Nicolas Véron

Nicolas Véron is a senior fellow at Bruegel and at the Peterson Institute for International Economics in Washington, DC. His research is mostly about financial systems and financial reform around the world, including global financial regulatory initiatives and current developments in the European Union. He was a cofounder of Bruegel starting in 2002, initially focusing on Bruegel’s design, operational start-up and development, then on policy research since 2006-07. He joined the Peterson Institute in 2009 and divides his time between the US and Europe.

Véron has authored or co-authored numerous policy papers that include banking supervision and crisis management, financial reporting, the Eurozone policy framework, and economic nationalism. He has testified repeatedly in front of committees of the European Parliament, national parliaments in several EU member states, and US Congress. His publications also include Smoke & Mirrors, Inc.: Accounting for Capitalism, a book on accounting standards and practices (Cornell University Press, 2006), and several books in French.

His prior experience includes working for Saint-Gobain in Berlin and Rothschilds in Paris in the early 1990s; economic aide to the Prefect in Lille (1995-97); corporate adviser to France’s Labour Minister (1997-2000); and chief financial officer of MultiMania / Lycos France, a publicly-listed online media company (2000-2002). From 2002 to 2009 he also operated an independent Paris-based financial consultancy.

Véron is a board member of the derivatives arm (Global Trade Repository) of the Depositary Trust and Clearing Corporation (DTCC), a financial infrastructure company that operates globally on a not-for-profit basis. A French citizen born in 1971, he has a quantitative background as a graduate from Ecole Polytechnique (1992) and Ecole Nationale Supérieure des Mines de Paris (1995). He is trilingual in English, French and Spanish, and has fluent understanding of German and Italian.

In September 2012, Bloomberg Markets included Véron in its second annual 50 Most Influential list with reference to his early advocacy of European banking union.

Disclaimer of external interests

Declaration of interests 23/24

Declarations of interests 2020

Featured work

Next steps for the European Anti-Money Laundering Authority

At this invitation-only event Raluca Pruna discussed the state of the legislation to create an EU Anti-Money Laundering Authority

European capital markets union: make it or break it

Capital markets union has not delivered, but it should be given a last chance, with a focus on supervisory integration

The European Union must be Ukraine's wartime financier of last resort

The European Union should do better than confiscate Russia’s reserve money

The EU can use interest income made on immobilised Russian reserve assets to support Ukraine, but confiscating the assets now would be a mistake

What are the consequences of the war in Gaza for financial markets?

The Polish experience of bank resolution

At this invitation-only online event Piotr Tomaszewski will discus the Poland's unique experience with bank resolution

Bruegel Annual Meetings, 6-7 September 2023

A symphony in progress: shaping a new agenda for Europe

The European Court of Auditors’ report on European banking supervision and credit risk

At this invitation only event Mihails Kozlovs and Edouard Fernandez-Bollo discuss report on EU supervision of banks’ credit risk

The European Commission’s legislative proposal on Crisis Management and Deposit Insurance

At this invitation-only event Marie Donnay will discuss proposed legislation on CMDI in the context of recent banking turmoil.

The US and Swiss messes may nudge the EU towards better international bank capital standards compliance

Bank collapses show the importance of strong capital and liquidity positions and should signal to the EU the benefits of closer adherence to Basel III

Will China’s new financial regulatory reform be enough to meet the challenges?

This paper aims to inform the discussion in relation to China with accounts of experiences in large and complex financial sectors.

Comparing notes on the banking turmoil

This members-only event was aimed at inspiring conversation around the collapse of the Silicon Valley Bank

Fully reimbursing SVB depositors may prove to be a bad move (via CNN)

Reimbursing all SVB and Signature Bank depositors — even if their deposits are worth millions of dollars will have long-term impacts.

Much of the Global South is on Ukraine’s side

The idea that the Global South is taking a neutral stance over the war in Ukraine is overstated.

How useful have the EU's financial sanctions on Russia been?

How Europe should answer the US Inflation Reduction Act

This policy brief explains what is in the IRA, the impact on the EU and other economies, and how the EU should react.

Macroeconomic and fiscal tensions and the outlook for Czechia

At this invitation-only event Mojmir Hampl discussed macroeconomic trends in Czechia.

Is it time to worry about systemic financial risk?

Invitation-only finance focus event at Francesco Mazzaferro joined us to discuss the ESRB’s recent risk assessment

Completing Europe’s banking union: economic requirements and legal conditions

This contribution analyses the deficiencies of the current framework and identifies possible responses, in line with three levels of reform ambition.

How to get the European Banking Union unstuck

War in Ukraine: Financing the victory

How can Europe financially support Ukraine in the short term?

The advance of China’s private sector pauses, but the trend is unclear

The drop in the previous private-sector advance should not be viewed as the start of a new trend of continuous decline, at least not yet.

China’s top ranked corporations are not as opaque as they may seem

Even though most large Chinese SOEs are not listed, they generate most of their revenue from their listed subsidiaries.

