The breakdown of the covered interest rate parity condition

A textbook condition of international finance breaks down. Economic research identifies the interplay between divergent monetary policies and new fina

The breakdown of the covered interest rate parity condition

What’s at stake: a textbook condition of international finance breaks down. Economic research identifies the interplay between divergent monetary policies and new financial regulation as the source of the puzzle, and generates concerns about unintended consequences for financing conditions and financial stability.

What’s the covered interest rate parity (CIP)?

According to the covered interest rate parity (CIP) condition, the interest rate differential between two currencies must be equal to the appreciation of the lower-interest rate currency priced in these two currencies’ foreign exchange (FX) swap.

Why? Consider an example with two currencies – say, the dollar and the euro. To borrow dollars, one obvious way is to go to the dollar money market and pay the corresponding interest rate (rtUSD). Another way is to borrow euros from the euro money market and then exchange them for dollars using a foreign exchange (FX) swap.

This type of borrowing, which is called synthetic, costs the borrower the euro rate (rtEUR) plus the price of the FX swap. As the swap involves exchanging euros for dollars today at the spot rate and buying them back at maturity at the forward rate, the cost amounts to the implied appreciation the euro versus the dollar, or forward premium (FPt). The forward rate, known and agreed upon at the time of the spot transaction, hedges the undesired currency risk of synthetic borrowing.

The intuition behind the CIP is that the prices of synthetic and direct borrowing should be equal, for all currency pairs (rtUSD=rtEUR+ FPt). Otherwise, a riskless arbitrage opportunity emerges: arbitrageurs can borrow at the lower rate and lend at the higher rate, earning a riskless profit. Taking advantage of this opportunity affects supply and demand flows until prices are equalised and the CIP holds.

And indeed, the CIP held well for a long while. However, the condition is being consistently violated since the Great Financial Crisis. In particular, the cost of borrowing dollars synthetically from the majority of currencies – the euro and the Japanese yen included – has been persistently more expensive than borrowing dollars directly (in the example).

What’s behind CIP deviations?

During the financial crisis, its aftermath and the euro crisis, the answer to the first question is straightforward, say Claudio Borio, Robert Mc Cauley, Patrick McGuire and Vladyav Sushko of the BIS: “At times of stress, counterparty risk inhibits arbitrage.” What accounts for deviations in the years that followed the crises is less obvious.

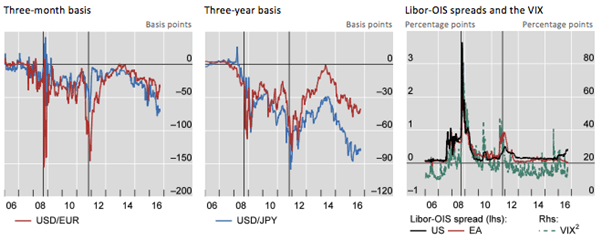

Figure 1

Notes: The vertical lines indicate September 15th 2008 (Lehman Brothers file for Chapter 11 bankruptcy protection) and October 26th 2011 (euro-zone authorities agree on debt relief for Greece, leveraging of the European Financial Stability. 2 Chicago Board Options Exchange S&P 500 implied volatility index; standard deviation, in percentage points per annum. OIS = overnight indexed swap; EA = Euro area. Sources: Bloomberg; authors’ calculations.

Borio at al. essentially argue that the key price that moves is the forward premium.[2] As pointed out above, the forward premium is the cost of hedging the currency risk of borrowing dollars using a foreign vehicle currency. If the CIP held, this should just be the interest rate differential. The CIP deviation though, rewards the party supplying the dollars in the spot leg of the swap and raises the hedging cost for the party supplying the foreign currency. This price is often called the dollar basis.[3]

Borio et al. underline the role of increased demand to swap other currencies into dollars that is structural and unlikely to be very sensitive to the opening up of the dollar basis. What’s more, they attribute this structural surge in demand to monetary policy divergence between large currency areas.

Basis-insensitive demand, they argue, emanates from three main sources:

- Banks’ desire to hedge a structural currency mismatch between their assets (e.g. loan book) and their liabilities (deposit base) arising from their business model.

- (European and Japanese) institutional investors’ demand to hedge strategic investing decisions in foreign-currency (dollar) denominated assets.

- (American) non-financial corporate investors’ demand to hedge opportunistic issuance in a foreign currency (euro or yen) where credit spreads are compressed.

