Venezuela’s hyperinflation

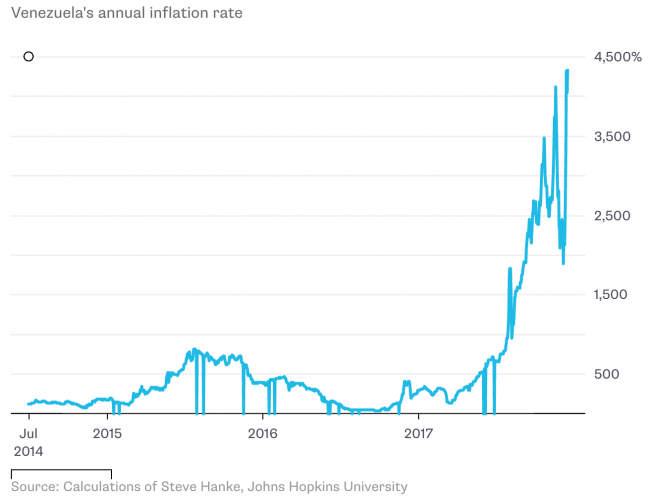

The International Monetary Fund forecasts Venezuelan inflation spiralling to 13,000 percent this year. As President Maduro is expected to introduce th

For those in need of a quick recap, the FT has the Venezuelan crisis in five charts.

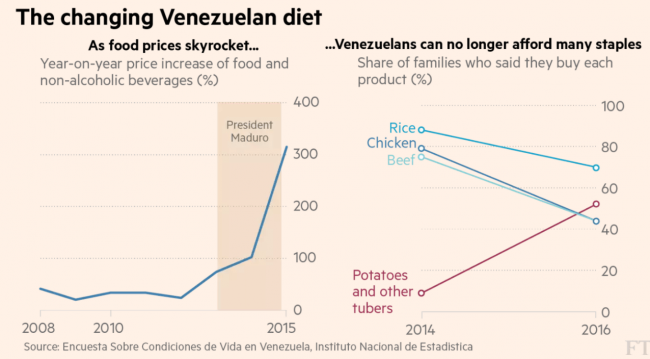

As prices have skyrocketed, and with unemployment expected to grow to more than 36% by 2022, income has not been able to keep up with the need to buy food. Nearly three-in-four Venezuelans reported suffering weight loss last year, and, of those, a 9kg loss on average. Venezuela has recently surpassed China and Mexico as the largest source of asylum applications to the US.

With the homicide rate having risen to the second highest in the world, fewer and fewer airlines still fly to Caracas. Even more devastating to many Venezuelans than the country’s lack of food is its medicine shortage, and according to Transparency International the Venezuelan government is the most corrupt in the western hemisphere.

Source: FT

Noah Smith argues that one problem with hyperinflation is that we don’t know exactly the causes. Hyperinflations are so rare, and so far outside the bounds of typical macroeconomic models, that it makes sense for economists to use a different approach to study them.

The best studies of hyperinflation approach the phenomenon as detectives – examine the specifics of events and policies in each case and try to draw generalisations. Sargent’s 1981 analysis, for example, is limited by the fact that all four of the inflations he studies were the result of war reparations made by the Central Powers in the wake of the First World War. More recent follow-ups mostly look at small and poor countries that mostly borrow from outside their borders. The question of whether government deficits matter, in other words, rests crucially on the still-unresolved question of what causes hyperinflation in the first place.

Source: Bloomberg View

José Niño has a two-part series on how Venezuela reached the current state of crisis. Henkel Garcia Uzcategui also takes us inside Venezuela’s collapse in a historical perspective. Venezuela’s crisis - he argues - is deep, complex and comparable, perhaps, only to the era of wars in the 19th and 20th centuries, when a series of military dictatorships caused widespread hunger and political instability, undermining confidence in Venezuela both at home and abroad.

After more than four decades of dizzying economic ups and downs, he says Venezuelans are understanding just how ineffective central planning has been. Rebuilding the nation will require fundamentally rewriting the rules of the game. That means reconstructing both the Venezuelan economy, by shifting it towards a market economy, and Venezuelan institutions, by reweaving the economic and political fabric back together.

Steve Hanke, who was President Rafael Caldera’s economic advisor in 1995-96, thinks President Maduro has flunked every economic literacy test he has ever taken. He also argues that there are only two sure-fire ways to kill Venezuela’s inflation and establish the stable conditions that are necessary to carry out much-needed economic reforms.

One way would be to dump the bolivar and officially dollarise the economy; the other way would be via a currency board system, which would impose a hard budget constraint and discipline on the economy. While the currency board idea became engulfed in controversy after Argentina’s convertibility collapsed in 2002, Hanke believes that those critiques are misplaced, because the Argentinian case had two major features that disqualified it from being an orthodox currency board.

Ana Maria Santacreu and Heting Zhu at the Federal Reserve Bank of St. Louis think that there is still hope for Venezuela. Brazil was in a similar situation for decades in the 20th century; its inflation rate reached over 2000% in 1993. To stabilise the economy, the Brazilian government created a virtual currency called a unit of real value (URV). URV’s intangibility and transparency made it much more trustworthy and dependable than the previously issued paper money. Therefore, if Venezuela can adjust its large imbalances and establish some fiscal disciplines to restore people’s trust in the financial system, they think that its hyperinflation could be tamed down eventually.

Matt O’Brien argues that Nicolás Maduro's Venezuela has learned what Robert Mugabe's Zimbabwe did a decade ago: that you can get people to stick with you no matter what, if they think your opponents are their enemies. It turns out, then, that revolutions do not live by bread alone. They need polarisation, too. That's the only way to explain the otherwise inexplicable fact that two of the most economically destructive governments in recent memory have also been two of the longest-lasting.

Ideology is about the only thing that Venezuela and Zimbabwe still have anymore. Both of their ideologies were born in opposition to extreme inequality and the ancien régimes that let it fester. These governments have failed for the same reason that people have stood by them – i.e. polarisation – and O’Brien thinks polarisation is a problem that does not affect only countries like Venezuela and Zimbabwe.

Venezuelan economist Ricardo Hausmann has been writing on the Venezuelan crisis for a long time, and he has a drastic view. Back in July 2017, he cited statistics according to which the minimum wage (the wage earned by the median worker) measured in the cheapest available calorie, had declined from 52,854 calories per day in May 2012 to just 7,005 by May 2017 – not enough to feed a family of five. Since then, conditions have deteriorated dramatically and by last month, the minimum wage had fallen to just 2,740 calories a day.

With all solutions either impractical, deemed infeasible, or unacceptable, most Venezuelans are wishing for some deus ex machina to save them from this tragedy. Hausmann thinks that free and fair elections are impossible; a domestic military coup to restore constitutional rule is unpalatable to many democratic politicians; targeted sanctions, managed by the US Office of Foreign Assets Control, are too slow and may entail tens of thousands of avoidable deaths and millions of additional Venezuelan refugees before they yield their intended effect.

Hausmann thinks that as conditions in Venezuela worsen, the solutions that must now be considered include what was once inconceivable, and military intervention by a coalition of regional forces may be the only way. This military assistance would need to be required by a new government, appointed by the National Assembly, after having impeached Maduro and the vice-president.