The exchange rate and inflation in the euro-area: words following facts

The reduced references in the speeches of the President and Vice-president of the ECB to exchange rate changes in assessing inflation developments cor

Some observers have been quite surprised by the repeated, unusually pointed, reaction of ECB President Draghi in his January Press Conference to the exchange rate statement of US Treasury Secretary Mnuchin, according to whom: “Obviously a weaker dollar is good for us as it relates to trade and opportunities”.

The term “exchange rate” was mentioned 28 times in the question-and-answer session of the ECB Press Conference and some of the statements made by Mario Draghi clearly expressed irritation, which must have, in turn, reflected irritation voiced in the Governing Council meeting. For instance Draghi said: “Finally, … there is a third reason [for exchange rate volatility] which [is] … the use of language being discussed in exchange rate developments, that doesn't reflect the terms of reference that have been agreed lastly on October 14, 2017 in the IMFC in Washington.” And then he added: “… The exchange rate has moved in part … for exogenous reasons that have to do with communication, but not by the ECB, but by someone else. This communication, not the ECB communication, but someone else’s communication, doesn't comply with the agreed terms of references; ….”

This insistence on the exchange rate is even more clearly a sign of irritation towards the Mnuchin statement if one recalls the long-term trend, which I documented in a post published on October 25, 2017. The ECB, based on quotations from speeches of the president and vice-president, has moved, in its understanding of inflation, from a small-country model in which the pass-through of exchange-rate movements to inflation is the dominant force, to a large-country model in which conditions in the labour market, as conceptualised by the Phillips curve, have more importance. With this change, the ECB got somewhat closer to the Fed approach to understanding inflation, in which conditions in the labour market have always been prevalent.sed on the evidence displayed in Figure 1 (in particular looking at the red line), I wrote: “One should conclude that, about a decade after the adoption of the euro, the ECB moved from the paradigm of a small, open economy towards that of a large economy. This change of perspective would have happened during Trichet’s tenure. Thus, since more than 10 years, the ECB clearly gives less weight than previously to the exchange rate and other variables consistent with the small-country approach in assessing inflation prospects.”

I expect that a similar exercise conducted over papers prepared in Eurosystem central banks would show an equally clear move away from studies concentrating on the exchange rate to studies looking at domestic determinants of inflation.

In the post mentioned above, I just documented the change but did not really give a possible reason for it. In principle one can think of a number of non-exclusive, reasons for the change:

- The first possible reason could be intellectual inertia; it just took time to understand that, with the euro, one had to move away from a small country to a large country model.

- The second possible reason, partially overlapping with the first, would consider psychology. The first ECB President, Wim Duisenberg, came from the Netherlands – a country that had as its only monetary guide keeping the exchange rate of the guilder stable towards the deutschemark. The second ECB President, Jean-Claude Trichet, under whom the move towards the large-country model took place, came from France, a larger country than the Netherlands, where domestic developments were more important for inflation.

- The third possible reason is of a more general nature. The euro was, and somehow still is, an unprecedented experiment and the euro exchange rate was, in a way, a sign of the success of the experiment, thus an emphasis on it was justified beyond its importance for monetary policy.

These three reasons are plausible but cannot be easily tested. I have however now found, in a speech by B. Coeure[1], a possible objective explanation for the trend decrease of the ratio between the frequency of terms consistent with the small-country model and the frequency of terms consistent with the large-country model that I documented in my post: the progressive decline in the pass-through of exchange-rate changes to inflation.

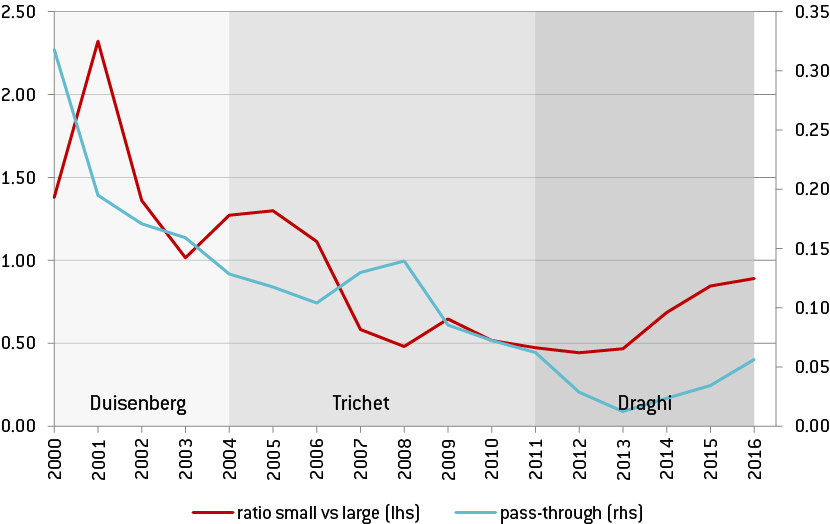

Figure 1. Exchange rate pass-through to HICP-inflation and ratio of frequency of terms consistent with the small and the large country approach.

Source: Authors elaboration, and Cœuré (2017).

Notes: The red line is the ratio between the frequency of terms consistent with the “small” country model and the frequency “large” country model. The blue line is the cumulated impulse response of HICP inflation to a 1% appreciation in the NEER after three years. It is based on the updated estimation of Hahn (2003) over a 20-year rolling window from the first quarter of 1980 to the first quarter of 2016. Each point on the blue line refers to the end of each 20-year rolling sample, with the first sample referring to the period from the second quarter of 1981 to the first quarter of 2000 and the last sample to the period from the second quarter of 1996 to the first quarter of 2016. The scale has been inverted. The underlying data of the pass-through as well as the above description have been kindly provided by the ECB.

I don’t want to make too much of the common trend of the two curves appearing in Figure 1, but it is certainly suggestive that the decrease in the weight given by the ECB to the exchange rate (and other variables consistent with the small-country model) in understanding inflation has coincided with a withering of the effect of exchange-rate changes on inflation. So, there may be objective, structural reasons for the change in perspective rather than intellectual inertia or other, less verifiable reasons.

To check this hypothesis I ran a regression in which the relative frequency of “small country” to “ large country” terms is explained by the structural decrease in the exchange pass-through as estimated in the Coeure speech. The results of this regression are presented in Table 1.

A possible interpretation of the regression results is that the decreasing importance attributed by the ECB to small-country variables in understanding inflation is explained by the reduced effect of exchange-rate changes on inflation. So, changing words seem to be determined by changing facts.

The policy conclusions of my previous post get somewhat reinforced by the reading offered here: the decrease in the weight of the exchange rate in assessing inflation developments is grounded in changing structural factors; thus, an exchange-rate appreciation should have less of an effect in deterring the ECB from reducing the ease in its monetary policy.

Still, the strong reaction to the Mnuchin statement shows that the ECB is well alert to the risks of competitive devaluations. And the risks are not only for the control of inflation and activity in the euro area: the damages of beggar-thy-neighbour policies for the world economy, especially when played by large, globally relevant countries such as the US and the euro-area, are too well documented to take a relaxed attitude to their manifestations. It is somewhat discomforting that this fact does not seem to be well understood by the Trump administration.

This post was prepared with the assistance of Alessandra Marcelletti.

[1] The transmission of the ECB’s monetary policy in standard and non-standard times

Speech by Benoît Cœuré, Member of the Executive Board of the ECB, at the workshop “Monetary policy in non-standard times”, Frankfurt am Main, 11 September 2017.