Greece budget update

Primary surplus picked up in June, but July is the key month to watch.

As discussion continue in the Greek parliament and in Bruxelles on the next steps towards the third Greek programme, the Greek finance ministry published the latest budget execution bulletin, with data up to June and comparing the actual outcomes with the estimates presented in the 2015 budget.

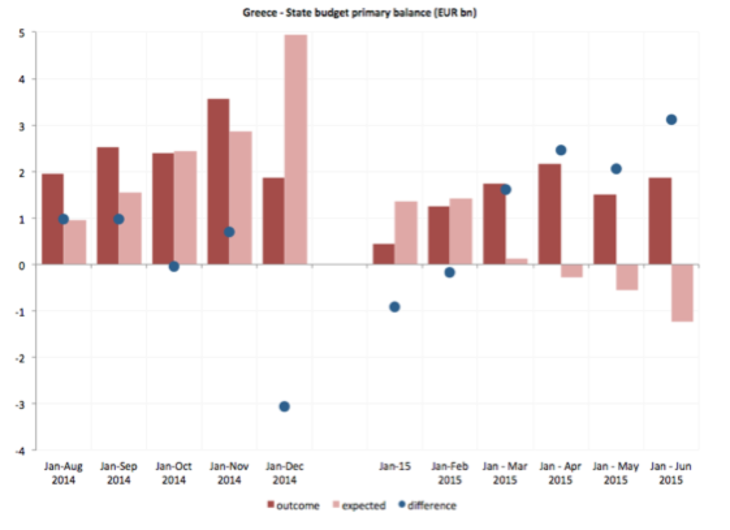

The state budget primary balance picked up again in June, compared to the previous month. Greece recorded a primary surplus of 1.9 billion euros over the first five months of the year, against an expected primary deficit of 1.2 billion euros. In cumulative terms, the state primary balance has therefore exceeded its target by 3.1 billion euros (figure 1).

Source: Ministry of Economy and Finance, Greece

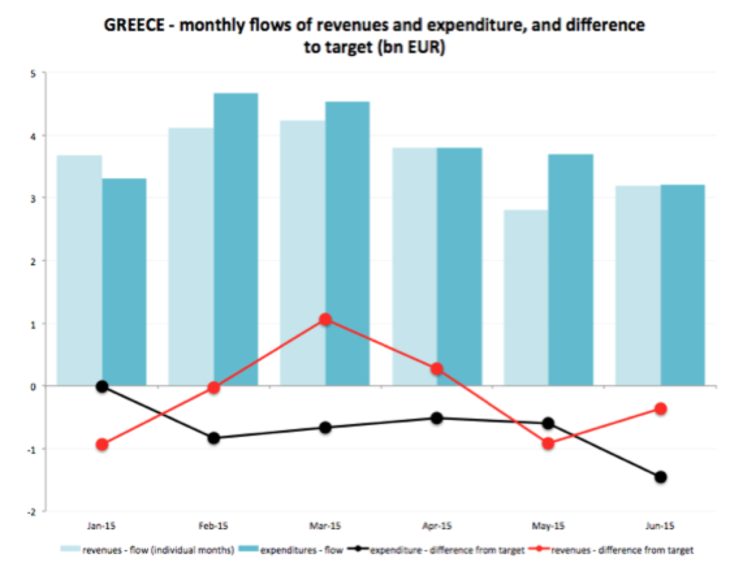

Revenues appear to have picked up in June, after the dismal performance in May (Figure 2). For the month of June alone, net revenues amounted to 3.2 billion euros, 360 million euros short of the monthly target. State budget net revenues amounted to a cumulative 21.8 billion euros for the period January-June 2015, still missing the target by 906 million euros. The ministry of Finance does not offer any explanation for the behaviour of revenues in June. Last month, it had said that the big shortfall in revenues recorded in May was partly attributed to the fact that the first installment of corporate income tax was not received (worth an estimated 555 million euros), so this may have come in in June and be partly responsible for the improvement. Ordinary budget net revenues amounted to 19.8 billion Euros, 1.7 million lower than the target on a cumulative terms. For the month of June in particular, ordinary net revenues were 701 million Euros below target.

