Demographics and Long Run Growth

Scholars have been investigating the relationship between demographics and long term growth, in the context of the secular stagnation hypothesis. We r

Cooley and Henriksen argue that demographic factors cannot fully account for the slowdown of long-run growth, but they likely represent an important contributing factor. Demographic change is persistent and predictable. Across the most advanced economies, average age will increase and life expectancy will almost surely increase. This may have important consequences for long-run economic growth. Economic policies that strive to mitigate the effects of ageing on long-run growth will have to target households’ incentives to supply capital and labour over their life-cycles; in particular late-working-life labour supply.

In a podcast interview, Hal Varian says that if technology cannot boost productivity, then we are in real trouble. Thirty years from now, the global labor force will look very different, as working age populations in many countries, especially in advanced economies, start to shrink. While some workers today worry they will lose their jobs because of technology, economists are wondering if it will boost productivity enough to compensate for the shifting demographics—the so-called productivity paradox. Varian thinks there are three forces at work. One of these is the investment hangover from the recession, as companies have been slow to reestablish their previous levels of investment. The second has been the diffusion of technology, the increasing gap between some of the more advanced companies and less advanced companies. And third, existing metrics are facing some strains in terms of adapting to the new economy. Varian believes demographics is important, particularly now that baby boomers, who made up most of the labor force from the 1970s through 1990s, are retiring but will continue to be consumers.

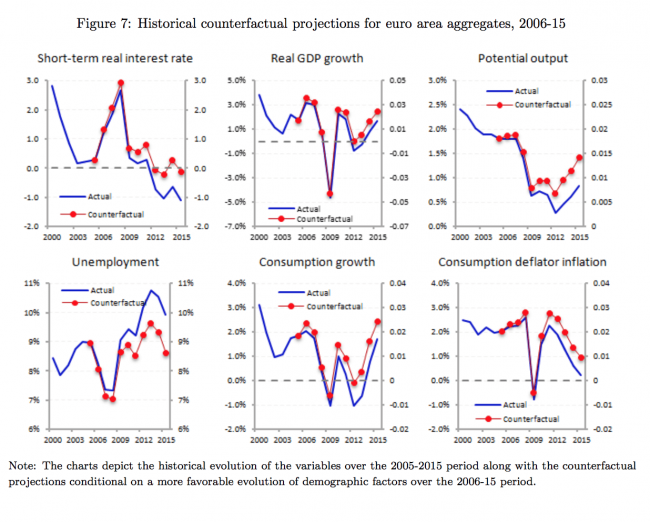

Ferrero, Gross and Neri thinks that demographics matter for secular stagnation and low interest rates. They develop a dynamic panel model for the euro area countries, and conduct a backward-looking counterfactual scenario analysis by assuming that dependency ratios behave more favorably than they did over the 10-year period from 2006-15. In addition, they also present a forward-looking counterfactual assessment, assuming that the dependency ratios move in line with the quite adverse projections by the European Commission, along with more favorable alternative assumptions over the 2016-25 period. In both cases, the counterfactual projections suggest an economically and statistically relevant role for demography. Interest rates would have been higher and economic activity growth measures stronger under the assumed more favorable historical demographic assumptions. Concerning the forward-looking assessment, interest rates would remain at relatively low levels under the assumption that demography develops as projected by the EC, and would rise visibly only under the assumed more favorable forward paths for dependency ratios.

Earlier research by Gottfries and Teulingens argued that demography has played an important role in reducing the interest rates. The increase in life expectancy, which has not been offset by an increase in the retirement age, has led to an increase in the stocks of savings. The latter will go into price increases for assets in fixed supply – such as housing – rather than in adding new capital. Potential remedies for absorbing the extra savings are increasing the retirement age and an extension of the pay-as-you-go benefit systems. Similarly, Aksoy, Basso, Grasl, and Smithargued that population aging predicted for the next decades is found to be a significant factor in reducing output growth and real interest rates across OECD countries.

But this is not an universally agreed conclusion. Earlier research by Favero and Galasso argues instead that demographic trends in Europe do not support empirically the secular stagnation hypothesis. Their evidence shows that the age structure of population generates less long‐term growth but positive real rates. Policies for growth become very important. They assess the relevance of the demographic structure for the choice between macro adjustments and structural reforms and show that middle aged and elderly individuals have a more negative view of reforms, competitiveness and globalization than young. Their results suggest that older countries ‐ in terms of share of elderly people ‐ should lean more towards macroeconomic adjustments, whereas younger nations will be more supportive of structural reforms.

Cervellati, Sunde and Zimmermann take a global, long-run perspective on the recent debate about secular stagnation, which has so far mainly focused on the short term. The analysis is motivated by observing the interplay between the economic and demographic transition that has occurred in the developed world over the past 150 years. To the extent that high growth rates in the past have partly been the consequence of singular changes during the economic and demographic transition, growth is likely to become more moderate once the transition is completed. At the same time, a similar transition is on its way in most developing countries, with profound consequences for the development prospects in these countries, but also for global comparative development. The evidence presented suggests that long-run demographic dynamics have potentially important implications for the prospects of human and physical capital accumulation, the evolution of productivity, and the question of secular stagnation.

Adair Turner argues that the current downward trend in the US fertility rate would be troubling if strong growth and economic confidence required a larger workforce, but the evidence linking births with economic performance in developed countries doesn't add up, and America has nothing to worry about. As people live longer and healthier lives, retirement ages can and should be increased. And in a world of radical automation potential, which threatens low wage growth and rising inequality, a rapidly growing workforce is neither necessary nor beneficial, and a slightly contracting supply of workers may create useful incentives to improve productivity and support real wage growth.