Goodbye deleveraging: Fiscal and monetary expansion to support growth in China

China has opted for a renewed fiscal and monetary stimulus to address the risk of the US-led trade war. The dual policies send a clear signal that ec

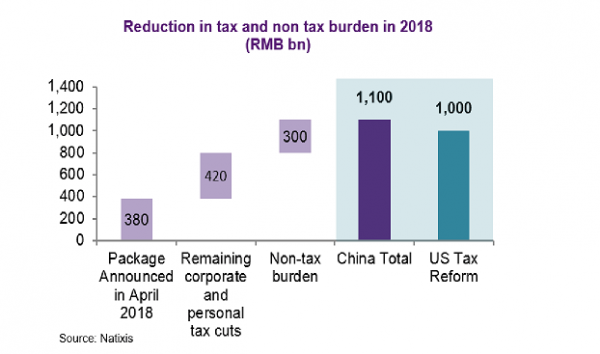

Against very clear headwinds due to the trade war and decelerating investment, China's State Council has unveiled plans to take a more aggressive fiscal policy in 2018 with a reduction of corporate and household burden by 1.1 trillion yuan. In the whole year, tax reduction will amount to 800 billion yuan for enterprises and individuals, which is equivalent to 5.5% of total tax revenue in 2017. This includes the adjustment in value added tax, the reduction in corporate tax rate of manufacturing, transportation, and other industries, and the rebate from research and development expense. Another 300 billion yuan will come from reducing non-tax burden on costs in logistics and utilities. The total amount is roughly equivalent to the reduction in corporate burden from the US tax reform of $150 billion (1 trillion yuan).

Such incentive does not come without cost. On the funding side, the Chinese government will accelerate the issuance of local government special bonds for infrastructure financing. Such action is echoed by the People's Bank of China (PBoC) through the earlier three cuts in the Reserve Requirement Ratio (RRR). It is also reported that Chinese banks will have a laxer “structural parameter” in the Macro Prudential Assessment (MPA), which essentially means more room for credit growth.

The dual fiscal and monetary policies send a clear signal that economic growth is the priority. An expansionary fiscal policy and a reduction in tax revenue mean stronger government intention to support the economy. But without facilitating measures, the new fiscal package will have to drive up interest rate and crowd out private investment. This is where monetary policy comes into place.

There are two consequences of the changed monetary tones. First, a faster credit growth can maintain abundant liquidity and low interest rate to support the private sector. The earlier three RRR cuts and expanding types of MLF collaterals already suggested an accelerated liquidity easing tone, with which the market quickly reacted with a rapid renminbi depreciation. The liquidity condition in conventional markets, such as the interbank and bond market, has also improved. SHIBOR 3M, the interest rate offered by 18 commercial banks in the interbank market, moved down from 4.91% in December 2017 to 3.17% in July 2018. This indicated the liquidity pressure for financial institutions, especially the large banks has eased.

Second, laxer monetary condition can ease the default risks due to liquidity crunch, which is particularly important against the backdrop of the recent crackdown on shadow banking. The reduced risk appetite of investors and the concern on more defaults also push the PBoC to include lower rated assets as the collaterals of the MLF.

Another recent development that undermines the risk appetite of investors is the problematic peer-to-peer (P2P) lending. The growth of P2P lending has plateaued at 956 billion yuan as of July 2018. And the number of normal operating platforms for online loans fell to 1,645 due to liquidity pressure and problem in asset quality, hampering the confidence of the financing channel. Together with the rising bond default risks, this has made the financing conditions for small corporates even more difficult.

Whilst total social financing seems to have stabilised so far, down the road, we expect it to accelerate in the second half of 2018 as a consequence of the RRR cuts and the MLF expansion. All of this is necessary to avoid higher rates making it even more difficult to finance the fiscal stimulus and to reduce the crowding out of private investment. All in all, China has opted for a renewed fiscal and monetary stimulus to address the risk of the US-led trade war. Forget about deleveraging efforts for the time being.