Should we worry about Greek banks?

Earlier this month, the IMF and the European institutions clashed over conditions for sustainability of the Greek debt. One of the main disagreements

Observers of the euro area crisis are accustomed to the fact that Greece periodically returns to centre stage. And when this happens, it is usually accompanied by a revival of the disagreement between the IMF and the European institutions. This happened earlier this month, as the two sides clashed over conditions for sustainability of the Greek debt and one of the main disagreements seems to lie in the evaluation of the Greek banks’ health.

The banks have undergone three rounds of recapitalisation since 2010 - the last of which in 2015 - for a total of €43 billion. The IMF Debt Sustainability Analysis (DSA), however, maintains the assumption that a buffer of around €10 billion - roughly half the amount of DTAs on Greek banks' balance sheet - should be set aside to cover potential additional bank support needs. The European DSA instead does not assume any additional costs from future bank recapitalisation needs. The Bank of Greece, on the other hand, argues that Greek banks are set to maintain high capital ratios even in the adverse scenario of a recently published sensitivity analysis.

Non-performing exposures are the banks’ material exposures which are more than 90 days past due or for which the debtor is assessed as unlikely to pay their credit obligations in full, without realisation of collateral, regardless of the existence of any past due amount or the number of days past due. The IFSR NPL definition only includes loans that are more than 90 days past.

The IMF justifies its caution by saying that the balance sheet situation of the Greek banks is still vulnerable. Table 1 shows that the ratio of non-performing exposures (NPE) remains very high, above 40% of total loans for all the four banks considered, and above 50% for two of them. The ratio of NPLs is lower but still close to 40% for those banks that report the measure.

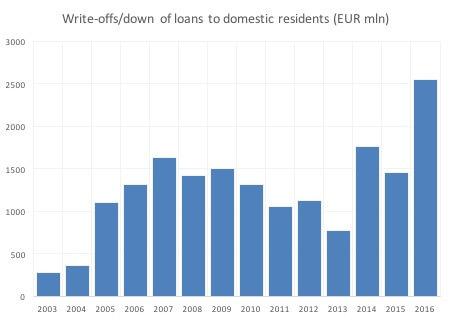

Greek banks have agreed to a plan of NPE reduction over a three-year horizon, with a quarterly target and the objective to reduce system-wide NPEs from 50% to 34% in 2019 and NPLs from 37% to 20%. The reduction is expected to be mainly driven by the curing of loans and write-offs, and to a lesser extent by liquidations, collections and sales. Consistently with the plan, write-offs have accelerated towards the end of 2016, reaching a record €2.5 billion for the year (Figure 1).

Source: Central Bank of Greece

However, Kathimerini reports that in January 2017 new NPLs spiked at almost €1 billion, reversing the downward course of late 2016, and apparently continued to grow in February. Research by Asimakopoulos et al. at the Bank of Greece finds that one out of six firms with non-performing loans are strategic defaulters and that strategic default is positively related to outstanding debt and economic uncertainty.

Kathimerini’s sources seem to validate this, attributing the recent spike both to uncertainty related to the second bailout review, and to the fact that a large number of borrowers would not cooperate in reaching a restructuring agreement, in the hope that the government’s introduction of the extrajudicial compromise could lead to better terms and possibly to a debt haircut.

If persistent, these factors could complicate the achievement of the NPE reduction targets. The NPL market has been liberalised in 2015, probably with the objective to attract foreign investors, but that it unlikely to happen if economic uncertainty remains. The current strategy for achieving the target is mostly bank-led. The IMF argues in its Article IV that an alternative could be to set up an Asset Management Company (AMC), but this could be difficult in Greece as there is little demand for a private AMC, and a public AMC would be exposed to governance concerns and carry risks, given stringent European rules that could trigger bail in if additional capital is needed in the short run.

A second concern mentioned in the IMF review is that of deferred tax assets and credits (DTAs/DTCs). I have previously discussed the issue here, but essentially DTCs are instruments that can be counted as capital regardless of whether the bank makes a profit or a loss, and depending on how they have been framed, they may entail a contingent liability for the state. These instruments are still relevant for the Greek banks (Table 1), which may reduce the quality of their capital.

So, whose assessment should be trusted when it comes to the Greek banks? As always, all assessments could be right or wrong, depending on the circumstances. It is very difficult to make a prediction of how things will evolve, particularly because the fate of banks is never separate from that of the country they are in, and for Greece economic uncertainty has by now become the norm. Yet, the two issues discussed here add a source of potential worry.