Bruegel Annual Meetings, 6-7 September 2022

The Annual Meetings are Bruegel's flagship event which gathers high-level speakers to discuss the economic topics that affect Europe and the world.

The European Single Access Point legislation

At this event we welcomed Ward Möhlmann to take stock of the European Commission's legislative proposal on the European Single Access Point (ESAP).

The Bufferati concept: A radical new bank capital model

At this event Sam Woods engaged in a conversation with the audience about the Bufferati concept.

Is China’s private sector advancing or retreating?

A look into the Chinese private sector.

Now is not the time to confiscate Russia’s central bank reserves

As the costs of Ukraine’s resistance mount, there are increasing calls to confiscate these frozen reserves to finance Kyiv’s war and reconstruction.

The European Union should sanction Sberbank and other Russian banks

EU should extend harsh sanctions to most or all of the largest Russian banks, including the largest that plays a central role in its financial system.

Putin’s Russia is a minnow compared to the Cold War Soviet Bloc

For the time being at least, based on the non-military metrics considered here, Moscow’s global heft is a shadow of its former Soviet self.

Is the private sector retreating in China? Not among its largest companies

China’s largest private-sector companies are expanding more quickly than state-owned enterprises (SOEs).

The private sector advances in China: The evolving ownership structures of the largest companies in the Xi Jinping era

This paper documents recent structural changes in China’s corporate landscape, based on company level data.

Six reasons why backstopping Russia is an increasingly unattractive option for China

China has too much to lose from aligning with Russia over Ukraine.

War in Europe: the financial front

Russia is reeling from massive financial sanctions, while Ukraine’s financial system is battered but remains functional, and the EU and global financi

War in Ukraine: implications for the global financial system and central banks

A special episode of the Sound of Economics Live on the global financial system and central banks in the wake of sanctions imposed on Russia.

The EU’s new foreign investment screening mechanism

At this members-only event Damian Levie joined us to discuss the European Commission's new foreign investment screening mechanism

How to deal with small banks: consolidation, tailoring and the fintech challenge

Small banks face multiple challenges. What structural changes are needed to tackle these pressures?

The UK strategy for Green Finance

This members-only event discussed the UK's strategy for greening the financial system.

Tailoring prudential policy to bank size: the application of proportionality in the US and euro area

In-depth analysis prepared for the European Parliament's Committee on Economic and Monetary Affairs (ECON).

Brexit and European finance: Prolonged limbo

It will take longer than many had anticipated for the dust to settle on the post-Brexit financial landscape and its respective implications for the EU

European banks: under global competitive pressure?

Bruegel Annual Meetings, Day 2 - European banks have lost stature and remain generally low-profitability, low-valuation in comparison to their global

Bruegel Annual Meetings, 1-3 September 2021

The 2021 Annual Meetings gathered high-level speakers and participants to discuss how to recover from the crises brought on by the Covid pandemic

Italy’s experience of dealing with a large stock of troubled assets

This members-only event welcomed Paolo Angelini, Deputy Governor of the Bank of Italy, to discuss the Italian experience of NPL sales.

Multilateralism in banking regulation and supervision

This members-only event welcomed Carolyn Rogers Secretary General of the Basel Committee on Banking Supervision.

Prospects for improving securities and financial reporting oversight in the EU

This members-only event welcomed Eva Wimmer, Head of the Directorate-General for Financial Market Policy at the German Federal Ministry of Finance.

The state of the policy debate on the EU crisis management and deposit insurance framework

This members-only event welcomed Jan Reinder De Carpentier, Vice-Chair of the Single Resolution Board for a conversation with an invited audience.

Financial services: The Brexit dust begins to settle

The phase of greatest Brexit-related uncertainty for the European financial sector ended on 1 January. Although too early to discern more than the bro

What lies ahead for the UK economy?

Nicolas Veron moderated a discussion with Jon Cunliffe to discuss the challenges and opportunities facing the UK economy.

COVID-19 credit-support programmes in Europe’s five largest economies

This paper assesses COVID-19 credit-support programmes in five of the largest European economies, and examines how countries have dealt with trade-off

Money laundering and hybrid threats: Has COVID-19 made it all worse?

Will the European Union and its member states be ready to control this risk – even if competition for financial inflows intensifies?

How could regulators address financial firms’ dependency on cloud and other critical IT services providers?

At this event Dirk Clausmeier, Head of IT security at the German Ministry of Finance discussed financial institutions use of cloud service providers.

Memo to the European Commissioner for Financial Services Policy

The Commissioner for Financial Services Policy should define and promote a vision for a sustainable global financial regulatory and supervisory order,

The forthcoming reform of EU Anti-Money Laundering Policy

At this closed-door event John Berrigan discussed how to create an strategy for countering money-laundering.

Can Europe build a Capital Markets Union without a strong European markets supervisor?

At this invitation - only event we discussed Europe’s Capital Markets Union.

