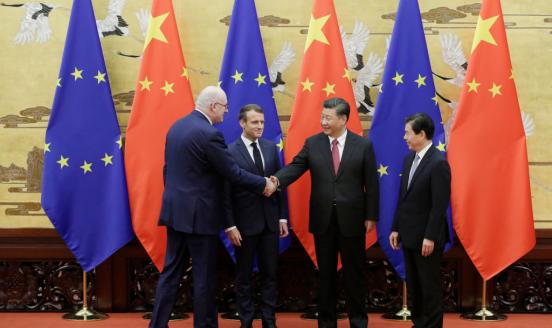

How to handle state-owned enterprises in EU-China investment talks

Chinese state-owned enterprises (SOEs) are one of the main obstacles preventing China and the European Union from agreeing a bilateral investment agre

Chinese state-owned enterprises (SOEs) are one of the main obstacles preventing China and the European Union from agreeing a bilateral investment agreement (BIT). Given the benefits that both China and EU could obtain from a BIT, the question of SOEs should be addressed in the most effective way.

We examine the main differences between Chinese and European SOEs, in terms of their sectoral coverage and, most importantly, their corporate governance. We argue that preferential market access for Chinese SOEs in China is the key to their undue competitive advantage globally, and is also the reason why global consumers might not necessarily benefit from Chinese SOEs in terms of welfare gain.

Preferential market access in China, rather than ownership of SOEs, should be the key factor when evaluating the undue advantage enjoyed by Chinese corporates because private companies with ties to the Chinese government might also benefit from preferential market access.

We also offer a checklist of issues for EU-China investment talks in relation to Chinese SOEs. First, creating barriers to prevent Chinese companies acquiring European assets will not solve the problem. Instead, equal market access in China is a much better goal to pursue in order to reduce the seemingly unlimited resources that Chinese SOEs seem to have to compete overseas. Second, bringing Chinese corporate governance closer to global market principles is also essential to ensure European and Chinese corporates operate on an equal footing in their cross-border investment decisions.