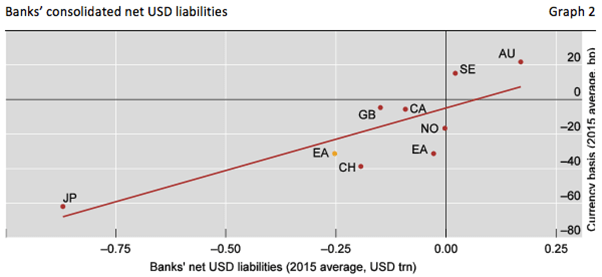

Figure 2

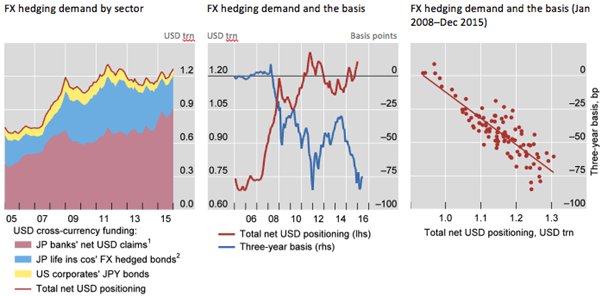

Notes: For Sweden (SE), net euro liabilities (x-axis) and the SEK/EUR basis (y-axis). The yellow dot adds a measure of US non-financial firms’ bond issuance in euros (reverse yankee bonds). AU = Australia; CA = Canada; CH = Switzerland; EA = Eurozone; GB = Great Britain; JP = Japan; NO = Norway; SE = Sweden. Sources: Bloomberg; BIS international banking and debt securities statistics; authors’ calculations.The evidence? The more dollar liabilities relative to dollar assets (a proxy for FX swap demand) that banks in different jurisdictions had, the larger the dollar basis has been vis-à-vis their home currency (Figure 2). Moreover, in the case of Japan – the only country with long reliable time series for institutional investors’ hedging demand – total demand tracks the basis very closely over time since the Great Financial Crisis (Figure 3).

Figure 3

Ultimately, Borio et al. posit, the factors driving this demand for hedging are very low interest rates, monetary policy divergence and large central-bank asset purchases. Low interest rates decrease bank profits (e.g. in Japan), fuelling foreign expansion (e.g. in the US). And large central-bank asset purchases absorb long-maturity assets and compress spreads, adding to the hedging demand of local institutional investors and foreign corporates.

In their paper, Dagfinn Rime, Andreas Schrimpf and Olav Syrsatd agree on the paramount importance of the FX swap market and monetary policy, and make three additional contributions.

The first two are methodological: First, they account for “realistic” interest rates for banks wanting to implement arbitrage trades. To assess the CIP, interest rates from Overnight Indexed Swaps (OIS) or the interbank market are usually used. Nevertheless, neither reflect banks’ actual funding cost: banks’ borrowing is longer-term, and thus riskier, than OIS rates imply, while the interbank market has become a less vibrant source of banks’ funding post-crisis. It has been partly replaced by non-bank money-market funding (e.g. Commercial Paper (CP) from money-market funds).

Second, they distinguish between the law of one price (LOOP) and arbitrage. As stated at the beginning of this review, the CIP is really the law of one price – the cost of borrowing dollars must be the same even if another currency is used as a vehicle. A riskless arbitrage trade, on the other hand, must be self-financing – meaning that the investment leg must be in a risk-free asset, i.e. not lending to banks , for instance.

These methodological improvements lead them to two conclusions: 1) the law of one price holds at the bank level, when one considers the appropriate funding (CP) interest; 2) on the contrary, true arbitrage opportunities are limited only to a handful of banks, global and top-rated, when one considers the risk-free interest rate for the currency of investment.

How do they reconcile these two conclusions? This is their third contribution: CIP deviations using OIS rates are the result of segmented money markets and different liquidity conditions across currencies. The implementation of quantitative easing in the euro zone and Japan has generated so much excess liquidity sitting in central banks’ deposit facility that it has lowered borrowing costs in euro and yen for all banks. Meanwhile, segmentation in the dollar money market persists, meaning that banks still face much more heterogeneous borrowing costs, costs that increase as their creditworthiness declines.

The relative scarcity of dollars compared to euro and yen has given rise to an additional cost, a liquidity premium spread, for all banks wishing to borrow dollars from the money market, captured in their marginal funding costs but not in the OIS. This explains their first conclusion.

But although obtaining dollar liquidity straight from the money market is hard for all banks, it is most expensive for the low-rated banks. The FX swap market clears at an equilibrium price attractive for all: low-rated banks are able to borrow dollars more cheaply using FX swaps and the euro or yen as a vehicle. On the other side of the transaction, top-rated banks are compensated for supplying the coveted – and relatively cheaper, for them – dollars in the swap through arbitrage profits on central bank deposits’ investment, hence their second conclusion.

Why do the deviations persist?

Both papers are in agreement as far as this second question: arbitrage by banks has become more difficult. Rime, Schrimpf and Syrsatd point to “effective limits to arbitrage, in particular the difficulty to scale the arbitrage due to quantity constraints in the supply of [dollar] funding by non-banks”. Borio et al. similarly argue that tighter limits to arbitrage are “by [their] very nature… harder to quantify, but the footprints are clearly there”.