Europe’s banking union should learn the right lessons from the US

In revived discussions on European banking union, some have suggested a new regime to deal with failing banks, alongside existing ones, drawn from par

Completing the banking union in the age of Next Generation EU

At this invitation-only event President of the Eurogroup Working Group - Tuomas Saarenheimo discussed the future prospects of the banking union.

Evaluating the European Commission’s control of state aid in the banking sector

Evaluating European Commission’s control of state aid to banks in the period 2013-2018.

Government-guaranteed bank lending six months on

In March and April 2020, European governments announced massive credit support programmes. After an initial surge, take-up appears to be stabilising (

Bruegel Annual Meetings 2020 - Day 3

Third day of Bruegel Annual Meetings.

Bruegel Annual Meetings 1-3 September, 2020

Bruegel's flagship event transformed into a virtual conference for pandemic times

Government-guaranteed bank lending: beyond the headline numbers

Loan guarantees have been a major part of the COVID-19 support packages offered by European governments to companies. The actual take-up numbers so fa

Tackling too-big-to-fail banks: have the reforms been effective?

Evaluation of the global reforms implemented to deal with "too-big-to-fail banks".

The Wirecard debacle calls for a rethink of EU, not just German, financial reporting supervision

The spectacular collapse of Wirecard AG should serve as a wake-up call for the European Union on the need to pool the relevant supervisory mandates at

Insuring for pandemic-related losses, in this crisis and future ones

What remedies and lessons for the insurance sector in the time of pandemic?

Study on the differences between bank insolvency laws and on their potential harmonisation

This study identifies the national insolvency procedures applicable to banks and analyses key differences between them, notably concerning the circums

Banking regulation in the Euro Area: Germany is different

Despite progress in recent years towards a single banking policy framework in the euro area – a banking union – much of the German banking system has

Corporate credit in Europe: How bad is the outlook?

Corporate credit and COVID-19.

Is the United States reneging on international financial standards?

The new Fed rule is a material breach of Basel III, a new development as the US had hitherto been the accord’s main champion. This action undermines t

Banks in pandemic turmoil

The banking system is critical to society and requires attention and support. In doing so, however, tough love is preferable to complacency.

Hybrid threats in the financial system

This one-day workshop focused on hybrid threats in the context of the financial system by examining vulnerabilities and raising awareness, looking for

A European anti-money laundering supervisor: From vision to legislation

In fighting anti-money laundering, the European Commission should act fast toward creating a central supervisory authority.

The UK election viewed from continental Europe: Meh

It will take more than the vote on December 12 to make the continent pay attention to the UK. Viewed from the continent, the UK election is one more e

A Major Step Toward Combating Money Laundering in Europe

Combating money laundering in Europe took a momentous step with finance ministers of France, Germany, Italy, Latvia, the Netherlands, and Spain puttin

Bank resolution: consistency and predictability

Closed-door workshop on various aspects of bank resolution.

Brexit and Finance: Brace for No Impact?

Amid the daily high drama of Brexit, it is easy to lose track of the structural shifts, or lack thereof, that may be associated with the UK’s possible

Banking disrupted by FinTech and Big Tech

Today banks are facing competition from non-bank firms whose core strategy is based on technological innovation - Big Tech and Fin Tech. What is in st

Questions on financial services policy for Valdis Dombrovskis, Executive Vice-President-designate of the European Commission

Completing the banking union is the dominant task in the financial services area for the next five years. In the short term, the Commission should aff

Banking, FinTech, Big Tech: Emerging challenges for financial policymakers

FinTech and Big Tech firms are both increasingly stepping on banks’ traditional turf. This column introduces the 22nd Geneva Report on the World Econo

The EU is in the US trade war crosshairs. It should further raise its game

The incoming European Commission faces a dilemma on the transatlantic trade relationship, because of the unpredictable policies of the Trump administr

EU trade policy amid the China-US clash: caught in the crossfire?

What risks face the EU with regard to China’s strategic aims in trade policy and how can the EU respond? The US effort to isolate China poses particul

Bruegel Annual Meetings 2019, 4-5 September

The 2019 Annual Meetings featured the launch of Bruegel's memos to the new European Leadership, proposing how to deal with future policy challenges

Bruegel Annual Meetings 2019

Bruegel's 2019 Annual Meetings will be held on 4-5 September and feature the launch of Bruegel's Memos to the New European Commission.

An Effective Regime for Non-viable Banks: US Experience and Considerations for EU Reform

The US regime for non-viable banks has maintained a high degree of stability and public confidence by protecting deposits, while working to minimise t

Tech-enabled payment processes: policy implications of new developments

What challenges does a shift towards new payment processes imply for EU financial services policy?

How comprehensive is the EU political realignment?

Has the left-right divide become obsolete in EU politics?

European Parliament election results: The long view

Following the latest European elections, the author updates his previous analysis of trends in the share of European Parliament seats among ‘mainstrea

The emerging new geography of financial centers in Europe

What shape is the new financial continent of Europe?

