Transatlantic trade, butterflies and earthquakes

To deliver a deal that is more welfare-improving, TTIP negotiators will need to focus on means to enhance long-term competitiveness of the two partner

European Union and United States heads’ of state are meeting this week to reinforce among other things the political will to conclude the transatlantic trade talks termed the Transatlantic Trade and Investment Partnership (TTIP). The agreement is meant to bring down the remaining tariffs on goods and unnecessary regulatory barriers that undermine the transatlantic trade and investment potential. According to an independent study, an ambitious deal could boost overall EU exports by 6% (or €220 billion) and overall US exports by 8% (or €240 billion). The sectors that are expected to benefit the most are largely in manufacturing, namely metal products (+12% in EU exports), processed food (+9%), chemicals (+9%), other manufactured goods (+6%), and other transport equipment (+6%). The study’s estimates incorporate trade creation and trade diversion, as well as dynamic effects in third countries.

Yet TTIP negotiators need not to forget that in an integrated world economy a multitude of unpredictable factors can alter the intended consequences of the agreement. To contextualise the ongoing TTIP negotiations in the larger global trade scenario and show its relevance for TTIP's prospects, in this blog I illustrate how world trade patterns have changed in the past two decades and highlight current trends. If TTIP negotiators cannot predict whether the flap of a butterfly in Chinese factories will provoke a hurricane in transatlantic trade, they can look at how an earthquake in China has shaped trade to date and try to think how future earthquakes could be accounted for. I focus on merchandise trade, as this is the area that TTIP’s impact would be most apparent.

Changing trade patterns: the world upside down.

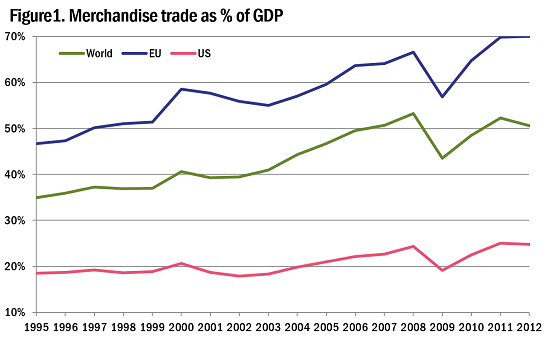

The past twenty years witnessed dramatic changes in global trade shares. The first one of them is the increased relevance of merchandise trade. According to World Bank data, the percentage of imports plus exports over GDP increased from 46% to 66% for the EU and from 18% to 24% in the US over the 1995-2008 period (Figure 1). Noticeably, intra-EU trade increased less than extra-EU trade did. The crisis produced a major shock: world trade to GDP fell by 10 points in one year, but then reversed in 2010 and 2011. However, the data does not allow predicting if we are entering a phase of slow or negative trade to GDP growth.

Source: The World Bank

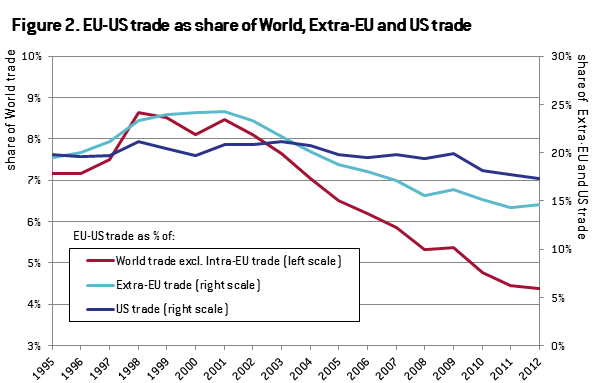

Relevant intra-regional trade patterns also radically changed in the 1995-2012 period, albeit in the opposite direction, and underlying trends were not hugely affected by the crisis. The year 1995 is an interesting reference as it marked a transition point for world trade, with the completion of both the Uruguay Round and NAFTA. According to UNCTAD data, the EU-US share of world merchandise trade (excluding intra-EU trade) almost halved from 8.5% in 2001 to 4.4% in 2012 (Figure 2). Noticeably, bilateral EU-US trade also became less significant for the two partners, falling sharply to 15% of total extra-EU trade and 17% of US trade in 2012 (Figure 2) as both partners diversified their export and import destinations.

