Big improvement in the Greek primary budget

Ahead of what promises to be a very tense negotiation period, the Greek Ministry of Finance released the preliminary budget execution data for the fir

Ahead of what promises to be a very tense negotiation period, the Greek Ministry of Finance released the preliminary budget execution data for the first three months of 2015. The State primary budget is reported to considerably exceed expectations, due to both expenditures below target and revenues picking up.

The coming month promises to be very tense for Greece, as negotiations seem to proceed slowly and payment deadlines are approaching fast. The Eurogroup is due to meet next week, on April 24th, to discuss the Greek reform list that will be the basis for the final programme review and that must be agreed by the end of April, according to the terms of the 20th February agreement. Agreeing on a reform list is paramount for Greece to be able to unlock some of the frozen funding of the programme and relief the cash issues.

However, EU policymakers sound increasingly skeptical about the possibility that a deal can be reached on the 24th. Germany’s Finance Minister Schauble reportedly said “nobody expects there will be a solution” next week, while EC Vice President Dombrovskis also ruled out an agreement and said the meeting is most likely going to be just an assessment of the progress in talks with Greece. If no agreement is reached on 24th April, then the discussion would shift to the Eurogroup on May 11th, just ahead of a 750 million repayment due to the IMF the 12th May (see here for the detailed repayment schedule).

Against this background, the Greek Finance Ministry posted today the preliminary budget execution data for the period January - March 2015. The release is important to assess, because the fiscal performance will certainly be scrutinised and it could strengthen or weaken the Greek position in the Eurogroup negotiations.

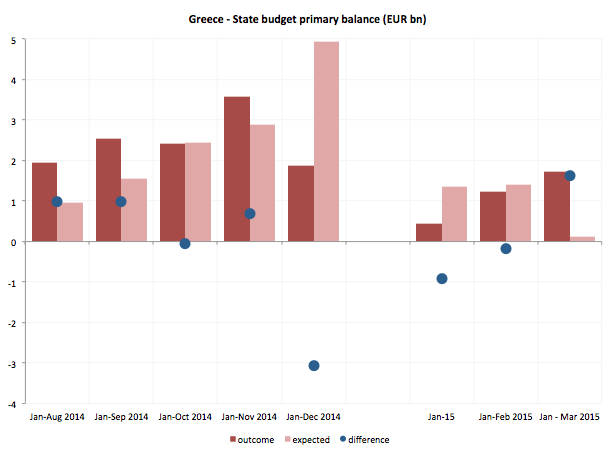

At first sight, the data is extremely positive. The State budget balance for the period January - March of 2015 presented a deficit of 500 million Euros against a target deficit of 2.1 billion, and in line with the figure reported last year (448 million euro for the first three months of 2014). The State budget primary balance recorded a surplus of 1.7 billion Euros, against a target of 119 million euro. This continues the improvement of the primary budget underperformance that was recorded in January and partially corrected in February (I talked about it here and here).

Source: Greece Finance Ministry

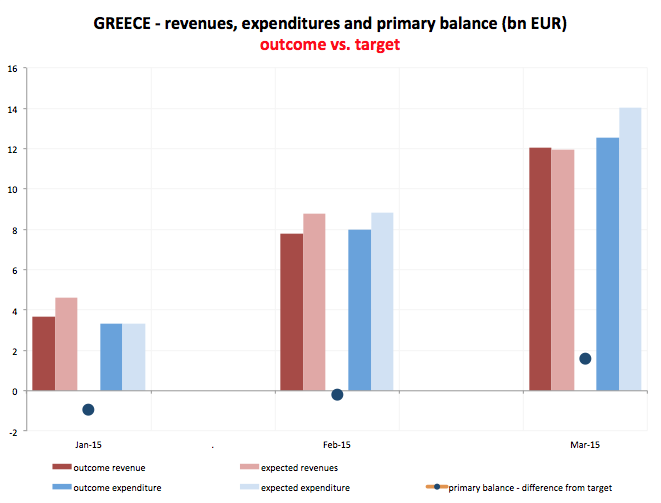

A detailed look at composition reveals an improvement in the revenue side. For the month of May, State Budget net revenues amounted to 4.2 billion euro, over performing the target by about 1 billion. The improvement was driven by the ordinary revenues component, which amounted to 3.3 billion, beating the target by 590 million.

On a cumulated three-months horizon, total State budget net revenues over-performed by 94 million for the January-March 2015 period, after coming short of targets by about 900 million in January and February. However, the overall cumulated improvement was driven mostly by the Public Investment Budget - amounting to 1.4 billion [1] [2] [3] [4] [5] against a 770 million target. These reflect revenues on the investment state budget and mostly linked to EU funds. Ordinary revenues cumulated over the three months amounted to 10.6 billion, so 584 million still short of target. This suggests that the problems with revenues’ underperformance recorded in January and February have not completely gone away, and they still weigh on the budget execution.

Source: Greek Ministry of Finance

Similarly to what happened last month, expenditure control was the main driver behind the improved primary surplus. State budget expenditures amounted to 12.5 billion euros, i.e. 1.5 billion lower than the target. Ordinary Budget expenditures amounted to 11.98 billion Euros and were decreased by 1.3 billion against the target.

After looking at the details in the press release, however, things appear less rosy. The lower expenditures are in fact mainly attributed to “the rearrangement of the cash payments projection”, i.e. delay in payments to third parties. According to Kathimerini, the state spent just 43 million euro by the end of March on paying expired debts to suppliers, which received some 500 million euros in total in the first quarter of 2014.

In conclusion, the data published today suggest there has been an improvement in the primary budget, mostly due to expenditure cuts. Revenues over-performance is mainly explained by increase in the public investment budget, whereas ordinary revenues have not yet picked up sufficiently to absorb the underperformance of the first two months of the year. At the same time, expenditure control is mainly achieved by postponing payments to suppliers, which can be effective in improving the budget in the short term, but the postponement of state payments suppliers may hurt the real economy even further and is in fact unsustainable of the state wants to receive the necessary supplies.