Taking stock of the Single Resolution Board: Banking union scrutiny

The Single Resolution Board (SRB) has had a somewhat difficult start but has been able to learn and adapt, and has gained stature following its first

The European Union must change its supervisory architecture to fight money laundering

Money laundering scandals at EU banks have become pervasive. The authors here detail the weaknesses the current AML architecture's fundamental weaknes

Does Europe’s anti-money laundering framework need a regime change?

Proposal for a more efficient fight against money laundering.

A better European Union architecture to fight money laundering

A series of banking scandals in multiple EU countries has underlined the shortcomings of Europe's anti-money laundering regime. The impact of these sh

Bruegel Annual Meetings 2018

The 2018 Annual Meetings will be held on 3-4 September and will feature sessions on European and global economic governance, as well as finance, ener

Integrity of official statistics under threat

Andreas Georgiou has unwittingly become an international icon for statistical integrity. His continuing politically-motivated persecution is highly da

Germany’s savings banks: uniquely intertwined with local politics

German savings banks, known as Sparkassen, form an important feature of the country's banking assets. Unlike in other European countries, German Spark

The European Union must defend Andreas Georgiou

Andreas Georgiou’s case raises disturbing questions about the integrity of European statistical processes. Forceful action by EU authorities on Mr Geo

EU financial services policy since 2007: crisis, responses and prospects

This paper presents a holistic overview and assessment of the European Union (EU)’s financial services policy since the start of its financial crisis

Completing Europe’s banking union means breaking the bank-sovereign vicious circle

Several euro area leaders, including the German chancellor, her finance minister, and the French president, have recently referred to the need to “com

Making a reality of Europe’s Capital Markets Union

It is high time to make the CMU project real.The authors of this publication suggest that capital markets will only transform with concrete action and

Bank assets and business models: addressing complexity

At this event, we discussed the lack of transparency and problems in valuing correctly significant parts bank assets in the euro area based on an exte

Breaking the Stalemate on European Deposit Insurance

Many EU-level reports have highlighted a European Deposit Insurance Scheme (EDIS) as a necessary component of banking union, but none of these options

Reconciling risk sharing with market discipline: A constructive approach to euro area reform

This publication proposes six reforms to improve the Eurozone’s financial stability, political cohesion, and potential for delivering prosperity.

Bad News and Good News for the Single Resolution Board

A first report on a key plank of the European Union’s banking union reflects on shortcomings thus far, but also suggests that recent improvements migh

Sovereign Concentration Charges are the Key to Completing Europe’s Banking Union

The past crisis revealed that most euro-area banks have disproportionate sovereign exposure in their home country. Charging banks for sovereign concen

Brexit: When the banks leave

More than a tenth of the City’s business is now bound to go, but how much worse could things get?

Sovereign Concentration Charges: A New Regime for Banks’ Sovereign Exposures

Europe’s banking union has been central to the resolution of the euro-area crisis. It has had an encouraging start but remains unfinished business. If

A ‘twin peaks’ vision for Europe

The organisation of the European Supervisory Authorities (ESAs) is based on a sectoral approach with one ESA for each sector, with separate authoritie

A European perspective on overindebtedness

The sequence of crisis and policy responses after mid-2007 was a gradual recognition of the unsustainability of the euro-area policy framework. The ba

A resilient Euro needs Franco-German compromise

In a piece signed by 15 leading French and German economists, Nicolas Véron lays out a path to a more sustainable Euro. Germany will need to accept so

Europe’s fourfold union: Updating the 2012 vision

The depiction of the euro area/European Union (EU) as a ‘fourfold union’ emerged in the first half of 2012 at the height of the euro-area crisis. In t

Bruegel Annual Meetings 2017, 7-8 September

The Annual Meetings are Bruegel’s flagship event.

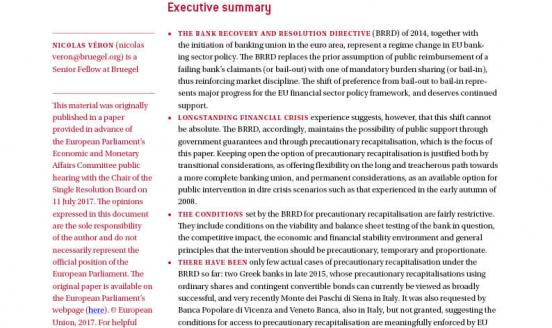

Precautionary recapitalisation: time for a review?