Source: UNCTAD, Bruegel computations

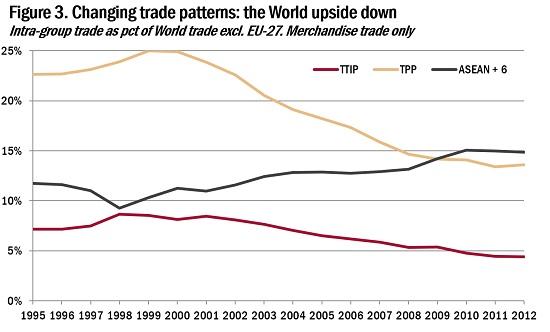

But trade patterns were affected everywhere: by way of comparison, we consider intra-group trade between partners in two other supra-regional agreements currently under negotiation, i.e. the Trans-Pacific Partnership (TPP) and the Regional Comprehensive Economic Partnership, also known as ASEAN + 6 (Figure 3). The observed change is startling: trade between the TPP partners – comprising the US, Canada, Mexico, Japan, and other eight countries in the Pacific area – fell from 25% of world trade in 2000 to 13.6% in 2012, while trade between ASEAN + 6 countries – comprising China, India, Japan, Australia, New Zealand, South Korea and ten countries in the South-East Asian region – increased from 9.3% in 1998 to 15% in 2010. These figures suggest that the dominating trade groups in the Nineties saw their influence on the global scene declining to make way for the rise of the Asia-Pacific region. The prospects of continued high growth in Asian countries suggest that the trade relations could further strengthen in their influence: the global trade landscape seems to have suddenly turned on its head. While the economic balance between the Western World and Asia might be reassuming the pre-industrial revolution trends, the speed of this adjustment so far has undoubtedly been extraordinary.

Source: UNCTAD, Bruegel computations

How do changing trade patterns affect TTIP?

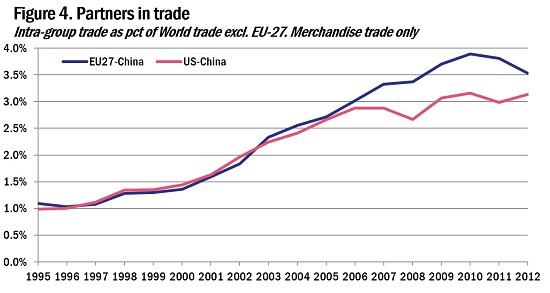

Despite its declining relevance for the two partners and for the world, transatlantic trade still amounted to $648 bn in 2012, or 4.4% of extra-EU global trade, which as a base level is likely to result in far-reaching impact of the negotiations. Yet shifting trade patterns worldwide indicate a change in the composition of the goods bilaterally traded between the EU and the US, which must be reflected in the TTIP negotiations. Indeed the past fifteen years also witnessed a critical shift: China's accession to the WTO twinned with increased possibilities of slicing up the manufacturing production processes boosted the relocation of the low-value added intermediate goods production from the EU and the US to lower-cost Asia, in particular China. Figure 4 shows the steady rise in bilateral trade of the TTIP partner’s vis-à-vis China.

Source: UNCTAD, Bruegel computations

In turn, European and American companies refocused their domestic industrial capacities to high-value high-tech products and activities like product design and R&D. Arguably, today's transatlantic trade in final goods incorporates inputs from many other countries. To grasp the relevance of these shifts for the ongoing bilateral trade negotiations, one can imagine that had the two partners agreed to tear down regulatory barriers in the year 2000, as was being attempted, the savings from the costs of multiple regulations would have partly offset for the huge labour cost savings from relocating to China. Thus, benefits would have been a lower drop in the bilateral trade share relative to extra-EU global trade, and retaining of more manufacturing employment at home. Perhaps in the past political capital has been expended in favour of the owners of capital and technology as opposed to interests of labour. Nonetheless, the fall in manufacturing employment in the EU and the US could not have been avoided. Today, cutting unnecessary regulatory costs through TTIP can be seen as a competitiveness-boosting measure that benefits business while also protecting labour’s interests.

Ultimately, to deliver a deal that is more welfare-improving, TTIP negotiators will need to focus on means to enhance long-term competitiveness of the two partners rather than bargain concessions that will be bear little fruit in the global trade arena.

Special thanks to Suparna Karmakar for her useful comments.