from developing countries. And in fact, the G7 countries have acknowledged their readiness to provide climate finance, and to help to organise private climate insurance and technology transfer to developing countries (Group of Seven, 2015). Many of these commitments are still rather vague, as explicit transfers of fiscal resources are an extremely thorny issue. But as Wolff and Zachmann (2015) argued, delivering on climate finance has both side-benefits for the developed countries (such as exporting ‘green technology’) and is much cheaper than shouldering more extreme mitigation burdens (if the EU decides to go from 40 percent decarbonisation to 60 percent decarbonisation, it will reduce global emissions by only 2 percent). Accordingly, we argue that providing a mechanism for pooling the risks of extreme climate-related events – which should (as we will explain below) also entail a transfer component – could also offer business opportunities for developed countries (eg for financial and insurance services) and would be cheaper than a corresponding additional increase in developed countries’ mitigation ambitions.

How to design a climate risk pool?

The principles of (re-)insurance can be applied in the design of a global climate risk pool. The insurance literature stresses the importance of having the right incentives for minimisation of risk (Stiglitz, 1983). This can be done on two levels. The insured country should bear the first layer of loss itself so that it has an incentive to work on climate adaptation (for example, no more buildings along vulnerable coastlines, better infrastructure to weather hurricanes). Next, the premium should be partly related to a country’s carbon footprint to provide an incentive for climate mitigation. This is basically the ‘polluter pays’ principle.

Another feature of insurance is a precise specification of the trigger for the pay-out and the size of the pay-out. Our scheme would help protect countries against fiscal disasters by paying out in the event of climate-related disasters that exceed the trend line by a certain amount. As climate change is underway, the trigger or meteorological threshold for ‘extreme’ events will also be subject to change over time. The high uncertainty about future extreme events would make a fully private insurance solution problematic. Empirical studies indicate that actuaries and underwriters are so averse to ambiguity that they tend to charge much higher premiums if risks are not well specified (Kunreuther et al, 1995). This reinforces the point that it would be difficult for vulnerable countries to bear the full costs of climate insurance (see also the communiqué of the Vulnerable Twenty Group, 2015).

The insured amount will be related to the extremeness of the event and will be anyway capped. The ‘extremeness’ will be based on meteorological standards (see below) and not on actual damages. That fits in with the idea that the global climate risk pool aims to help countries deal with the fiscal and macroeconomic consequences of an extreme natural disaster.

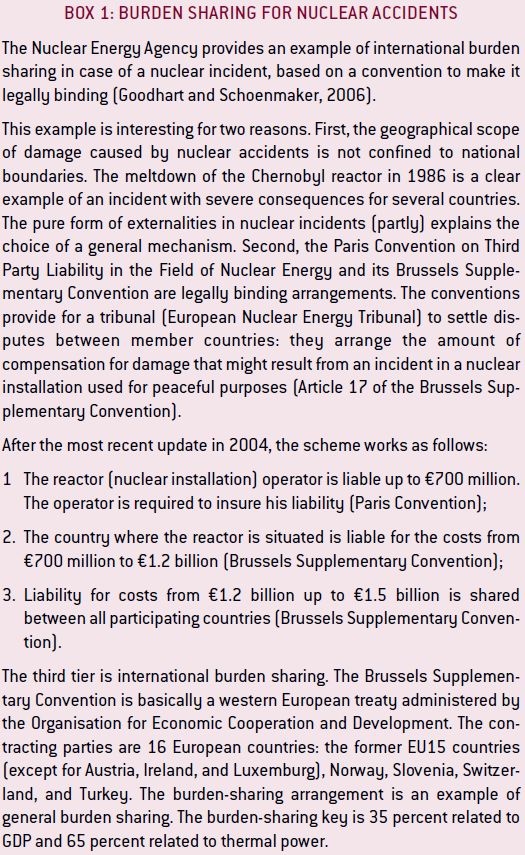

Any burden sharing arrangement for public goods has to strike a balance between the capacity to pay and the contribution to the problem. In the case of burden sharing for a nuclear accident, for example, a participating country’s burden is based on its wealth measured in GDP and its nuclear industry measured in thermal power (see Box 1).

These elements produce the following premium structure:

- Premiums for vulnerable countries based on risk of climate hazard and greenhouse-gas footprint;

- Premiums for donor countries based on GDP and greenhouse-gas footprint.

The Global Facility for Disaster Reduction and Recovery, established by the World Bank, provides already expertise for the African Risk Capacity and the Caribbean Catastrophe Risk Insurance Facility (CCRIF, see Box 2). Building on this infrastructure, the World Bank in conjunction with the Global Facility for Disaster Reduction and Recovery could provide the global climate risk pool’s secretariat, including the necessary climate expertise to devise objective hydro-meteorological standards (Courbage and Mahul, 2013). The pool can be based on a public-private partnership.

For the public part, an official treaty and tribunal (to settle disputes) would be needed to make the obligations of donor countries enforceable. In the design of the treaty, one must resolve a potential time-inconsistency of the pledges by rich countries today to pay for future climate events, and deal with the incentive to renege when such events start to become really expensive. A typical (re)insurance contract has a period of cover of one year, which is very short. Nevertheless, the nuclear treaty and the CCRIF require exiting participants to give a one-year notice period, with all damages until exit still needing to be paid. The nuclear treaty, which started in the 1960s, allows notice periods to be activated only after an initial ten-year lock-in period.

To get started, we propose that the G7, which has already made pledges on climate insurance, and the Vulnerability Twenty Group, representing the most vulnerable countries, take the initiative to establish the global climate risk pool. Other countries can join later. Based on the proposed premium structure and the initial ten-year lock in period, the G7 and V20 (joined by others) can start to build a reinsurance fund for ‘fiscal disasters’ following extreme weather events by paying premiums into the risk pool. After ten years, some funds for the insurance pool may have been gathered in excess of pay-outs.

Conclusion

While coping with climate change requires a clear focus on mitigation and adaptation, a global climate risk pool might make it easier for developed and developing countries to agree on measures to tackle global warming. The most vulnerable countries cannot deal with future extreme events on their own. A global climate risk pool, with a mix of contributions from donor countries and insured countries, can prevent a vicious fiscal cycle in these countries. Insurance against a one-in-fifty-year event might enable vulnerable countries to recover from such a macroeconomic and fiscal shock. Post-Paris, the Group of Seven and the Vulnerability Twenty Group could take the lead in establishing the global climate risk pool with the assistance from the World Bank. Nevertheless, the main focus should remain on mitigation and adaptation to climate change.

The authors would like to thank Guntram B. Wolff for comments. Elena Vaccarino provided excellent research assistance.