While precautionary recapitalisation is a legitimate instrument for bank crisis management, the conditions set for it by BRRD (Bank Recovery and Resol

Precautionary recapitalisations: time for a review

Precautionary recapitalisation, a tool for public intervention in the banking sector defined in the Bank Recovery and Resolution Directive (BRRD), is

Charting the next steps for the EU financial supervisory architecture

The combination of banking union and Brexit justifies a reform of the European Banking Authority (EBA) and the European Securities and Markets Authori

Substance requirements for financial firms moving out from the UK

In the run-up to Brexit, UK-based financial firms are considering how to organize their operations across the future divide between the UK and EU27. T

The governance and ownership of significant euro-area banks

This Policy Contribution shows that listed banks with dispersed ownership are the exception rather than the rule among the euro area’s significant ban

EBA relocation should support a long-term ‘twin peaks’ vision

As the Commission launches a review of European financial supervision, the authors argue that Europe needs to move towards a twin peaks model – dividi

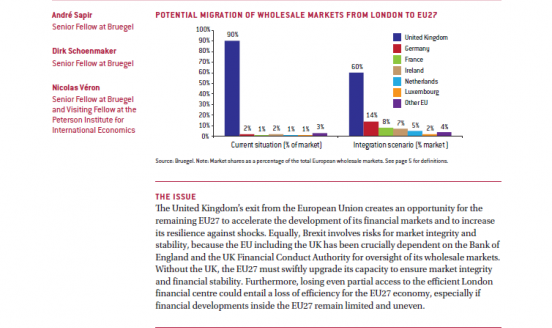

Brexit should drive integration of EU capital markets

Brexit offers EU-27 countries a chance to take some of London’s financial services activity. But there is also a risk of market fragmentation, which c

Making the best of Brexit for the EU27 financial system

The EU27 needs to upgrade its financial surveillance architecture to minimise the financial market fragmentation resulting from Brexit

Tackling Europe’s non-performing loans crisis: restructuring debt, reviving growth

How can we connect the different initiatives for NPL resolution and identify an agenda that is shared between EU, national authorities and the private

The outlook for European financial centres

This event organised jointly by Bruegel, the Malta Financial Services Authority, and the Maltese Ministry for Finance will discuss the outlook for Eur

Giving Asia its due in global financial regulation

With US inward turn, China should get a bigger role to bolster system

ECB finally addressing Italian bank woes

Italy’s banking problem has been left unaddressed for too long. Similar to Japan in the 1990s, it is best understood as a combination of structural an

Reform of the European Union financial supervisory and regulatory architecture and its implications for Asia

This Working Paper reviews recent developments in the EU’s financial supervisory and regulatory architecture with a view to draw out lessons for regi

Not so low: A review of Paul Blustein’s book on the IMF and the euro area crisis

"Laid Low" is an important addition to the burgeoning literature on the euro-area crisis and its main contribution is to assemble essential factual ma

Financial regulation: The G20’s missing Chinese dream

The current fairly peripheral role of China in the global financial regulatory system is increasingly problematic. The system needs a guiding vision i

Breaking the vicious circle

Nicolas Véron argues that EU banking union can only be complete if the vast amounts of domestic sovereign debt held by many banks are reduced

The City will decline—and we will be the poorer for it

Just as the City owes much of its current awe-inspiring prosperity to European integration, the brutal realities of Brexit will make it shrink, not th

Bruegel Annual Meetings 2016, 6-7 September

The Annual Meetings are a high point in Bruegel's calendar.

Bruegel Annual Meetings 2016

The Annual Meetings are a high point in Bruegel's calendar.

The IMF’s performance on financial sector aspects of the euro area crisis

The recently published in-depth evaluation of the International Monetary Fund (IMF)’s role in the euro area crisis highlights important contrasts in t

The IMF’s role in the euro-area crisis: financial sector aspects

Nicolas Véron reviews in-depth the role played by the IMF in understanding the financial-sector dynamics of the euro-area crisis. The IMF was the firs

Italy’s banking problem is serious but can be fixed

Following the UK vote to exit the European Union, the fragility of the Italian banking system has come into the spotlight. The Economist described it

The UK / EU separation: how fast does it happen?

Up until the British rebuff on 23 June 2016, the European Union had always been in expansion mode, also known in EU parlance as enlargement. The UK vo

European banking supervision: the first eighteen months

After its first 18 months, how has the SSM affected the European banking system?

European banking supervision: compelling start, lingering challenges

The new European banking supervision system is broadly effective and, in line with the claim often made by its leading officials, tough and fair, but

European banking supervision: the first eighteen months

The Blueprint provides a review of the first 18 months of European banking supervision. It reviews the overall situation and the

situation in a numbe

With Brexit London would lose business as a global financial centre

London could lose its status of a global financial hub if there is a Brexit. Who would win the business that London would lose?

The European Union remains a laggard on banking supervisory transparency

Financial supervisors must provide the public with more information about the European banking sector in order to ensure financial stability. The leve

Market turbulence highlights bumpy transition to Europe’s new bank policy regime

Concerns about Europe’s banks contributed to turmoil in global financial markets in February, but Europe’s new banking sector policy regime should gra

Stock taking of the ongoing bank crisis resolution in Europe

What progress is being made on an optimal system of bank resolution following the disasters of the financial crisis?