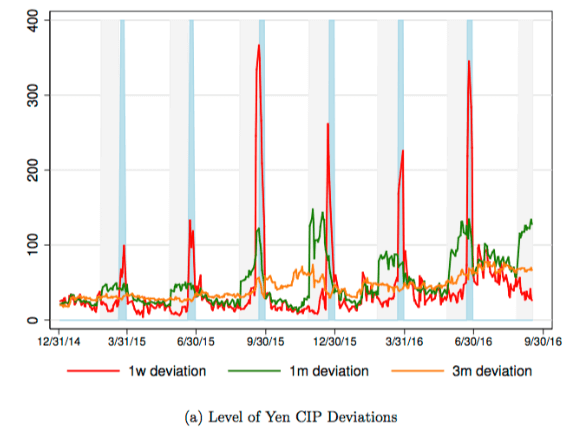

The “footprints” Borio et al. refer to are spikes in CIP deviations towards the end of quarter, shown in Figure 4 (which shows the absolute size of the basis, i.e. the sign is reversed) by Du, Trepper and Verdelhan. John Cochrane (here and here) writes about their paper “their conclusion: it’s real. Banks are constrained by capital and liquidity requirements. The trade may be risk free but you need regulatory capital to do it”.

What’s the idea behind this? The appearance of these quarter-end deviations has coincided with changes in the regulatory framework. Expanding the balance sheet by borrowing in one currency and investing in another requires the issuance of costly capital beyond some point, and the basis may not be large enough to justify that cost.

“It turns out that European banks only need capital against quarter-end trading positions. US banks need capital against the average of the entire quarter”, Cochrane explains. “Thus, one week before the end of the quarter, [E]uropean banks will not enter into any one-week bets. And one week before the end of the quarter (red line), the spread on one week covered interest parity zooms. One month before the end of the quarter, the spread on one month covered interest parity zooms.”

Figure 4

Notes: Illustration of Quarter-End Dynamics for the Term Structure of CIP Deviations: The blue shaded area denotes the dates for which the settlement and maturity of a one-week contract spans two quarters. The grey shaded area denotes the dates for which the settlement and maturity dates of a one-month contract spans two quarters, and excludes the dates in the blue shaded area. The top figure plots one-week, one-month and three-month Libor CIP deviations for the yen in red, green and orange, respectively.

A recent paper by Gino Cendese, Pasquale Della Corte and Tianyu Wang (here and here) corroborates and quantifies the effect of the so-called leverage ratio on the CIP. The “Basel Committee on Banking Supervision (BCBS)”, the authors write, “introduced a minimum requirement on the leverage ratio, defined as the capital measure over the exposure measure, to act as non-risk based “backstop” to the risk-weighted capital requirement”. In other words, it is the size, not the risk, of the exposure that matters in the calculation.

They “estimate that a one standard deviation increase in the leverage ratio of dealer banks can raise the dollar funding cost for clients up to 28 basis points per annum. This translates, using a simple back-of-the-envelope calculation, into (up to) $92 billion of extra borrowing costs per year given an outstanding amount of dollar-denominated FX swaps and forwards of $33 trillion at the end of December 2016”.

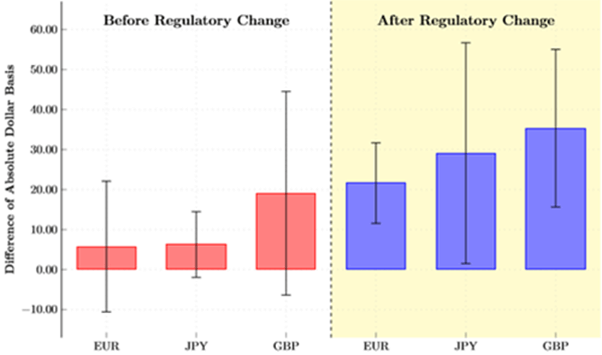

Moreover, when they exploit the “exogenous variations in banks’ capital resulting from…the introduction of the UK leverage ratio framework in January 2016”, the “difference in absolute dollar basis in bps per annum between the treatment (major UK banks with deposits over £50 billion) and control (other banks) groups before and after the change in regulatory requirements is statistically significant (Figure 5).

Figure 5

Cochrane concludes by wondering why non-leveraged investors shy away from exploiting the deviations. “None of the papers address this question”, he says, “but maybe the answer is too obvious. We are still talking about small differentials”.

What are the implications?

This leads him to question the significance of the apparent inefficiency: “that you can get 50 bp. more or less in various short term credit instruments is interesting, but how much social cost is there”?

For one thing, Borio et al. argue that certain policies could lead to paradoxical outcomes. “By easing aggressively to improve domestic financial conditions, a central bank may find that it raises the cost of funding in foreign currency for its banks, if they rely extensively on this market” for instance.

For another, Cenedese, Della Corte and Wang warn that the rising hedging cost implied by CIP deviations could potentially change the behaviour of banks and international investors “in a way that could threaten financial stability, for example by incentivising them not to hedge their FX exposures or invest in more risky assets to cover the higher costs”.

[1] Libor stands for London Inter-bank Offered Rate and is the average interest rate at which global banks borrow from each other. OIS stands for Overnight Index Swap, an interest rate derivative that is based on overnight interest rates such as the Federal Funds Rate in the US or the Euro Overnight Index Average (EONIA) in the euro area.

[2] As the authors put it, “interest rates in the cash market and the spot exchange rate markets are much larger than those for FX derivatives markets”.

[3] A positive dollar basis is conventionally represented as a negative number added to the synthetic cost so that. Rearranging makes the cost of hedging equals to , i.e. increases the cost.