Source: author’s calculations based on MEF bulletin

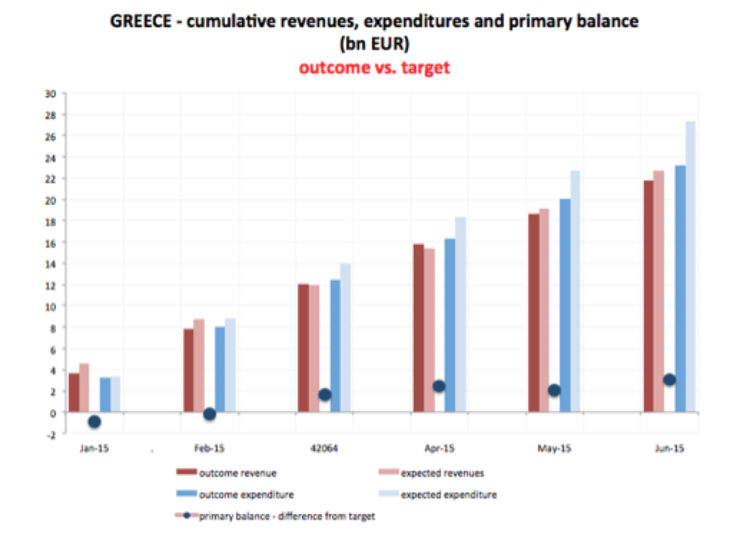

As it has become the norm for Greece since the beginning of the year, expenditures have been lower than expected. For the month of June, state budget expenditures amounted to 3.2 billion euros, i.e. an impressive 1.5 billion lower than the target, with ordinary budget expenditures under performing by 1.1 billion. Over the period January-June 2015, cumulative state budget expenditures amounted to 23.2 billion euros, 4 billion lower than the target. Ordinary Budget expenditures amounted to 22 billion euros and decreased by 3 billion against the target, again mostly due to the reduction of primary expenditure by 2.6 billion euros.

Source: Ministry of Economy and Finance, Greece

In June, the Greek primary balance has picked up compared to the dismal performance in May. However, this was once again the result of severe cuts in primary expenditure, most of which reflects arrears, according to local news report. Revenues have increased in June (although part of the increase may be due to the coming in of corporate income taxes that had been missed i May) but they continue to underperform both on a monthly and on a cumulative basis.

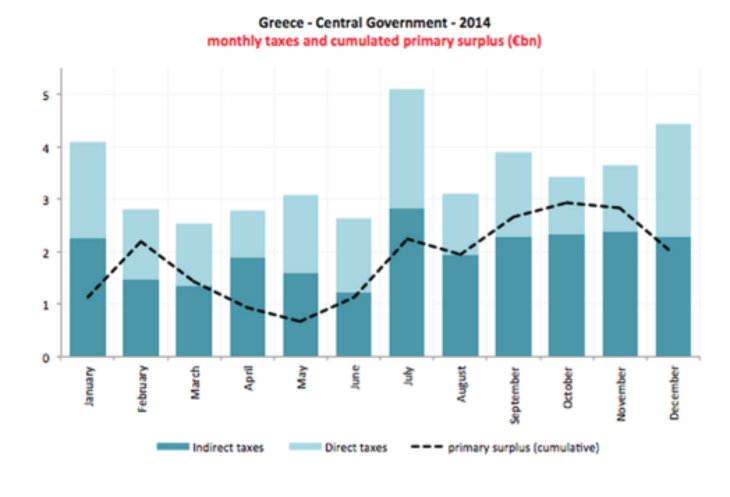

June data do not yet include the impact of the capital controls which had to be introduced at the end of the month when Prime Minister Tsipras called the referendum on the potential agreement with Greece’s creditors. Data for July will incorporate the full effect of the capital controls and will be key to watch because, as previously shown and as evident in figure 4, it is the most important month for revenues formation in Greece. The European Commission has already revised its estimates of real GDP growth for Greece downwards, between -2% to -4.0% in 2015, compared to the +2.9% projected in Autumn '14 forecasts and +0.5% in Spring 2015 forecast. this will certainly hamper the feasibility of the previously discussed fiscal targets, which is probably the reason why there is still no primary surplus target specified in the text of the preliminary agreement.