How to improve national insolvency regimes

How can we reduce divergencies in national corporate insolvency regimes in order to create an integrated Capital Markets Union?

European Deposit Insurance: a response to Ludger Schuknecht

Nicolas Véron argues that there are two major oversights in Dr Schuknecht’s anti-European Deposit Insurance outburst, respectively about deposit insur

EU Endorsement of the IFRS 9 Standard on Financial Instruments Accounting

Statement prepared for the European Parliament’s ECON Committee Public Hearing of 1 December 2015

Completing the Banking Union

The Five Presidents’ report published in July 2015 argues that completing the banking union should be one of the most immediate steps of the broader p

Economic governance of the EU: Quo Vadis?

This event will address topics of central interest in current EU policy debates: fiscal and competitiveness coordination, financial union and the dive

Cyprus: Financing the Recovery

As Cyprus looks ahead to post-bailout growth, what lessons have been learnt from the crisis and subsequent bank restructuring?

Capital Markets Union: what’s the vision for European debt capital markets?

After the launch of the Commission's Capital Markets Union action plan on September 30, what changes can be realistically expected in Europe’s debt ca

Enhancing financial stability in developing Asia

This paper outlines guidelines for policymakers pursuing financial stability in developing Asia. It aims at supporting Asian policymakers’ judgment b

Europe’s Capital Markets Union and the new single market challenge

Nicolas Véron comments on the Capital Markets Union Action Plan launched by the European Commission on 30 September 2015.

Bruegel’s multiple births

Nicolas Véron takes us back to the very early days of Bruegel in 2005.

Bruegel's Annual Conference

Bruegel's Annual Conference is a closed-door event with three panel discussions on banks and capital markets, growth perspectives, and monetary policy

Europe’s radical banking union

Bruegel scholar Nicolas Véron argues in this thought-provoking essay that banking union ultimately enabled the European Central Bank’s announcement th

Capital Markets Union: a vision for the long term

This Policy Contribution presents facts about EU capital markets, issues that should be taken into account in the development of CMU policy, correspon

The European Union is the global laggard on Basel III

On Friday, December 5, the Basel Committee on Banking Supervision published its reports on the compliance of rules adopted last year in the European U

Chart of the week: Political groups in the European Parliament since 1979

The results of the European Parliament election of May 22-25 have been described as “a shock, an earthquake”. The long-term trends, however, indicate

Defining Europe's Capital Markets Union

The new European Commission has signalled that it will work to create a ‘capital markets union’. This is understood as an agenda to expand the non-ban

The ECB’s bank review: Kill the Zombies and heal the wounded

The European Central Bank’s comprehensive assessment of euro area banks has had an encouraging start. But complacency could still lead to another fail

Europe’s Banking Union starts on an encouraging note

Sunday, October 26 was D-Day for Europe’s banks: at noon in Frankfurt, the European Central Bank (ECB) announced the results of its “compreh

Flash Cards for European Commissioner-designate Jonathan Hill

To enable Mr Hill’s overworked staff to enjoy a rare sunny weekend in Brussels, ready-made answers to next week's remedial hearing are suggested

Banking union in nine questions

Prepared for the Interparliamentary conference organized by the Italian Presidency of the European Council in Rome.

The G20 financial reform agenda

Five years ago, the declarations of the G20 in landmark leaders’ summits in London and Pittsburgh listed specific commitments on financial regulatory

Europe’s Single Supervisory Mechanism: Most small banks are German (and Austrian and Italian)

A closer look at the ECB’s list shows that the smaller banks are concentrated in a limited number of countries, much more so than larger ones. Germany

Chart: Alibaba IPO underlines rise of Chinese private sector

Alibaba’s coming of age underlines a continuous trend of the last half-decade. For all the fashionable talk of China’s dominant state capitalism&

Europe's half a banking union

Even with all the risks in mind, we are convinced that in terms of financial stability and beyond, the half a banking union that has been undertaken w

Inquiry on 'Review on the EU financial regulatory framework

Evidence given to the Select Committee on the European Union, Economic and Financial Affairs (Sub-Committee A).

EU to DO 2015-2019

Memos to the new EU leadership.

Euro crisis turning point: Two years of Banking Union

The anniversary of Europe’s banking union is worth celebrating. Two years ago, and for lack of alternative options, Europe’s leaders avoided their usu

The G20's financial reform agenda

How unequal is the European Parliament’s representation?

The European citizens’ relative lack of interest in the European Parliament is often blamed by critics on its inherent inequality of representation.&n

Is “losing” Alstom really a symbol of France's relative decline?

Irrespective of the economics, the factual observation remains unambiguous. French-headquartered companies are well represented among the population o

Highlights from the IMF, World Bank Spring Meetings

Who's paying for bank bailouts?

Tectonic shifts

Europe has just started a long journey of discovery. Banking union amounts to a regime change for European finance. Even as prospects for the first st

European Banking Union: Current Outlook and Short-Term Choices

Presented to the Portuguese parliament.

Un grand pas pour l'Europe, mais le déficit démocratique demeure

Le 18 décembre, les ministres des finances européens ont annoncé un accord sur la mise en place d'un mécanisme de résolution unique (MRU) pour le trai

What to make of the Single Resolution Mechanism?

Europe’s Institutional Mismatches Will Create More Turbulence in 2014 than in 2013

2013 has been a remarkably calm year in Europe, arguably the calmest since the onset of financial crisis in 2007.

The ECB’s big moment

Europe’s banking union project has had many doubters since it started to be widely discussed in the spring of 2012. What is not in doubt, however, is

An encouraging start for the ECB’s Big Bank Review

Europe’s leaders will need to be clear-sighted about the consequences of their choices in the weeks and months ahead.

Banking Nationalism and the European Crisis

Oral remarks prepared for a speech on the changing European financial system, given in Istanbul on 27 June 2013 at a symposium of the European Private

Erosion of the World's trust in the sanity of US fiscal management

Europe’s Cyprus Blunder and Its Consequences

The late Mike Mussa, a former Chief Economist of the International Monetary Fund, noted about some episodes of the late-1990s Asian financial tur

Past and future of the banking union debate

A realistic bridge towards European banking union

New obstacles to the European banking union have emerged over the last year, but a successful transition remains both necessary and possible. The key

Bank versus non-bank credit in the United States, Europe and China

In the wake of recent crisis developments in the US and Europe, non-bank credit channels have often been portrayed as 'shadow banking' and have been c

EU-Korea Economic Exchange

Articles published during the Bruegel/Korea Institute of Finance project on ‘EU-Korea policy responses to the global financial and economic crisis and

With Cyprus, Europe risks being too tough on banking moral hazard

Europe has long been far too tolerant of moral hazard in its banking system. But with the Cyprus plan, the pendulum may now be swinging too far in the

Basel III: Europe’s Interest Is to Comply

On February 14, European Commissioner Michel Barnier and Federal Reserve Governor Daniel Tarullo indicated their agreement to quickly give t

From supervision to resolution: next steps on the road to European banking union

Policy note in anticipation of hearing of Mario Draghi at the Economic and Monetary Affairs (ECON) Committee: The European Council has outlined the cr

Europe Takes an Important Step Forward on Banking

The political agreement reached early on December 13 by Europe’s finance ministers makes it highly likely that legislation establishing a Single Super

Obama Should Think Globally in Appointing a New SEC Chair

Global financial reform and cross-border integration: Asian leadership needed?

The first step in Europe’s banking union is difficult but achievable

Europe's single supervisory mechanism and the long journey towards banking union

This Policy Contribution was prepared as a briefing paper for the European Parliament Economic and Monetary Affairs Committee’s Monetary Dialogue: Pro

The Political Redefinition of Europe

For the past few years, headlines in Europe have been dominated by the financial and economic developments of the crisis, first in the banking system

The challenges of Europe's fourfold union

This Policy Contribution reproduces Nicolas Véron’s statement delivered at the hearing on 'The Future of the Eurozone: Outlook and Lessons' at the Sub

Transatlantic economic challenge in an era of growing multipolarity

The contributions in this volume by subject area experts from the Peterson Institute for International Economics and Bruegel ponder how or whether t

Europe’s Banking Union: Possible Next Steps on a Bumpy Path

In Memory of Olivier Ferrand

What kind of European banking union?

This policy contribution discusses in detail how a future banking union could be organised by examining seven fundamental choices that decision makers

A European banking union

The European debate on bank capital is not just about Europe

Europe’s finance ministers are currently deciding on the legislation intended to implement the Basel III international agreement on bank capital, le

Is Europe ready for banking union?

Move the financial stability board’s secretariat to Asia

Making sense of the CRD4/CRR debate

Europe needs to drop its resistance to non-bank credit

Banking union or financial repression? Europe has not chosen yet

A new era for global financial standards

Even as headlines remain dominated by the Eurozone crisis, the financial world is transforming itself along multiple other dimensions. One intriguin

Europe’s Fiscal Union Still Lacks a Blueprint

Global financial authorities must adapt to a changed world

Financial reform after the crisis: an early assessment

This paper takes stock of global efforts towards financial reform since the start of the financial crisis in 2007-08, and provides a synthetic (if s

Europe must change course on banks

Rating agencies and sovereign credit risk assessment

This Policy Contribution was prepared as a briefing paper for the European Parliament's Economic and Monetary Affairs Committee’s Monetary Dialogue: C

Europe needs institutional creativity

Rate expectations: what can and cannot be done about rating agencies

Nicolas Veron scrutinizes the current European debate about credit rating agencies. He warns against restricting the agencies’ freedom of expressi

Global financial authorities must adapt to a changed world

The Dubai challenge

Testimony on the European debt and financial crisis

Euro area banks must be freed from national capitals

An accounting perspective on financial globalization

Stress tests fail to rescue Europe’s banks

Dodd Frank: One year on

Keeping the promise of global accounting standards

G20 and financial regulation

The G20 needs to refocus its financial regulatory agenda

Markets, politics and the euro

The IFRS' Stress Test

Suggestions for reforming the governance of global accounting standards

The challenge of Europe's efforts at financial redesign

Some Progress in the Banking Reform Debate

The European Union should start a debate on too-big-to-fail

The Global Accounting Make-or-Break

Has global financial reform run out of steam?

Too big to fail: the transatlantic debate

European bank stress tests: third time lucky?

EU financial regulatory reform: a status report

After the G20: time for realism in global financial regulation

After the G20: time for realism in global financial regulation

The European Union has not yet solved its banking problem

Financial newcomers will have global impact

An assessment of the G20's initial action items

Twenty months after the first G20 summit in Washington, we assess the implementation of the 47 action items included in that summit’s final decla

Not all financial regulation is global

Financial regulation at global level has been high on the G20 agenda. However, financial multipolarity, with the rise of emerging economies, and its i

Europe's stress tests: only one step toward banking repair

Detailed disclosure is the key to stress-test success

The G20 needs to refocus its financial regulatory agenda

The era of corporate split personalities

Financial Regulation: A New Fortress Europe

The Jury is Still Out on the European Union's Crisis Performance

EU Has Major Challenges to Confront

Will Governments Overrearch in their Crisis Interventions?

IFRS Sustainability Requires Further Governance Reform

Turbulence Ahead for the City of London

Europe’s banks still need restructuring

Why the Issue of Convergence Should Remain on Backburner

Europe's Oligarchs

Rules of the Game

Memos to the new Commission- Europe's economic priorities 2010-2015

EU inaction on banks grows ever costlier

European banking needs a state-led triage body

A solution for Europe's banking problem

A US strategy for IFRS adoption

The European Banking Gordian Knot

Crony Capitalism In America?

G20 Readout

An agenda for the London Summit

Rating agencies: an information privilege whose time has passed

Fuzzy oversight will not solve standards issue

Global crisis: global solutions?

How big a watchdog?

The Route Back to Credit

A European framework for foreign investment

Supervisory Colleges

La Hora de Europa

Safe and Sound: an EU approach to Sovereign Investment

All together now

The challenges of implementing the Brown-Sarkozy Plan

A flimsy triumph for Global Accounting Standards

IKB: a sad German story

Empower users of financial information as the IASC Foundation‘s stakeholders

High risk summer

The demographics of global corporate champions

The changing geography of global corporate power

Asset management revolution may be looming in Europe

Fair value accounting is the wrong scapegoat for this crisis

Something new on the audit front

The wheel of fortune is turning for the Global Champions

Two Learning Curves on Sovereign Wealth Funds

Can accounting standards save the banks?

Europe and the US: A tale of two Financial Crises

Where will tomorrow's champions come from?

Cinq réformes pour financer les champions de demain

A change of tone

The Lure of nostalgic capitalism

Better finance for more enterprise growth in Europe

Europe's saplings need Financial Fertiliser

Economic nationalism: not all play it like the French

Credit crunch pushes cross-borderwatchdogs high on EU agenda

Early Lessons of the Financial Crisis

Can accounting standards be scapegoated for the turmoil?

Financing Europe's fast movers

Wertvolles Kapital

Crisis brings sovereign funds back into favour

The credit crisis and the role of public policy

Selection through crisis in the banking system

Superfund blues

London's Moment

EU adoption of the IFRS 8 standard on operating segments

Rethinking Europe's Financial Regulation... in London

Triple whammy on the Credit Markets

Europe must get ready for a banking crisis

The hot Summer of Sovereign Wealth Funds

Une crise de l'information sur les risques

Is Europe ready for a major banking crisis?

Transparency would help to address the audit market problem

For whom are accounting standards set?

So far, so good for the Mittals

Gouvernance de l'IASB: une réforme indispensable

Can France build a clean tech policy?

So few great French places to work

Called to account

Normes comptables internationales : le débat continue

Has the European banking exception come to an end?

Electricity: the shifting power equation

The global accounting experiment

Halliburton: Pariah or Precursor?

In French business, old castes die hard

The French Presidential debate A war too late

A multipolar business world

Family capitalism and the French problem with work

Why France's addiction to economic nationalism?

The Integration of EU Financial Services: Who is Gaining from It?

ECON Committee: Workshop on 'the Integration of EU Financial Services: Who is Gaining from It?'

Bob Nardelli's governance lessons

2007: Risky New Year

When France makes Germany despair

The dilemmas of corporate dual Citizenship

Global governance: an agenda for Europe

The global Stock Market and the challenge of regulatory competition

Should emerging multinationals be kept out?

Economic Patriotism: lessons from Italy

The EU and the governance of globalisation

Choice in the UK audit market

The new 'grammar of business'